Passive Activity Loss Exceptions

Thus most rental activities involving real estate are treated as passive activities.

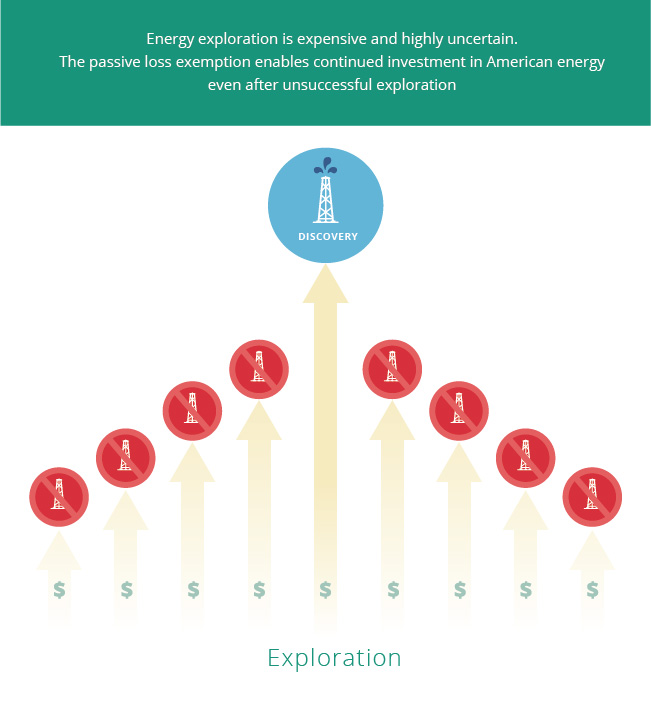

Passive activity loss exceptions. Why was the passive loss exception created. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. Ordinarily rental activities are automatically considered passive activities and their losses may only be used to offset passive activity income.

But the obama administration would repeal the passive loss exception. Unless you qualify for an exception. The tax reform act divided investment income loss into two baskets active and passive. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

It is labeled passive activity loss carryforward and can be offset by any passive activity loss income in future years including income from. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. An exception to passive activity loss rules.

This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. Per irs regulations a loss from a passive activity can only offset income from a passive activity. There are two exceptions that allow. Pre 1994 passive loss carryovers attributable to rental real estate activities which are subject to the new rules are treated like former passive activity carryovers and may offset only income.

However there is an exception to this unfavorable passive activity loss rule for real estate professionals. Why is understanding this important. Losses from passive activities can only offset passive income.