Passive Activity Loss Agi Limitation

Nor can you offset taxes on income other than passive income with credits resulting from passive activities.

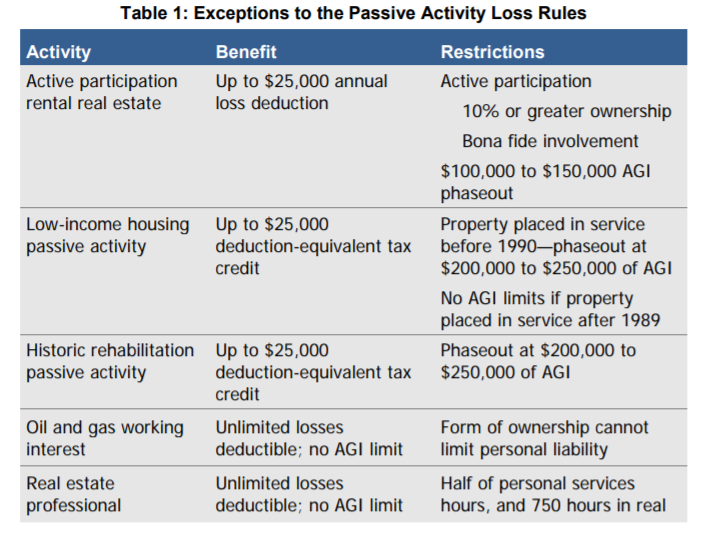

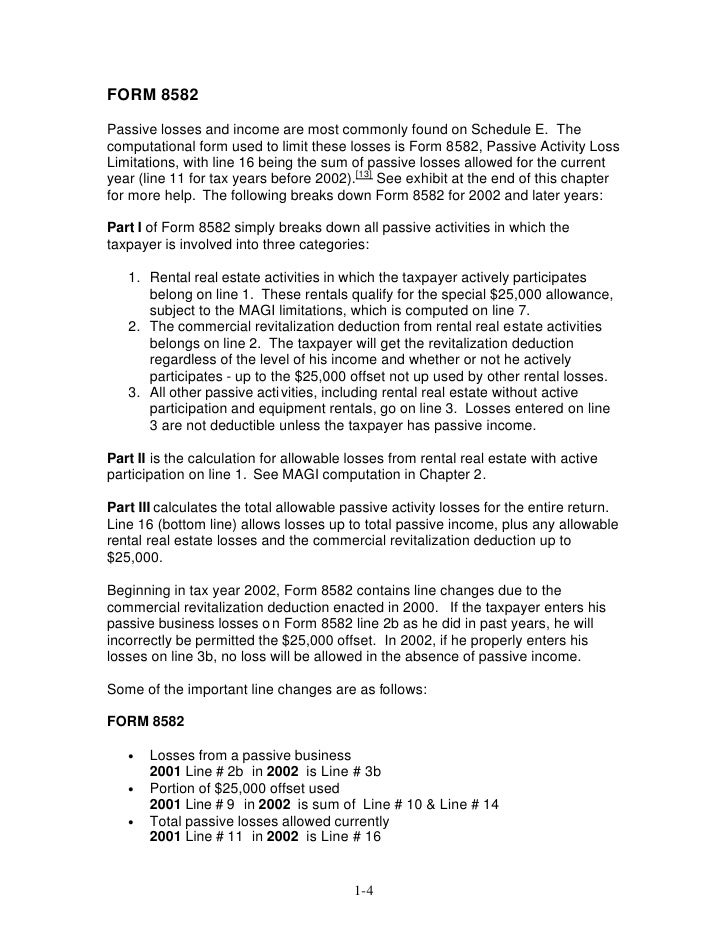

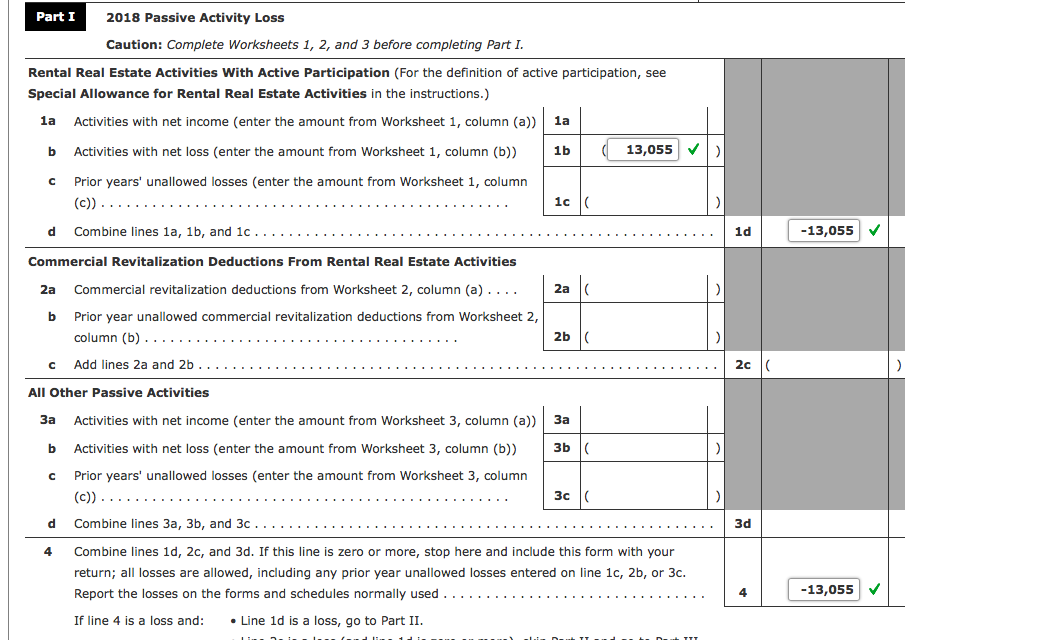

Passive activity loss agi limitation. You generally cannot offset income other than passive income with losses from passive activities. My question about whether or not you can get around passive loss deduction agi limits by forming some kind of business structure still stands though. Deductions or losses from passive activities are limited. Form 8582 passive activity loss limitations trade or business activities in which the taxpayer did not materially participate during the year.

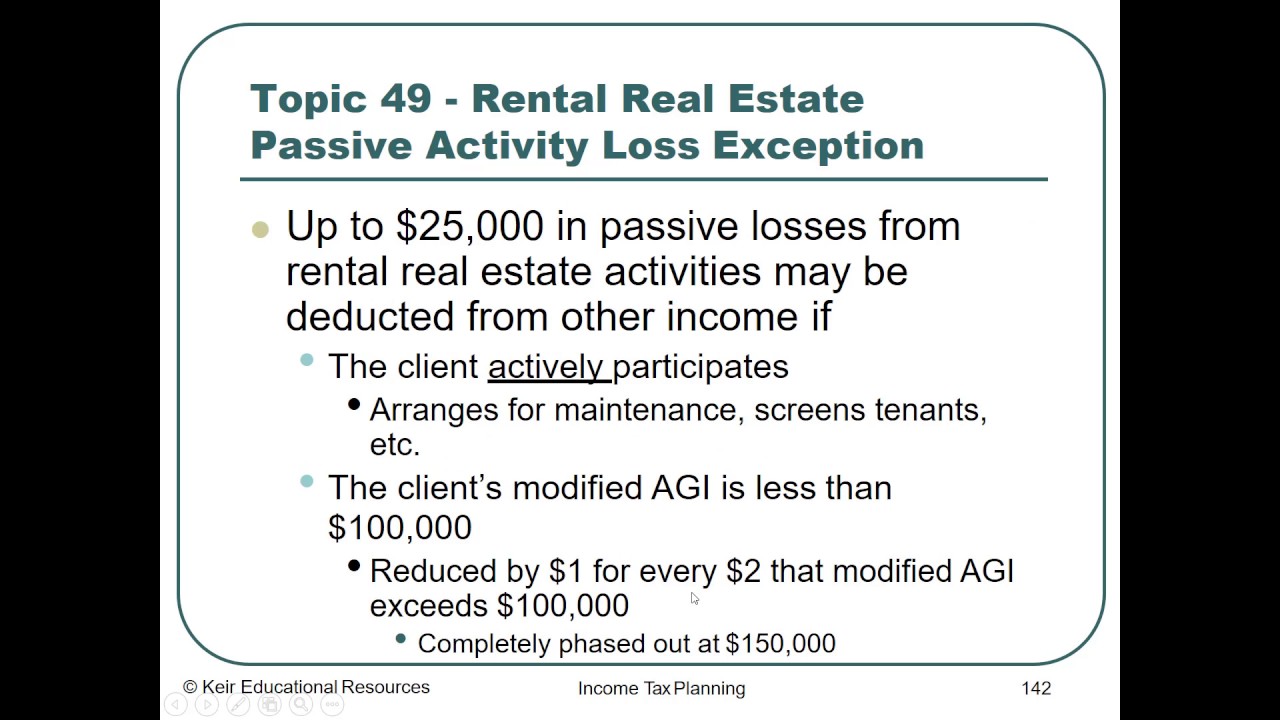

Any rental real estate loss allowed because you materially participated in the rental activity as a real estate professional as discussed later under activities that aren t passive activities. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Passive activity loss rules prevent investors from using losses incurred from income producing activities in which they are not materially involved. Reporting passive activity losses you can carry over passive activity losses to a future tax year to offset passive activity income in the future.

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. The exclusion from income of amounts received from an employer s adoption assistance program. That loss becomes a suspended passive loss and it is carried forward into the future. Rental activities even if the taxpayer materially participates in them unless the taxpayer is a real estate professional.

Form 8582 passive losses limited based on modified agi magi if you actively participated in a passive rental real estate activity you may be able to deduct up to 25 000 of loss from the activity from your nonpassive income. 1 being materially involved with earned or. Also i m not sure it s a good generalization to say that 50 of your income will be eaten up by cost since apparently what i could rent here in the chicago area for 2000 would cost 300 000. We talk about that extensively here.

The passive loss allowance which allows taxpayers with a modified adjusted gross income magi of less than 100 000 to deduct. If your magi is above 150 000 the only way to avoid passive losses from your rental real estate activities becoming suspended and carrying forward is to qualify as a real estate professional.