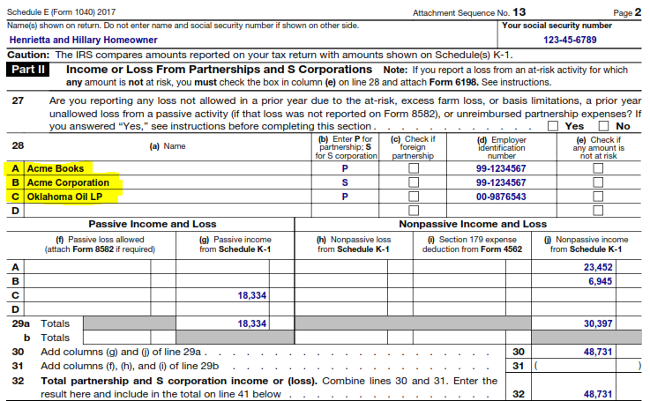

Non Passive Income Schedule K 1

March 20 2013 passive vs nonpassive losses.

Non passive income schedule k 1. Pass through or cash flow. Even if you ve never thought about being a marketer in the past you can discover the ad biz faster than probably any other method of electronic advertising that s out there. On the other hand if you re self renting which means that you have your own space and that you re renting it it doesn t count as passive income either unless the agreement has been signed before 1988. To that end if you re a real estate professional then the income generated through rental is regarded as active income or non passive income.

