Passive Activity Loss S Corporation

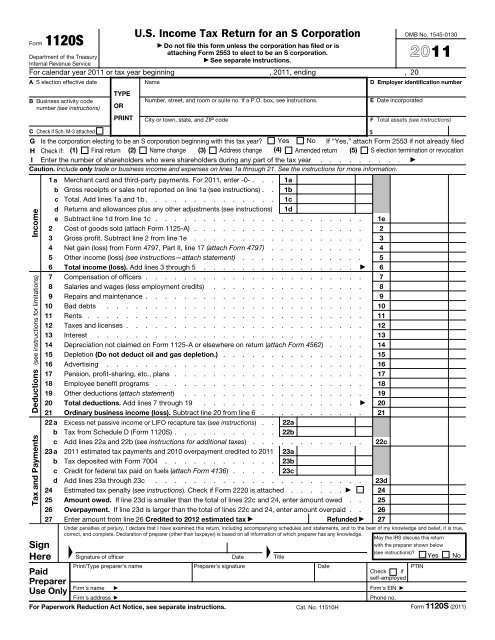

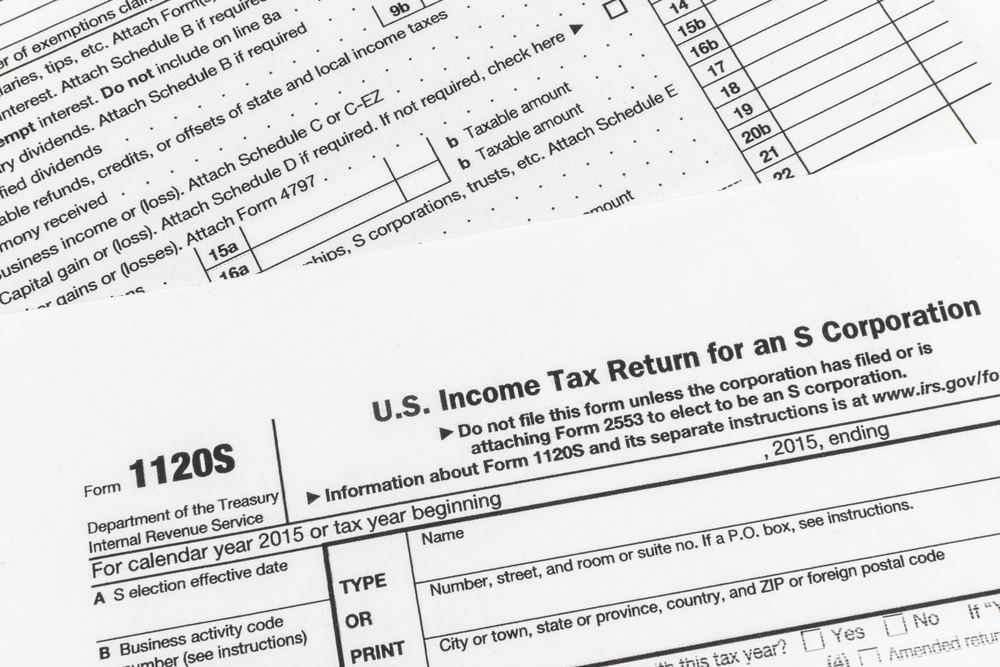

Passive activity loss rule the second in a series on the rules governing deductions for s corporation losses.

Passive activity loss s corporation. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. All shareholders in an s corporation will receive a schedule k 1. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you.

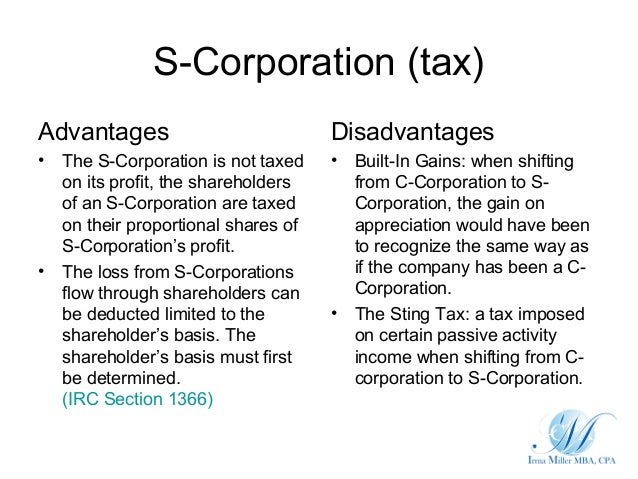

Passive income like rents and royalties. S corporation passive income restrictions. This means that any losses passed through to you by partnerships or s corporations will be treated as passive unless the activities aren t passive for you. When a corporation elects s corporation status one of the primary reasons is the tax benefits it provides.

While there are tax advantages to being. The internal revenue service irs defines two types of. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. It is valid for the s corporation sting tax and not losing an s election because of passive income.

Passive losses and passive activity passive activity is activity that a taxpayer did not materially participate in during the tax year. Stock basics and at risk limitations s corporations are flow through tax entities meaning income deductions credits and other activity are allocated to shareholders to be reported on their individual tax returns. The passive activity loss rules also apply to any items passed through to you by partnerships in which you re a partner or by s corporations in which you re a shareholder. Capital gains and or losses.

If the activity is disposed of in a fully taxable as opposed to tax deferred transaction to an unrelated party both current and suspended passive activity losses generated by that activity as well as any loss on the disposition can be deducted sec. Disposing of a passive activity allows suspended passive losses to be deducted.