Non Passive Income Tax Rate

Many people are unaware of the tax implications as well as the potential benefits of this alternative.

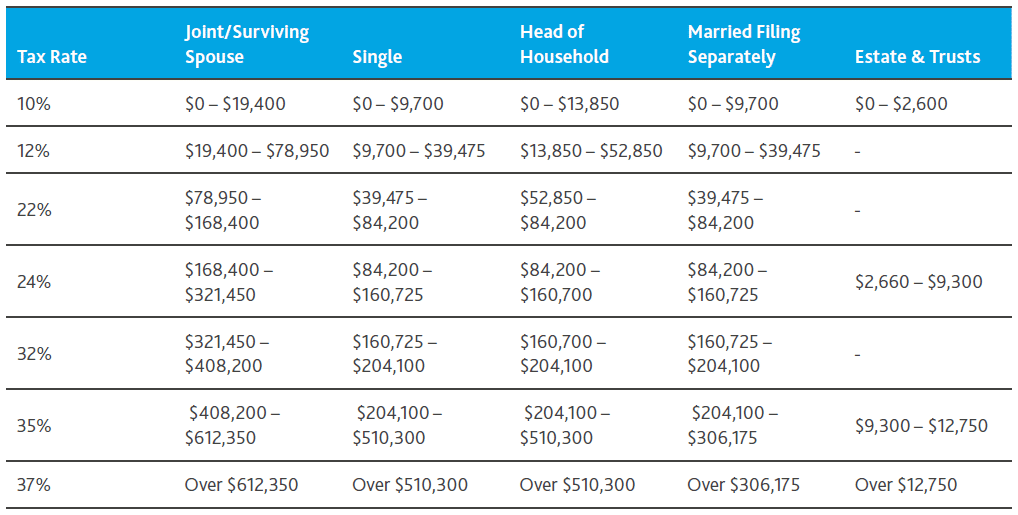

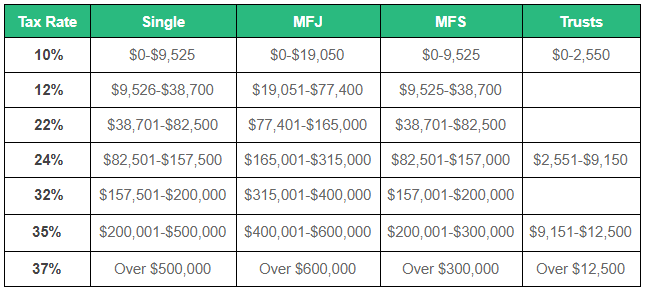

Non passive income tax rate. 10 12 22 24 32 35 and 37. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. Registered plans like tax free savings accounts tfsas or registered retirement savings plans rrsps may fully or temporarily shield investment earnings from inclusion in the income of the. Non passive income and the tax.

Nonpassive income and losses are any income or losses that cannot be classified as passive. You can really take advantage of passive income by being fully aware of your tax liabilities. The current tax rates for short term gains are as follows. In other words short term capital gains are taxed at the same rate as your income tax.

For the most part when it comes to passive income tax it is usually deducted on passive income. Short term passive income tax rates. Passive income can be taxed up to 15 which is considerably a lower rate compared to non passive income. All passive income earned through investments that are part of a non registered investment plan or portfolio are considered to be taxable income in canada.