Passive Activity Loss Year Of Disposition

The passive loss rules are aimed at preventing individual taxpayers from using their losses from passive activities to offset their income from active businesses.

Passive activity loss year of disposition. A passive loss allowed from a disposition of a k1 activity will be reported as a nonpassive loss on schedule e line 28. Thus the 100 000 of suspended passive losses could be treated as losses that are not from a passive activity in other words they were deductible from the landlord s other nonpassive. While net income or gain on sale is non passive it may be used to trigger prior year passive losses or credits from. If all aspects of the activity are aggregated current year income loss previous suspended losses gain loss from disposition and the aggregate is an overall gain the overall gain is passive.

The rules operate by disallowing the current deduction of passive losses the excess of an individual taxpayer s losses from passive activities for the year over his. However when there is a qualifying disposition of a passive activity losses from that activity that have been carried over can be claimed in full without regard to passive activity income. If the current year non passive activity triggers deductibility of prior year suspended passive activity losses irc 469 f permits a prior year passive loss to offset current year income from the same activity even though that income might be non passive in the current year. Disposition of passive activity property.

The passive losses are multiplied by this ratio to generate the current year allowed loss. Unused losses are suspended and carried over only to be used to offset passive activity income in future years. All gains if. The irs chief counsel advised that the foreclosure qualified as a taxable disposition of substantially all of the landlord s interest in the property.

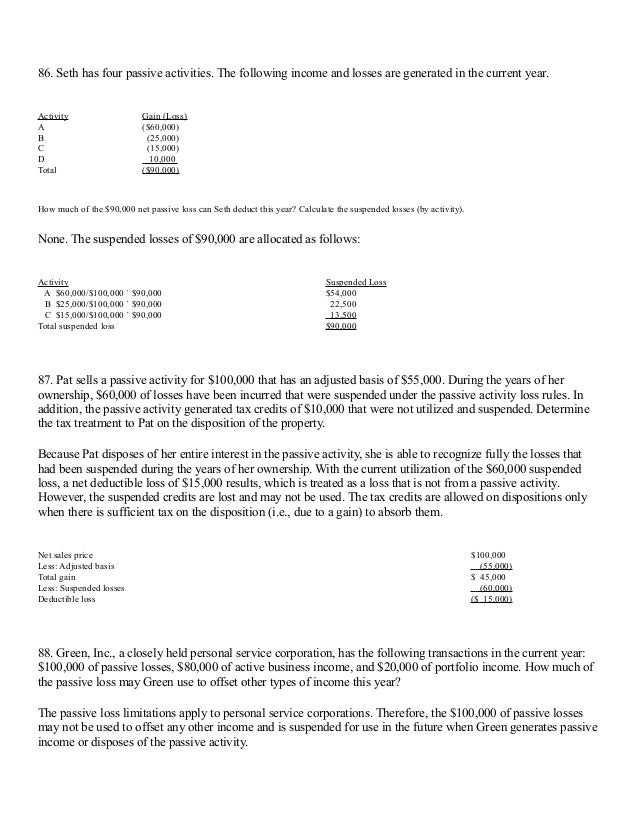

If the disposition of a passive activity results in a capital loss the 3 000 capital loss limitation applies. A inc is a psc that owns two passive activities a leased office building and a book unit. If the gain from the disposition of the activity exceeds its suspended losses the gain may be used to offset losses from other passive activities. The suspended passive losses that had been denied including any passive loss for the current year may be deducted when the entire interest in the property is disposed of in a taxable transaction to an unrelated party.

If there is an overall loss the loss shall be allowed. The building lease activity has no suspended losses and a current year income of 10 000. The book unit has 50 000 in suspended losses and a current year loss of 10 000. 469 accomplishes this by recharacterizing the activity as nonpassive.