Passive Activity Loss Special Allowance

This special allowance is an exception to the general rule disallowing losses in excess of income from passive activities.

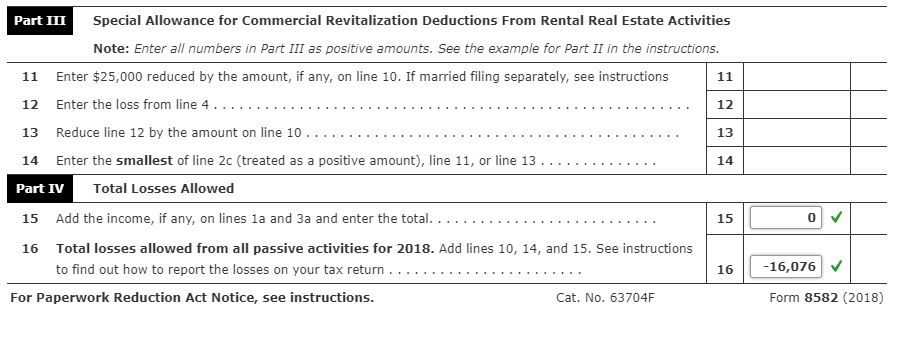

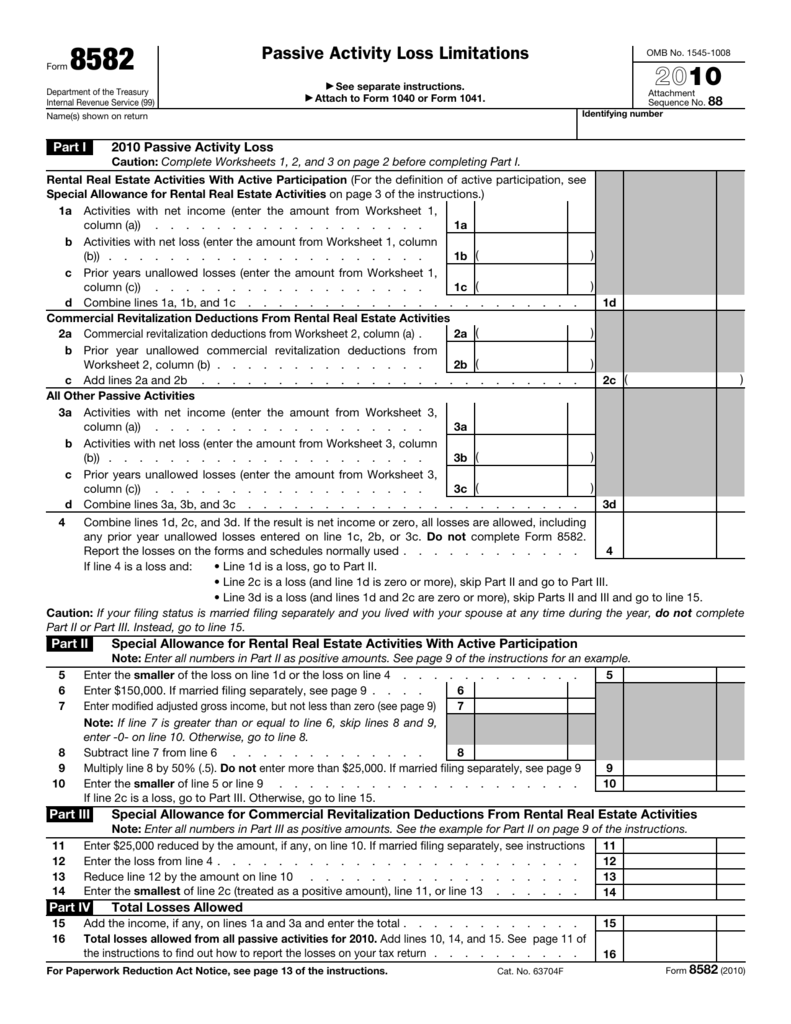

Passive activity loss special allowance. However a special allowance for rental real estate activities may allow some losses even if the losses exceed passive income. This special allowance is an exception to the general rule disallowing losses in excess of income and passive activities. Pals not allowed in the current year are carried forward until they re allowed either against passive activity income against the special allowance if applicable or when you sell or exchange your entire interest in the activity in a fully taxable transaction to an unrelated party. If you or your spouse actively participated in a passive rental real estate activity you can deduct up to 25 000 12 500 for married filing separate filers of loss from the activity from your nonpassive income.

Special 25 000 allowance for real estate nonprofessionals. Modified adjusted gross income for this purpose is your adjusted gross income figured without the following. This is because the special allowance is reduced to 0 since the modified adjusted gross income is over the 100 000 amount. The portion of passive activity losses attributable to the crd.

If you re not a real estate professional a special rule let s you classify up to 25 000 of rental losses as nonpassive. This means you can deduct up 25 000 of rental losses from your nonpassive income such as wages salary dividends and interest. If the property was not disposed ultratax cs would limit the losses on form 8582 in accordance with the special 25 000 allowance rules. 25 000 for single individuals and married individuals filing a joint return for the tax year.