Passive Activity Loss Rules S Corporation

A pal can usually only be used to offset passive income although the irc does provide a few exceptions.

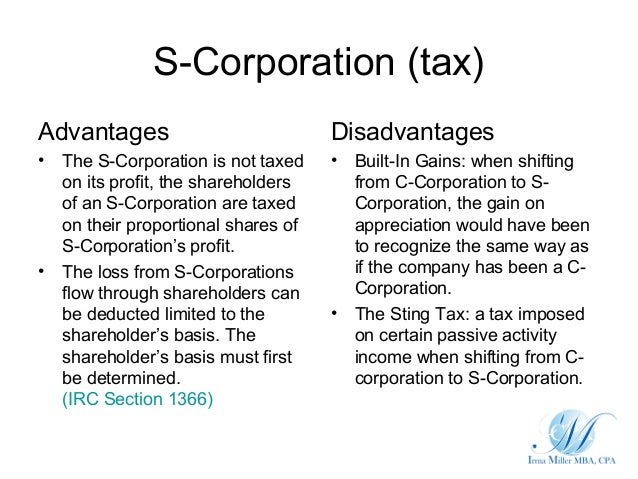

Passive activity loss rules s corporation. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. In previous years these shareholders could deduct their passive activity losses from either active or passive income.

The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. A pal is the amount by which the taxpayer s aggregate losses from all passive activities for the year exceed the aggregate income from all of those activities. As a result if a taxpayer s total losses from all passive activities exceed the total income those losses cannot be used to offset non passive income. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder.

Under pal rules losses from a passive activity are deductible only to the extent of the income related to that or another passive activity. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. The passive activity loss and the passive activity credit and the 25 000 amount under subsection i shall be allocated to activities and within activities on a pro rata basis in such manner as the secretary may prescribe. For details on net active income see the instructions for form 8810.

The income or losses their shares incur are known as passive activity income or passive activity losses. Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you.