Passive Activity Loss Carryover Sale Of Property

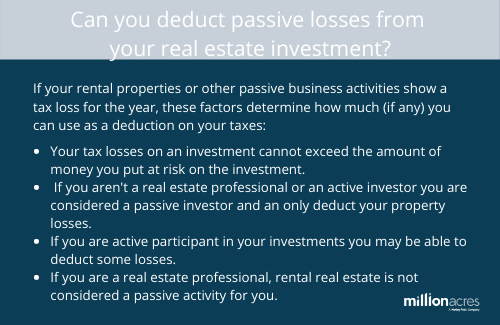

The tax rules provide that you may deduct your suspended passive losses from the profit you earn when you sell your rental property.

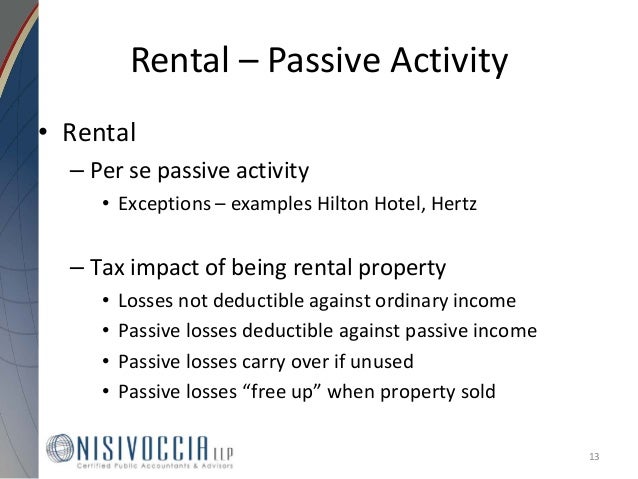

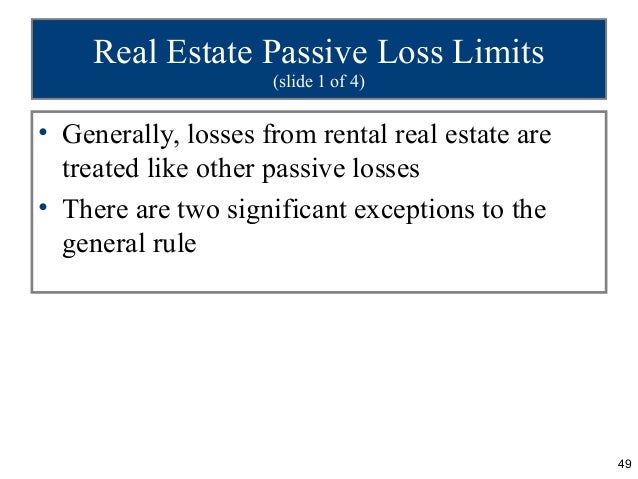

Passive activity loss carryover sale of property. If you own only one rental property and sell it then you can take the deduction because that property is your entire rental activity. The passive activity loss rule allows you to deduct these losses against passive activity income from other sources such as property rentals with positive cash flow or income from the sale of other. To take this deduction you must sell substantially all of your rental activity. This leaves suspended losses available to offset taxable passive income in the future.

The suspended passive losses cannot be used to offset depreciation recapture. To take this deduction you must sell substantially all of your rental activity. The taxpayer who gives up the passive activity property in the exchange continues to carry over the suspended losses. If you own only one rental property and sell it then you can take the deduction because that property is your entire rental activity.

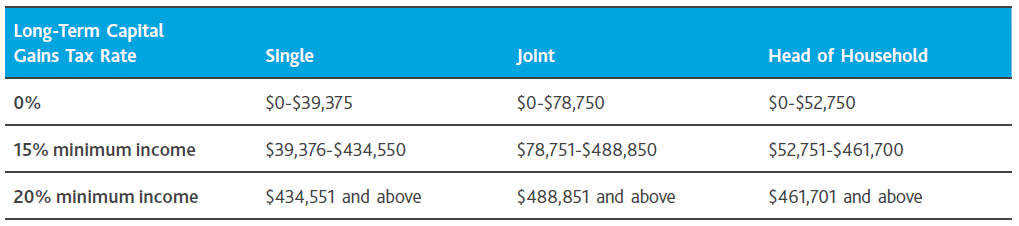

On october 30 2007 d sold property a to an unrelated party realizing a long term capital gain of 15 000. Disposition of an entire interest or substantially all 2. Suspended passive losses former principal residence in a taxpayer friendly result in chief counsel advice cca201428008 irs has determined that suspended passive activity losses from the passive rental of a home which was formerly used as the taxpayer s principal residence did not offset gain excluded under code sec. If you have suspended passive activity losses you may be able to.

As an example assume you have suspended passive losses of 300 000 from an activity that you have held for more than one. 121 on the property s sale. Property a generated a current year passive loss of 1 500 in 2007 before the date of sale d incurred a pal of 3 000 on property b in 2007. Dispose of a passive activity at a gain and not have to pay any taxes.

The corporation does not have any active income in 2007 against which its pal can be offset. Under irc 469 g a qualifying disposition requires three criteria. Your accumulated loss of 13 000 is deductible from the gain or loss from the reported sale. The tax rules provide that you may deduct your suspended passive losses from the profit you earn when you sell your rental property.

The carryover losses can be offset against the passive income from the property received that is attributable to the original activity but not against income attributable to a differentactivity. But you can fully deduct these suspended passive losses when you sell your rental property in a qualifying disposition.

.png?width=450&name=3d%20Ultimate%20Guide%20(1).png)