Passive Activity Loss In Year Of Disposition

However special rules apply to dispositions.

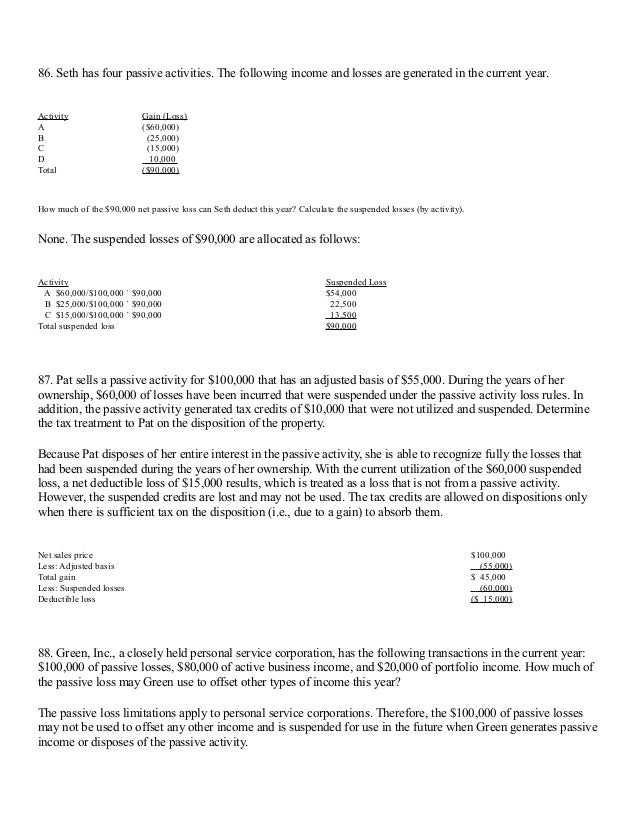

Passive activity loss in year of disposition. If the activity is disposed of in a fully taxable as opposed to tax deferred transaction to an unrelated party both current and suspended passive activity losses generated by that activity as well as any loss on the disposition can be deducted sec. A passive loss allowed from a disposition of a k1 activity will be reported as a nonpassive loss on schedule e line 28. However when there is a qualifying disposition of a passive activity losses from that activity that have been carried over can be claimed in full without regard to passive activity income. When a taxpayer disposes of the entire interest in a passive activity that activity is no longer subject to the passive activity rules.

Unused losses are suspended and carried over only to be used to offset passive activity income in future years. Any gain or loss from the disposition of a passive activity is generally also passive. The passive losses are multiplied by this ratio to generate the current year allowed loss. Unused pals are suspended and carried forward to future years until the taxpayer 1 disposes of the particular activity that generated the losses 2 generates net passive activity income in the case of a personal service corporation or 3 generates net passive activity income or net active income in the case of a closely held corporation.

How do the disposition rules work. Disposing of a passive activity allows suspended passive losses to be deducted. A special rule accomplishes this.