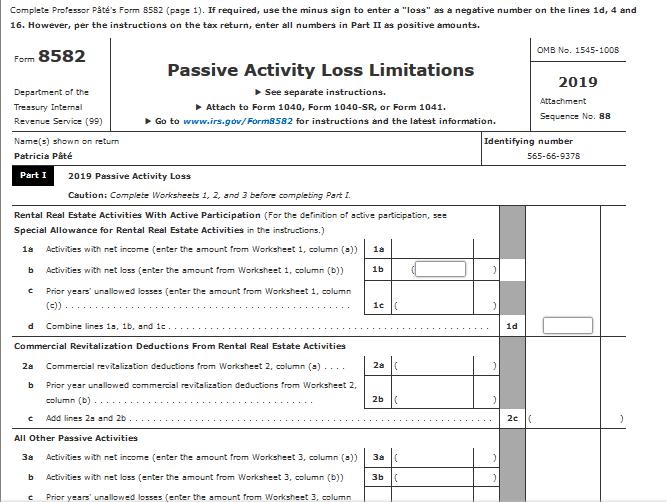

Passive Activity Loss Carryover Form

See screenshot 1 below click to enlarge.

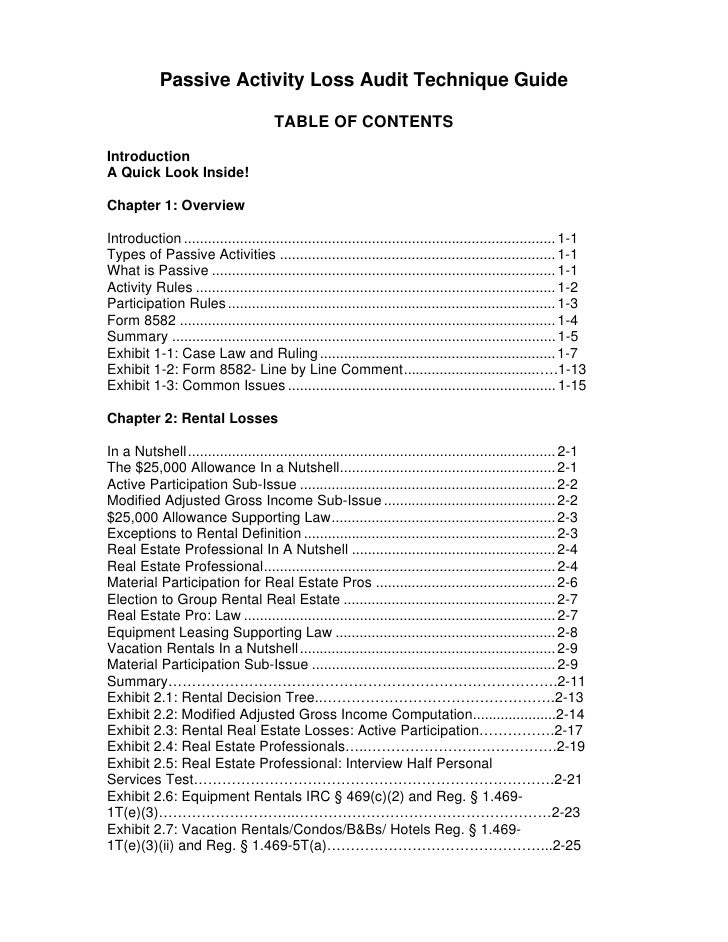

Passive activity loss carryover form. Use form 8582 cr passive activity credit limitations pdf to summarize the credits from passive activities and to compute the allowed passive activity credit. Information about form 8582 passive activity loss limitations including recent updates related forms and instructions on how to file. Income from another passive activity. Non corporate taxpayers will need to use irs form 8582 to determine the amount.

Under the boat management agreement the charter company manages all aspects of the boat and pays us a set monthly fee. For example gain or loss from the sale of assets used in a trade or business is nonpassive if the taxpayer materially participates in the business. Attach to form 1040 form 1040 sr or form 1041. Form 8582 instructions page 6 former passive activities a former passive activity is any activity that was a passive activity in a prior tax year but is not a passive activity in the current tax year.

You may also use form 8582 cr to make. This is clearly a passive hobby activity. Passive loss carryovers can be created by any passive activity. See the instructions for form 461 limitation on business losses.

Form 8582 handles this automatically. A prior year un allowed loss from a former passive activity is allowed to the extent of the current year income from the activity. Income from the same activity. When the same activity produces net income this will trigger use of former losses from the same activity.

Form 8582 department of the treasury internal revenue service 99 passive activity loss limitations see separate instructions. Most come from rental properties schedule e. Special instructions for ptps. As of 2011 irs form 8582 must be filed by taxpayers who have a net gain from business or passive rental activities.

The following is an excerpt from the 8582 form instructions. Pals passive activity losses from a ptp generally may be used only to offset income or gain from passive activities of the same ptp. Noncorporate taxpayers use form 8582 to. Form 8582 is used by individuals estates and trusts with losses from passive activities to figure the amount of any passive activity loss pal allowed for the current tax year.

If you used turbotax to file your tax return last year any passive loss carryovers would appear on schedule e wks carryforward to 2016 smart worksheet final page note this is a turbotax supplemental schedule and not an irs form. Gain or loss from the disposition of property retains the nonpassive or passive character of the activity in which the asset was used temp. Passive loss carryover form boxes my wife and i have a partnership llc owning our sailboat which is in commercial charter fleet. When there are suspended losses from such activities a taxpayer must wait for one of three events to claim the losses.