Passive Activity Loss Limitations Corporations

Work you do in your capacity as an investor does not constitute participation in the business unless you are directly involved in the day to day management or operations of the activity.

Passive activity loss limitations corporations. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. There are two types of passive income or loss. Personal service corporations and closely held c corporations use form ftb 3802 corporate passive activity loss and credit limitations to figure the amount of any passive activity loss pal or credit for the current taxable year and the amount of losses and credits from passive activities allowed on the corporation s tax return.

Monday november 23 2020 08 00 am pst. Passive activity rules apply to individuals estates trusts other than grantor trusts personal service corporations and closely held corporations. When the shareholder s interest in the passive activity is disposed of in a fully taxable transaction to an unrelated party any suspended passive activity losses attributable to the activity are. Passive losses and credits are carried over to the next year but may only offset passive income or tax attributable to passive activities.

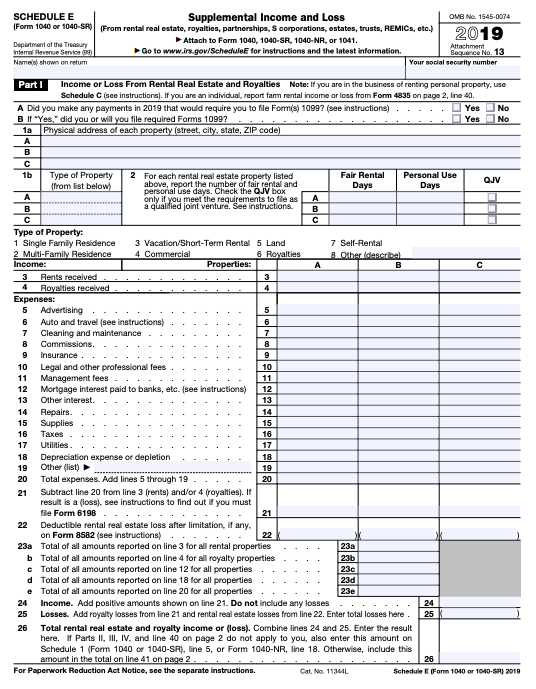

The excess business loss limitation applies to the total aggregate income and deductions from all of a taxpayer s trades or businesses including rental and nonrental businesses. In previous years these shareholders could deduct their passive activity losses from either active or passive income. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Working with the complex pal rules real estate tax issues.

The income or losses their shares incur are known as passive activity income or passive activity losses. The passive activity loss rules created a special category of income and loss called passive income or loss. Passive activity loss limitations. Personal service corporations and closely held corporations use this form to figure the amount of any passive activity loss pal or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation s tax return it is also used to make the election to increase the basis of credit property.