Passive Activity Loss Carryover Rules

Al does not follow the federal law for passive activity losses.

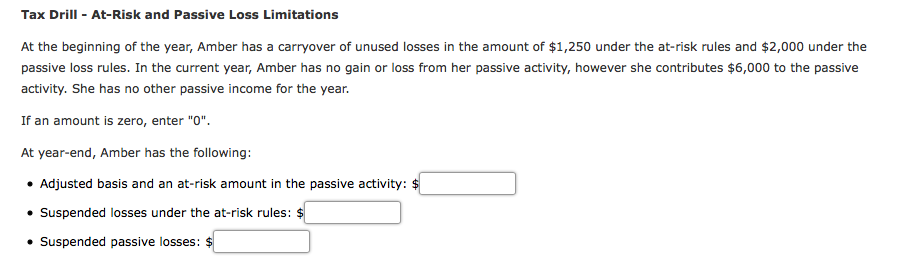

Passive activity loss carryover rules. Al requires reporting the entire income amount from schedule k 1 including out of state income on the al return. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. Use form 8582 passive activity loss limitations pdf to summarize income and losses from passive activities and to compute the deductible losses. Colorado passive losses of nonresident individuals.

There are a couple of things you need to be aware of. In other words you get tax free cash. See the instructions for form 461 limitation on business losses. A nonresident of colorado may source to colorado passive losses carried over from prior tax years and claimed in arriving at federal adjusted gross income to the extent such nonresident had colorado source passive.

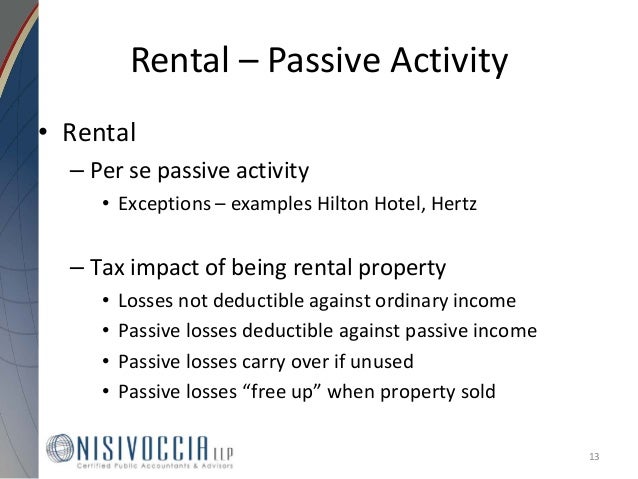

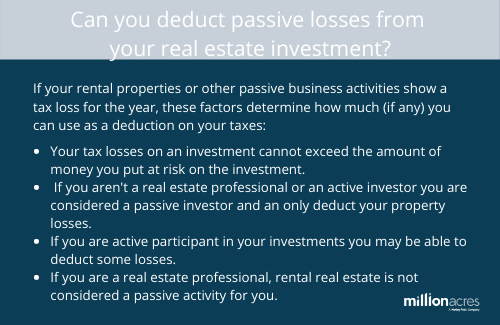

Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Losses and credits that a taxpayer cannot use because of the passive loss limitation rules are suspended and carry over indefinitely to be offset against future passive activity income sec. A taxpayer can apply suspended losses against passive activity income from any source not just from the activity that created the loss. Most come from rental properties schedule e.

Al allows passive activity losses to be deducted against all income passive and or ordinary income in a tax year. Yes the state does allow for passive loss carryovers for nonresidents. What is a passive loss carry over. In the case of any natural person subsection a shall not apply to that portion of the passive activity loss or the deduction equivalent within the meaning of subsection j 5 of the passive activity credit for any taxable year which is attributable to all rental real estate activities with respect to which such individual actively participated in such taxable year and if any portion of.

The internal revenue service places limits on passive losses the type that arise from activities you engage in on the side essentially as an investor. A passive activity is one wherein the taxpayer did not materially. Your allowable passive business losses may also be subject to an excess business loss. If you used turbotax to file your tax return last year any passive loss carryovers would appear on schedule e wks carryforward to 2016 smart worksheet final page note this is a turbotax supplemental schedule and not an irs form.

Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income.