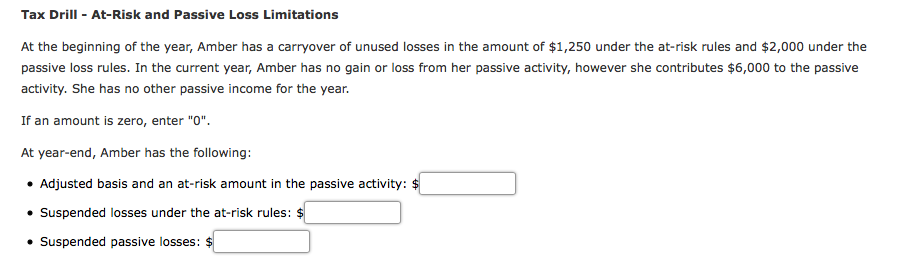

Passive Activity Loss Carryforward Rules

Passive activity loss rules prevent investors from using losses incurred from income producing activities in which they are not materially involved.

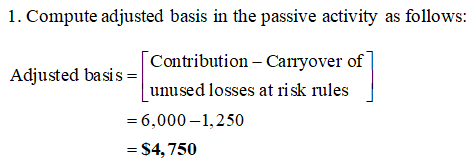

Passive activity loss carryforward rules. 1 being materially involved with earned or. You can carry over these losses until you sell the asset or realize. You can carry forward disallowed passive losses to the next taxable year. Generally losses from passive activities that exceed the income from passive activities are disallowed for the current year.

Passive loss carryover occurs when you do not have enough passive income by which to offset these losses for a given tax year.

Source : pinterest.com