Passive Activity Loss In Year Of Death

If the passive activity is a partnership interest the losses of the partnership in the year of death attributable to the decedent s interest are fully allocated to the decedent s estate since the tax year of the partnership does not close due to the death of a partner irc sec.

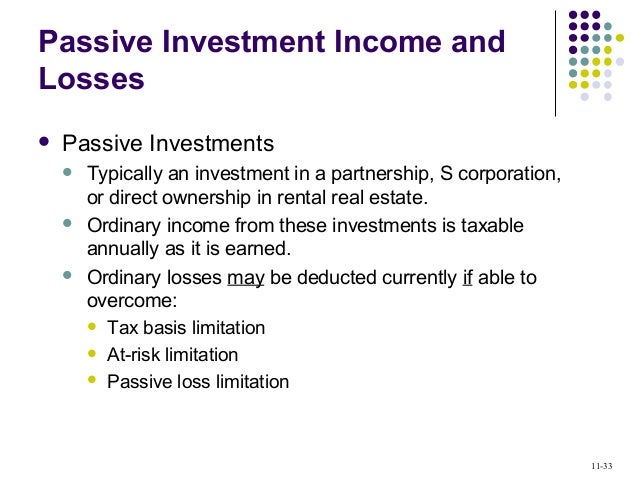

Passive activity loss in year of death. Passive activity losses pals generated when a taxpayer incurs ordinary losses in a passive investment may be treated differently in the case of a taxpayer s death. Suspended passive activity losses pals must be traced to the owner of the activity. Suspended losses transfers by. Passive activity loss carryovers.

Installment sale when the s corporation stock is disposed of in an installment sale suspended losses from the activity are deductible as installment payments are collected. If the passive activity is a partnership interest the losses of the partnership in the year of death attributable to the decedent s interest are fully allocated to the decedent s estate since the tax year of the partnership does not close due to the death of a partner irc sec. Passive losses and passive activity. Abstract the suspended losses ascribable to a passive activity are non deductible at the time of the disposition of the activity to a beneficiary by an estate or trust instead the losses should be included as basis of the activity.

Passive activity is activity that a taxpayer did not materially participate in during the tax year. The suspended passive activity loss of 75 000 would be added to the donee s basis in the property under sec. For individuals with large pals it is important that practitioners be aware of the rules relating to the disposition and transfer of passive assets and be proactive in. The internal revenue service irs defines two types of.

Planning for distributions of passive activities by estates. Suspended losses transfers on death suspended losses are deductible by the decedent when a passive activity is transferred by reason of death to the extent that the excess of the fair market value stepped up basis in the hands of the transferee over the decedent s adjusted basis is less than the amount of suspended loss. 469 g 2 b any of the decedent s pal carryovers are allowed on the final joint return for the year of death as the activity is considered disposed of.