Passive Activity Loss Limitations Partnerships

The irs asserted that the taxpayers interests in the companies should be treated as limited partnership interests for purposes of the passive activity loss rules and were subject to the additional limitations found in code section 469 h 2.

Passive activity loss limitations partnerships. The special allowance including crds for rental real estate activities does not apply to pals from a. 8582 passive activity loss limitations. Pals passive activity losses from a ptp generally may be used only to offset income or gain from passive activities of the same ptp. However exceptions apply for certain rental real estate activities and additional limitations apply to publicly traded partnerships ptp.

Section 469 k provides that passive activity limitations must be applied separately to items from each ptp. A taxpayer can apply suspended losses against passive activity income from any source not just from the activity that created the loss. Losses and credits that a taxpayer cannot use because of the passive loss limitation rules are suspended and carry over indefinitely to be offset against future passive activity income sec. The partnership informs sidney that his share of the partnership s annual operating loss is 75 000.

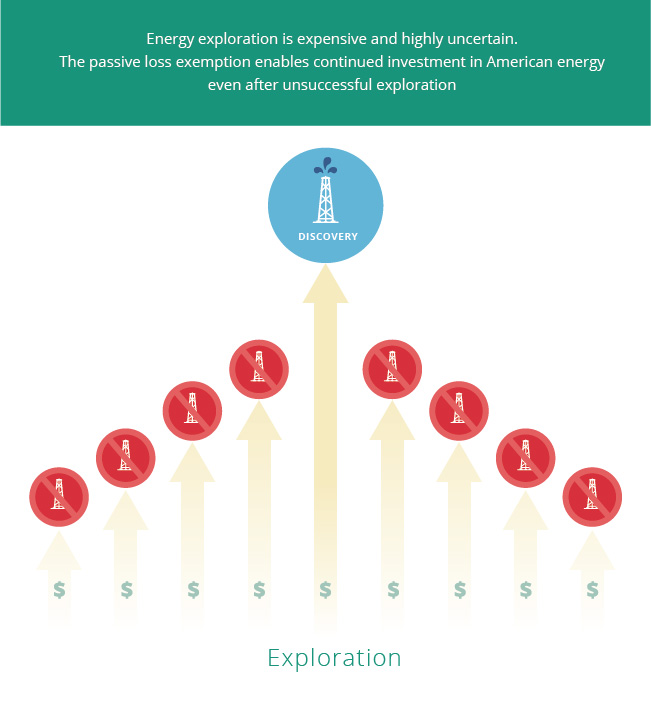

Generally passive activity losses are limited for income tax purposes because passive activity losses can only be offset by passive activity income. They will also be allowed if the partnership other than a ptp disposes of all the property used in that passive activity. If you dispose of your entire interest in a partnership the passive activity losses from the partnership that haven t been allowed are generally allowed in full. Understanding passive activity loss rules the key issue with passive activity loss.

The passive activity loss rules created a special category of income and loss called passive income or loss. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Sidney invested in the limited partnership because he wanted to use his share of. Common passive activity losses may stem from leasing equipment real estate rentals or limited partnerships.

Information about form 8582 passive activity loss limitations including recent updates related forms and instructions on how to file. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.