Passive Activity Loss 1031 Exchange

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

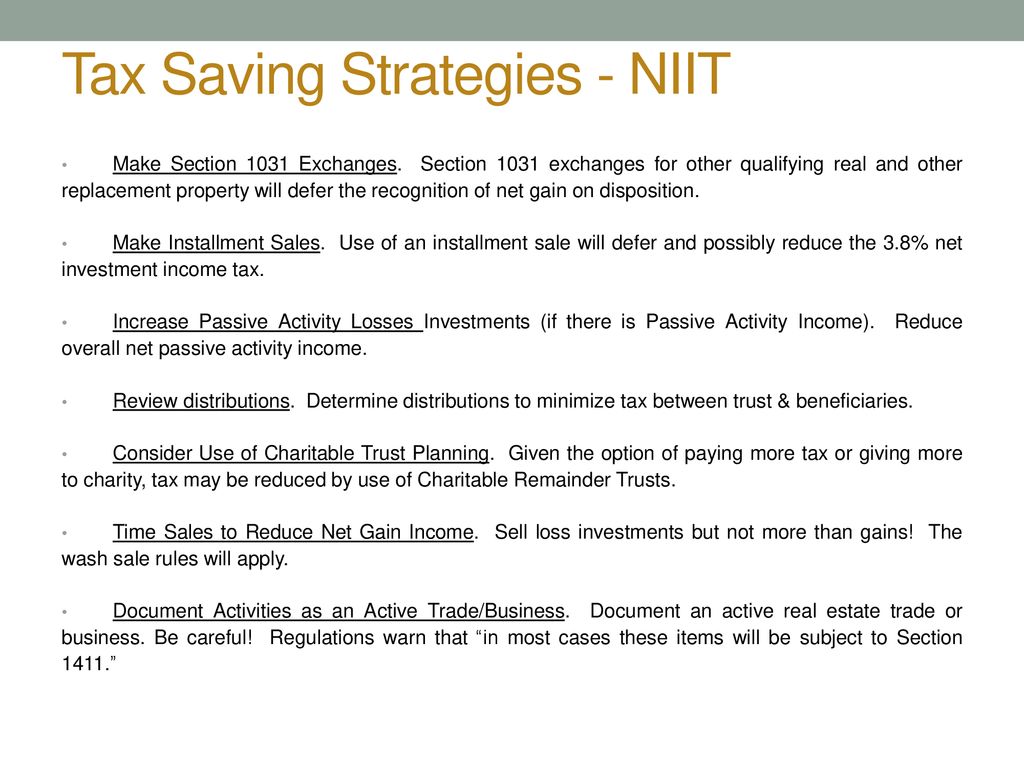

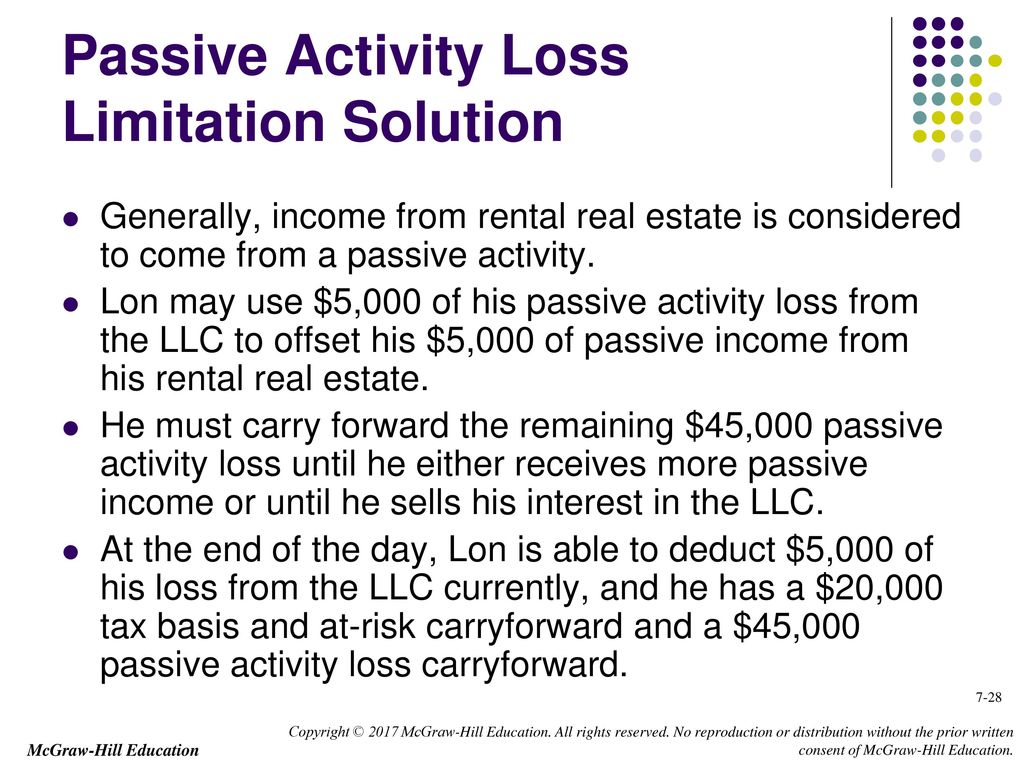

Passive activity loss 1031 exchange. Determine whether the property should be subject of a 1031 exchange. If you re subject to the passive activity rules and your purple duplex rental property generates a loss in year one that loss is not deductible it carries over to year two and you offset it against the year two. 800 795 0769 www 1031 us taxpayers with passive activity losses otherwise known as pals. Under irc 469 g current and carryforward passive activity losses are fully deductible in the year of an entire disposition in a fully taxable transaction to an unrelated party.

Suspended passive losses cannot be deducted when the passive activity is exchanged in a nonrecognition i e tax deferred transaction such as an exchange under sec. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. If these three tests are met losses are fully deductible against non passive income unless the taxpayer has basis limitations. These become suspended passive losses and are reported on irs form 8582 passive activity loss limitations as part of your regular federal tax return.

Because a 1031 exchange is by definition a nonrecognition event there is no income against which to deduct the loss. Not every property is a good candidate for a 1031 exchange. First a passive loss may only be deducted against other passive income or in a fully taxable sale or exchange. For each rental property activity an activity may be one or more properties the amount of.

For each rental property activity an activity may be one or more properties the amount of loss or gain and losses carried over from prior years are posted to form 8582 and attached worksheets. If a real estate owner disposes of his entire interest in a passive activity to an unrelated person in a fully taxable transaction he may offset any gain with all passive activity losses allocable to the activity not limited by the pal rules. Section 1031 allows the deduction of the loss under the passive activity loss rules. A 1031 exchange is by definition a nonrecognition event there is no income against which to deduct the loss suspended loss cannot be taken in a tax deferred.

Even if there is some taxable boot a like kind exchange is not fully taxable. In other words you get tax free cash. 1031 nontaxable exchanges if no gain is recognized. These become suspended passive losses and are reported on irs form 8582 passive activity loss limitations as part of your regular federal tax return.

351 transfers to a controlled corporation sec. Treatment of passive activity losses and 1031 exchanges.