Passive Activity Loss Example

This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

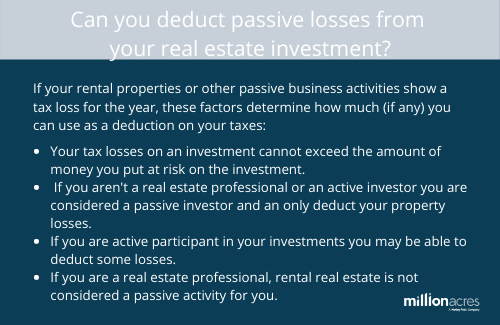

Passive activity loss example. On the other hand if you materially participate the activities aren t passive except for rental activities discussed below and the passive activity rules won t apply to the losses. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. When an investor buys shares in a rental property for example in which he or she is not actively involved in the operations it is considered a passive investment. The irs definition.

Such losses are deductible only from income from other passive activities. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. The passive activity rules prevent an investor from deducting a passive loss from salary self employment income dividends sales of investment property interest or retirement income. To materially participate you must be involved in the operations on a regular continuous and substantial basis.

For example your share of the loss from a partnership in which you re a limited partner may not be deducted from the salary you earned at some company in which you are an employee. Passive activities are trades businesses or income producing activities in which you don t materially participate the passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. For example if you have a passive loss of 5 000 and passive income of 2 000 you would have a suspended loss of 3 000 5 000 minus 2 000. How does a passive loss work.

If passive activity losses exceed passive activity income the excess must be carried over to future tax years and may be deducted from passive activity income of.

:max_bytes(150000):strip_icc()/rx-pharmacy-prescription-bottle-of-pills--100-usa-v2-1143294186-825ac411d0814eb28e822a9b3590e8d8.jpg)