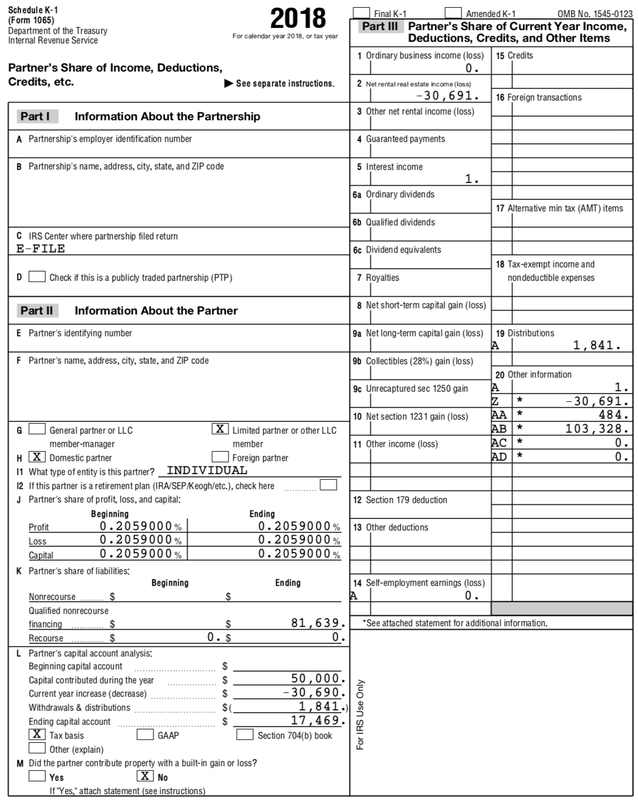

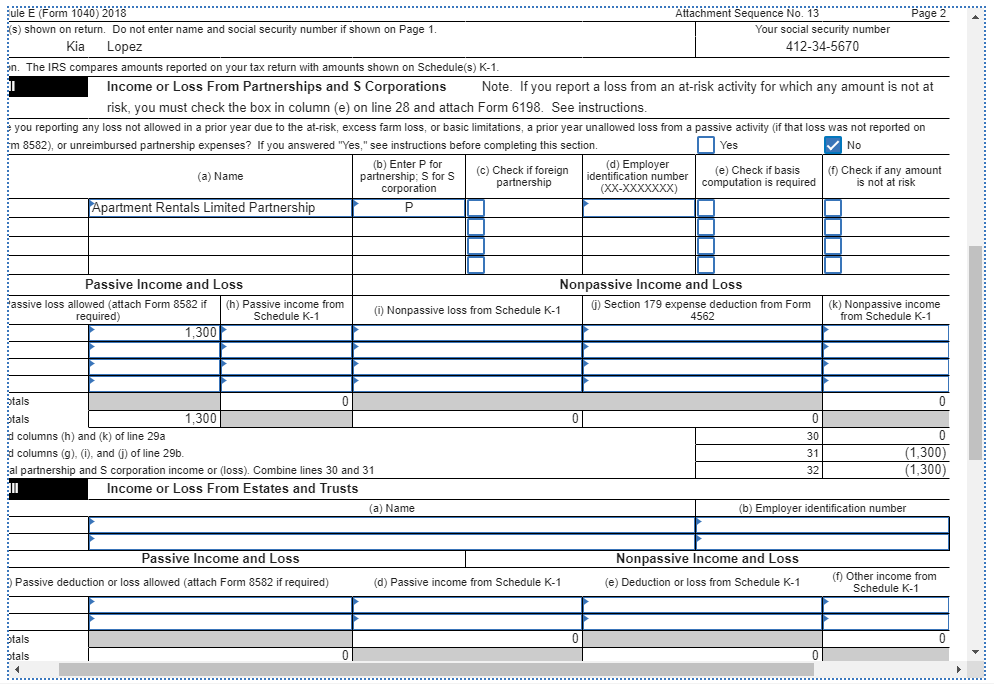

How do i carryover non passive loss from k 1 amount in line 41 from ty2018 to ty 2019 and beyond. This can have a significant impact on the individual s federal income taxes. To support this response take a look at fnma b3 3 1 09. Making this determination can determine if a loss is allowed or if it is a suspended loss.

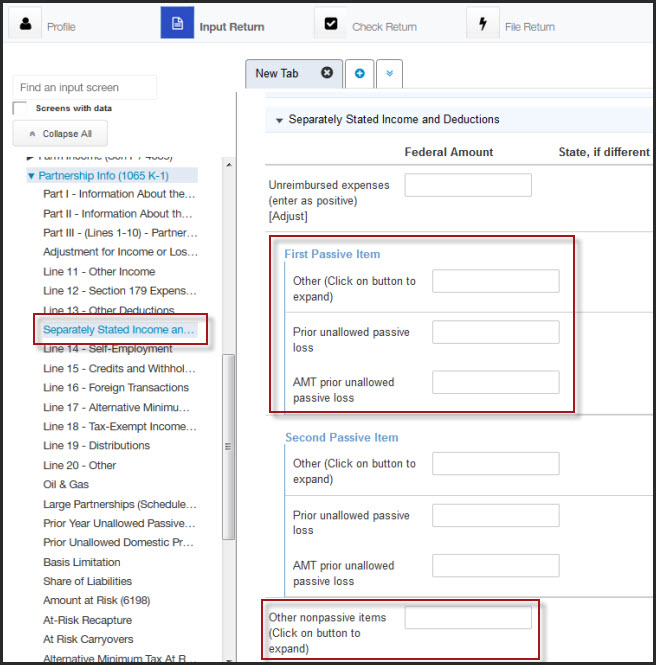

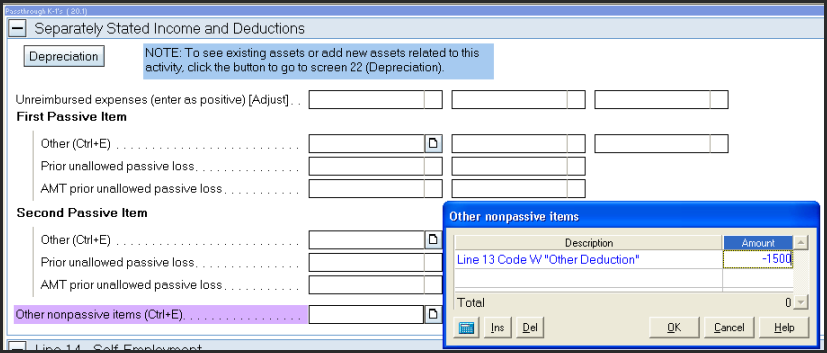

The reporting required of an llc under the passive loss rules can be as simple as one line item on the member s schedule k 1 if the llc has only one activity what is nonpassive income and losses nonpassive income and losses constitutes any income or losses that cannot be classified as passive. If you are passive and you have a loss there are many additional tests that need to be passed to see if you can even deduct the loss. May 8 2019 schedule b interest. What is non passive income on schedule k1.

Regardless of your status if you have net income on your k 1 it is taxable. All you require is a great product to market a person to pay you to offer it and also a platform to put your ads. See those instructions for more detailed information on determining whether your income was passive or nonpassive. If you meet these tests then the loss is typically only deducted to the extent you have passive income.

Please keep in mind those rules i quoted do not apply to the income received as guaranteed payments or w 2 wages from the company. Others go on your form 1040 tax return. The k 1 recipient needs to determine whether they are nonpassive or passive with regard to the pass through entity ownership interest. I have non passive loss and passive income from schedule k 1s.

When an individual is an owner of an interest in a partnership or s corporation a schedule k 1 is issued. First of all why is it important to know which you are. Other sources of income 10 24 2016 schedule k 1 income it does show the need for supporting income with distributions. You should receive a copy of the partner s instructions or shareholder s instructions with your schedule k 1.

Are you passive or non passive in regards to the k 1 you receive. Passive vs non passive k 1 income loss. I also have rental real estate income. It also determines if the income is subject to the net investment income tax.