Obamacare Passive Income Tax

Meet the 3 8 net investment income tax.

Obamacare passive income tax. Obamacare home sales tax obamacare real estate tax increase. If your income is between 100 and 400 of the federal poverty level you qualify for premium tax credits that lower your monthly premium for a marketplace health insurance plan. How the obamacare medicare tax works. For single filers the threshold is just 200 000.

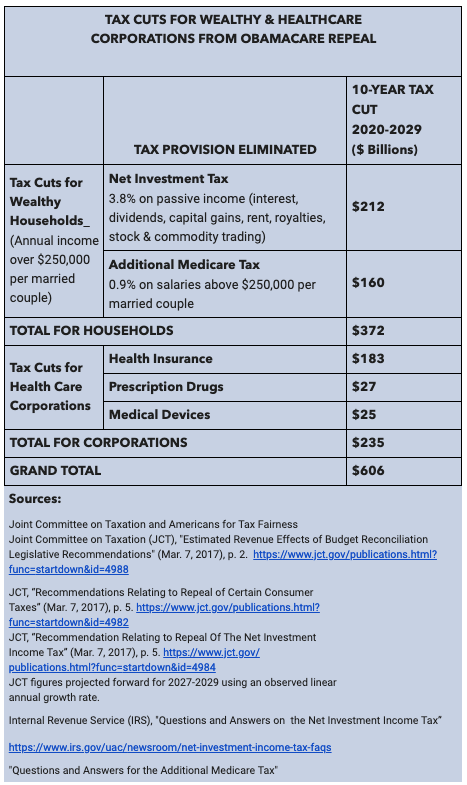

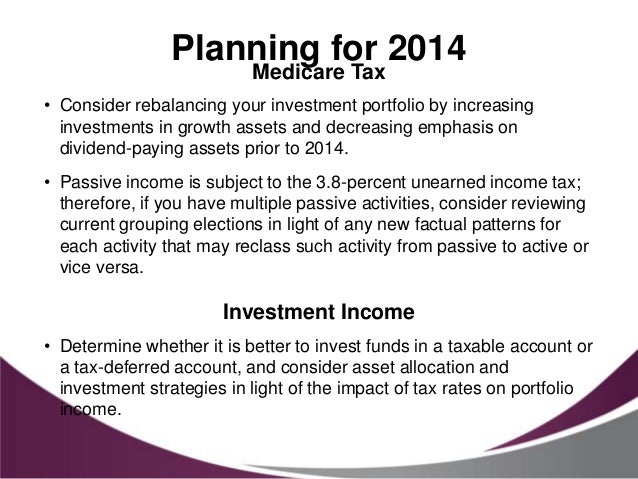

Obamacare investment income tax. Wealthy to pay 3 8 percent surcharge on capital gains dividends reuters president barack obama speaks at the nunn lugar cooperative threat reduction ctr symposium being held at the national defense university at fort mcnair in washington monday dec. The health insurance mandate for individuals and the 3 8 net investment income tax nit on upper income individuals and trusts. 3 2012 ap photo charles dharapak.

The household has a simple structure for assessing income. The levy is only investment income above the thresholds. Tax credits and exemptions. Obamacare increases taxes on unearned income by 3 8 and this can add additional taxes to the sales of some homes.

However many limitations apply so this won t affect most sellers. By stephen fishman j d. For the 2019 tax year that s line 8b on form 1040. If only some americans paid for health insurance while others opted out it would result in high premiums for those who participated and potential bankruptcy for the uninsured due to high medical bills.

Another example of the marriage penalty at work in our tax code. The tax actually started on january 1 2013 as a direct new tax that was explicitly intended to help fund the now not so new affordable care act. The 3 8 capital gains tax typically doesn t apply to your primary residence. To qualify for an obamacare tax credit you have to estimate your household income for the following year in your application.

You ll then need to add certain other income sources such as excluded foreign income nontaxable social security benefits and tax exempt interest if you have them most people don t. You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year. If your income is 400 or less of the federal poverty level you may qualify for a tax credit which varies by state. Individual mandate net investment income tax.

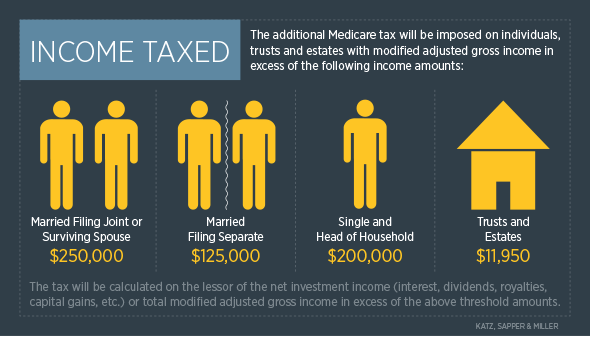

The obamacare tax penalty was a method to encourage national participation in health coverage. There is a flat surtax of 3 8 on net investment income for married couples who earn more than 250 000 of adjusted gross income agi. Obamacare uses an income unit called a household.