Net Investment Income Tax Non Passive Activity

In regard to the tax specifications it is more advantageous to focus on ways of producing passive income as opposed to concentrating on generating non passive income.

Net investment income tax non passive activity. So a taxpayer with income from a partnership or s corporation will generally include all of it in net investment income if the activity is a passive activity with respect to the taxpayer. In our last few tax letters we have discussed passive activities versus nonpassive activities in the context of the 3 8 percent net investment income nii tax. Nonpassive income and losses are any income or losses that cannot be classified as passive. The rules in sec.

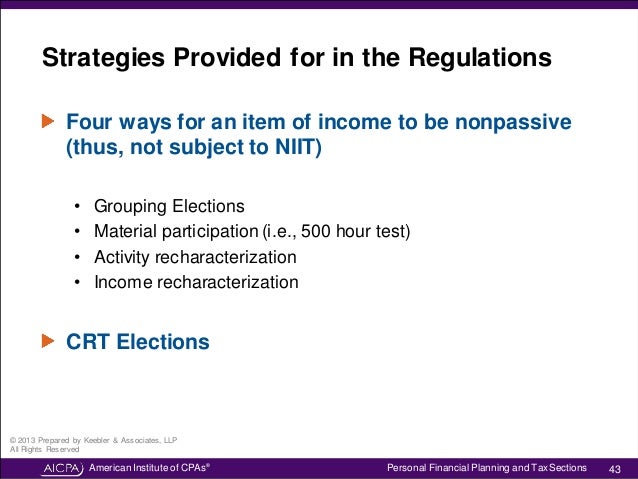

Nonpassive activities are businesses in which the taxpayer works on a regular continuous and substantial basis. Net investment income for this purpose includes interest dividends annuities rents and royalties plus passive income from a trade or. Meeting the standard of material participation and thereby turning an activity from passive to nonpassive is obviously a critical consideration for if an activity is passive all of the income. Among the benefits that are linked with the passive income tax rate flexibility and financial security are just as important.

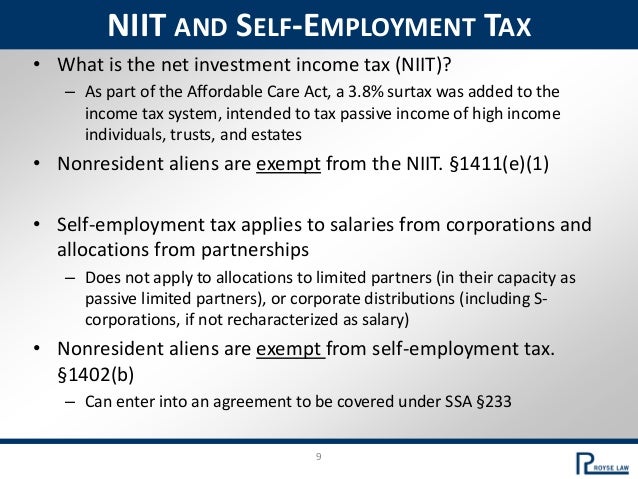

Included in nonpassive income is any active income such as wages business income or investment income. 469 originally were created to limit a taxpayer s ability to deduct passive losses against nonpassive income. Mac stevens kayleen masters net investment income tax issues submitted for discussion overview of the nii tax sale of c corporation stock vs. This article focuses on a nuance in the passive activity rules that in the right circumstances may allow taxpayers to avoid the 3 8 percent net investment income tax on certain income.

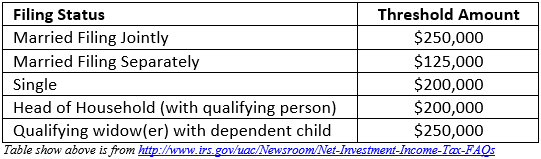

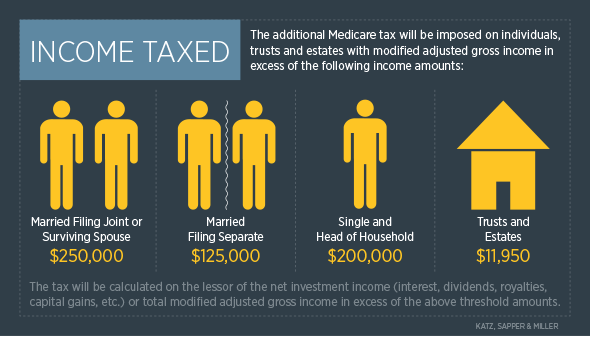

The net investment income nii tax is a 3 8 surtax on investment income that was created by the affordable care act in 2013. To avoid the 3 8 surtax your investment income must be offset with investment losses or your income has to be considered non passive vs. Passive for income to be considered non passive the taxpayer must materially participate in the activity.

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)