Passive Activity Loss Calculation

Limiting passive activity losses began with the tax reform act of 1986 as a means of discouraging economic activity undertaken strictly as a tax shelter.

Passive activity loss calculation. A regular tax passive activity loss of 2 500 a depreciation adjustment of 500 less depreciation allowed for the amt an adjustment of 250 to the gain from sale of property less gain for the amt in this case the taxpayer s passive activity loss for alternative minimum tax purposes is 2 250. The nonresident passive activity loss is calculated in an individual tax return as follows. A rental activity is a passive activity even if you materially participated in that activity unless you materially participated as a real estate professional. Add them up then divide each individual loss by the total.

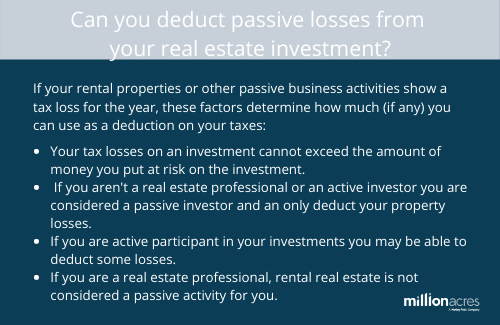

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. If say activity a gives you a 25 000 loss and b gives you a 75 000 loss totaling 100 000 you d have 25 percent and 75 percent as the results. Enter your losses on worksheet 5 on form 8582 if you have a net loss from all passive activities. Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income.

Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Passive activity loss modified adjusted gross income magi calculation. The portion of passive activity losses attributable to the crd. The portion of passive activity losses not attributable to the commercial revitalization deduction.

A passive activity is one wherein the taxpayer did not materially. Form 8582 passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Start with the total federal loss for each entity.