Passive Activity Loss Entire Disposition

Unused losses are suspended and carried over only to be used to offset passive activity income in future years.

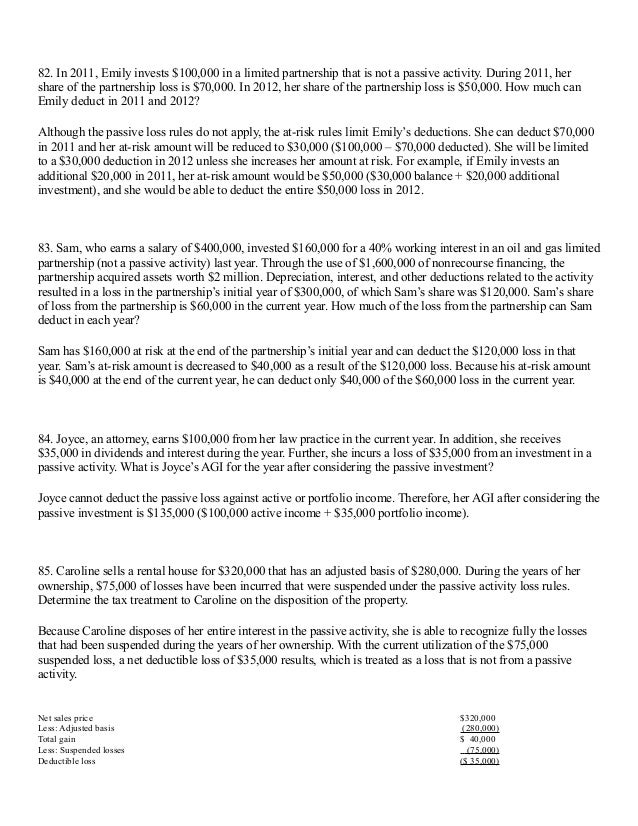

Passive activity loss entire disposition. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. If all aspects of the activity are aggregated current year income loss previous suspended losses gain loss from disposition and the aggregate is an overall gain the overall gain is passive. If the entire gain or loss from the sale of the property is recognized the current year loss from the activity including all suspended losses can be offset in full against any gain from disposing of the property or combined with the loss from such disposition. For example gain or loss from the sale of assets used in a trade or business is nonpassive if the taxpayer materially participates in the business.

Generally you may deduct in full any previously disallowed passive activity loss in the year you dispose of your entire interest in the activity. Generally all current and prior passive losses are allowed in full for a passive activity if a taxpayer disposed of the entire interest in the passive activity. How do the disposition rules work. 469 accomplishes this by recharacterizing the activity as nonpassive.

This allocation is necessary to determine the suspended losses for any particular activity. Gain or loss from the disposition of property retains the nonpassive or passive character of the activity in which the asset was used temp. However when there is a qualifying disposition of a passive activity losses from that activity that have been carried over can be claimed in full without regard to passive activity income. Disposition of entire interest.

If there is an overall loss the loss shall be allowed. These are allowed in full upon disposition. The portion of the loss that is suspended and carried forward is determined by the ratio of net losses from that activity to the total net losses from all passive activities for the year. However for the losses to be allowed a taxpayer must dispose of the entire interest in the activity in a transaction in which all the realized gain or loss is recognized.

If the gain from the disposition of the activity exceeds its suspended losses the gain may be used to offset losses from other passive activities.