Passive Activity Loss Publicly Traded Partnership

This is very different from interests in regular non ptp passive activities where allocated losses can be used to offset earnings for any other passive activity.

Passive activity loss publicly traded partnership. Limited to income from the same ptp excluded from being taken against other types of passive losses suspended and will carry forward until the ptp has income to offset the loss. As per schedule k 1 the passive activity limits apply separately for things from every ptp except credits for low income housing and rehabilitation. This is one of the more significant current year tax issues. Worthlessness of partnership interest and complete disposition of activity rule.

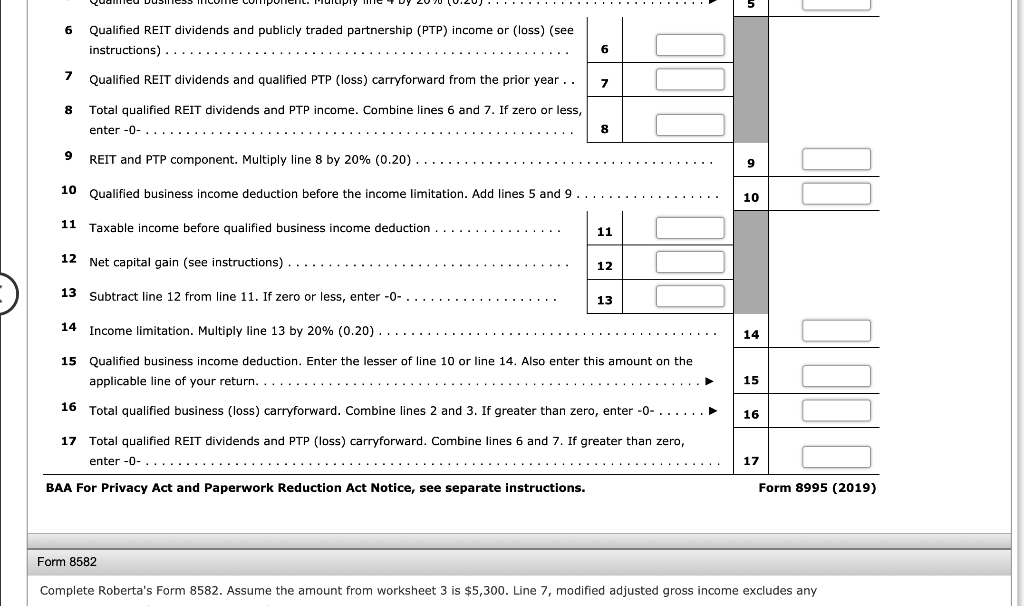

Passive activity is often discussed in contrast to nonpassive activity where there is material participation 29 sec. Is it used in computing the reit ptp component. Per the i nstructions for form 8582. The passive activity limitations are applied separately for items other than the low income housing credit and the rehabilitation credit from each publicly traded partnership ptp.

The loss is not currently allowable due to the passive activity rules. Thus a net passive loss from a ptp may not be deducted from other passive income. A passive activity is any activity involving a trade or business that the taxpayer does not materially participate in. In 2018 i receive a schedule k 1 allocating a ptp loss.

When a particular ptp incurs a loss that loss can only offset future earnings from that same ptp. By definition an owner of an interest in a ptp is not materially participating. Irs rules treat an overall loss from a publicly traded partnership ptp as passive and an overall gain from a ptp as nonpassive. You must also apply the limit on passive activity credits separately to your credits from a passive activity held through a ptp.

If the partner s entire interest in the ptp is completely disposed of in a fully taxable disposition any unused losses are allowed in full in the year of disposition. Thus a net passive loss from a ptp may not be deducted from other passive income. Also a publicly traded partnership s net passive loss cannot be deducted from other passive income. Passive activity rules apply separately to each interest in a publicly traded partnership ptp consider alternative minimum tax adjustments.

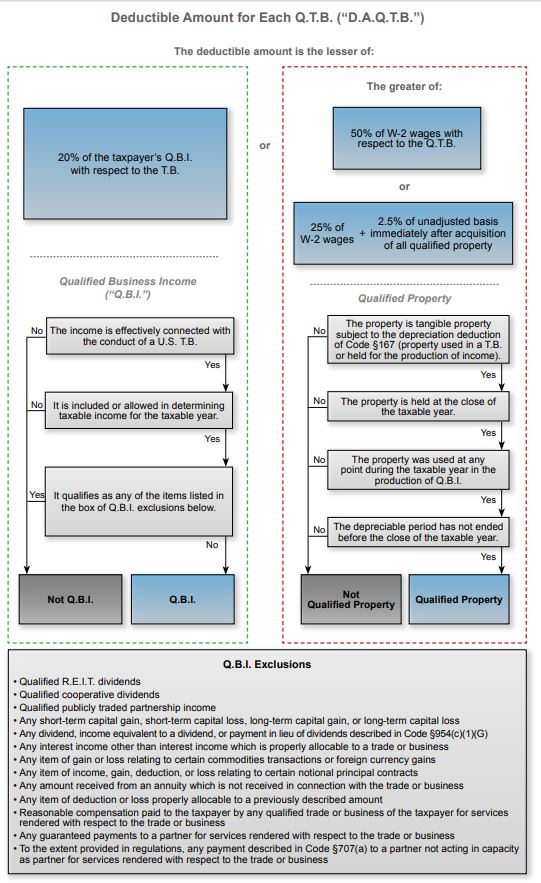

Passive losses for publicly traded partnerships are. Passive activity loss rules for partners in ptps. Do not report passive income gains or losses from a ptp on form 8582. The faq also clarifies that the passive loss limitation issue also spills over into publicly traded partnership qbi calculations.