Passive Activity Loss Rules C Corporations

11 a c corporation is clo sely held if at any time during the.

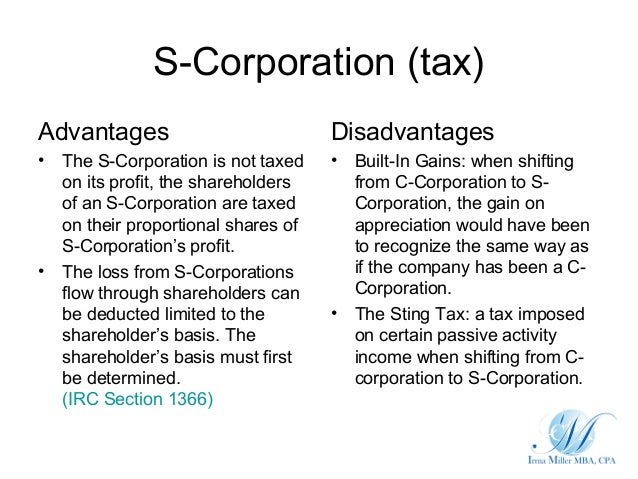

Passive activity loss rules c corporations. You can t deduct the excess expenses losses against earned income or against other nonpassive income. 10 chcs are subject to the passive loss rules because of concern that individuals would incorporate their portfolio investments to avoid the limitations. Figure the amount of any passive activity loss pal or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation s tax return. For the at risk rules a c corporation is a closely held corporation if at any time during the last half of the tax year more than 50 in value of its outstanding stock is owned directly or.

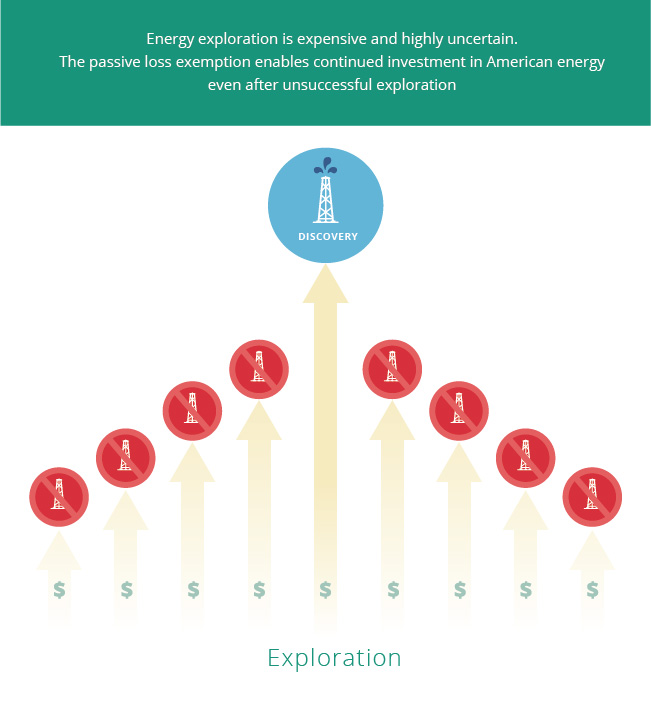

For more information on how to apply the passive activity loss rules to ptps and on how to apply the limit on passive activity credits to ptps. The passive loss rules apply to closely held c corporations chcs. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations.

:max_bytes(150000):strip_icc()/irs-5bfc3189c9e77c00519bc228.jpg)