Passive Activity Loss Rules When Selling Rental Property

If you own only one rental property and sell it then you can take the deduction because that property is your entire rental activity.

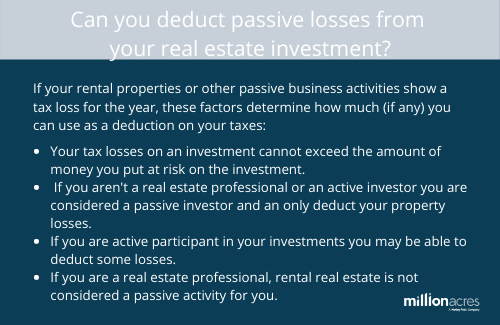

Passive activity loss rules when selling rental property. Generally a passive activity is any rental business activity in which the taxpayer does not materially. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. In addition to the passive activity loss rules we ve discussed there are two other irs rules that could potentially limit the amount of rental real estate or passive business losses you can. Exceptions to the rules for figuring passive activity limits for personal use of a dwelling unit and for rental real estate with active participation are discussed later.

Deducting suspended passive losses. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. If you own only one rental property and sell it then you can take the deduction because that property is your entire rental activity. Suspended passive losses continue to track forward until they can be deducted against active or passive income or you dissolve your interest in the property.

To take this deduction you must sell substantially all of your rental activity. Nor can you offset taxes on income other than passive income with credits resulting from passive activities. You might have some passive activity losses pals if your rental property generated losses in the past years. The tax rules provide that you may deduct your suspended passive losses from the profit you earn when you sell your rental property.

If your rental income generates a passive activity loss that is not deductible it becomes a suspended passive loss. The tax rules provide that you may deduct your suspended passive losses from the profit you earn when you sell your rental property. To take this deduction you must sell substantially all of your rental activity. Any excess loss or credit is carried forward to the next tax year.

The internal revenue service irs says that a passive loss can t be deducted against ordinary income. For most real estate investors a loss from rental properties is considered a passive loss. In general you should be able to deduct these passive losses against passive income from passive rental business activities.