Passive Dividend Income Tax Rate

It is also worth noting one additional difference investors need to account for.

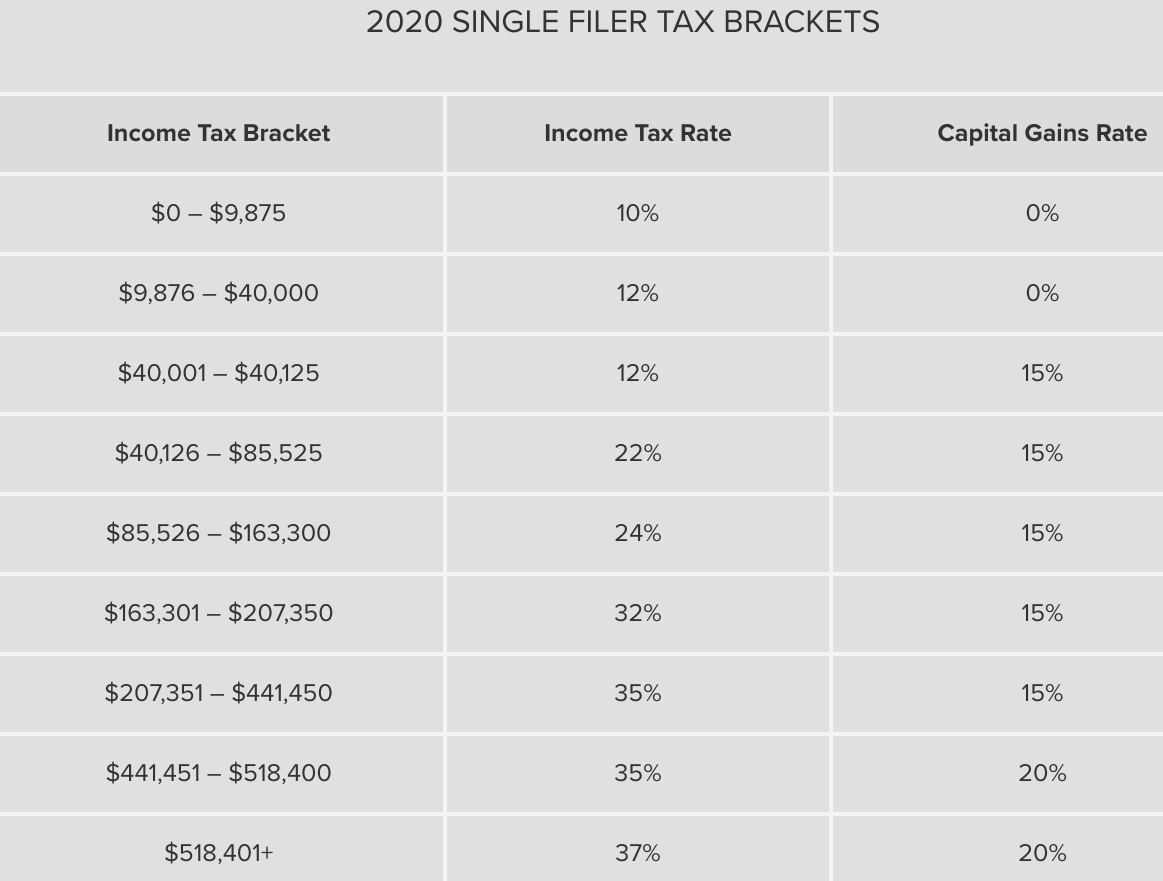

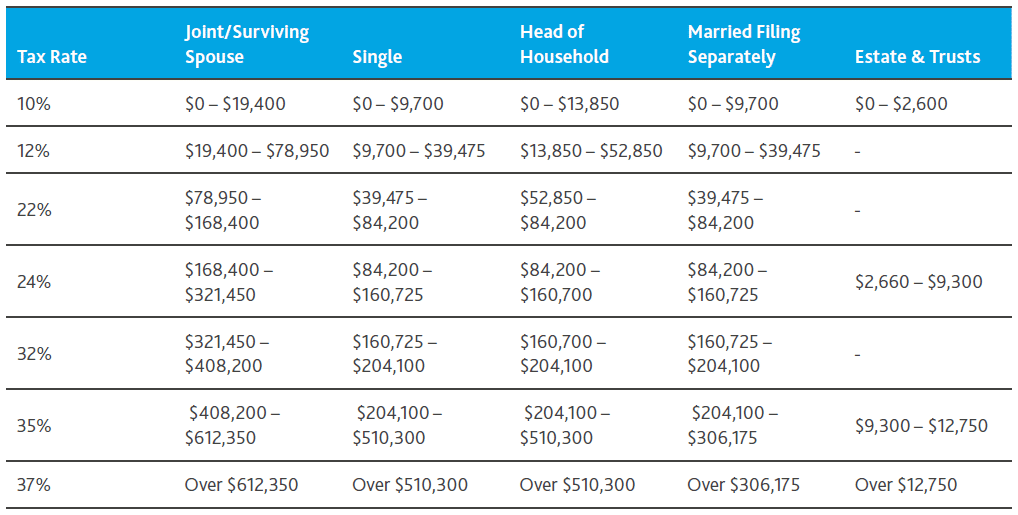

Passive dividend income tax rate. The current tax rates for short term gains are as follows. 10 12 22 24 32 35 and 37. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. Basically it allows owners of pass through businesses to take a 20 deduction on the ordinary dividend tax from these business dividends.

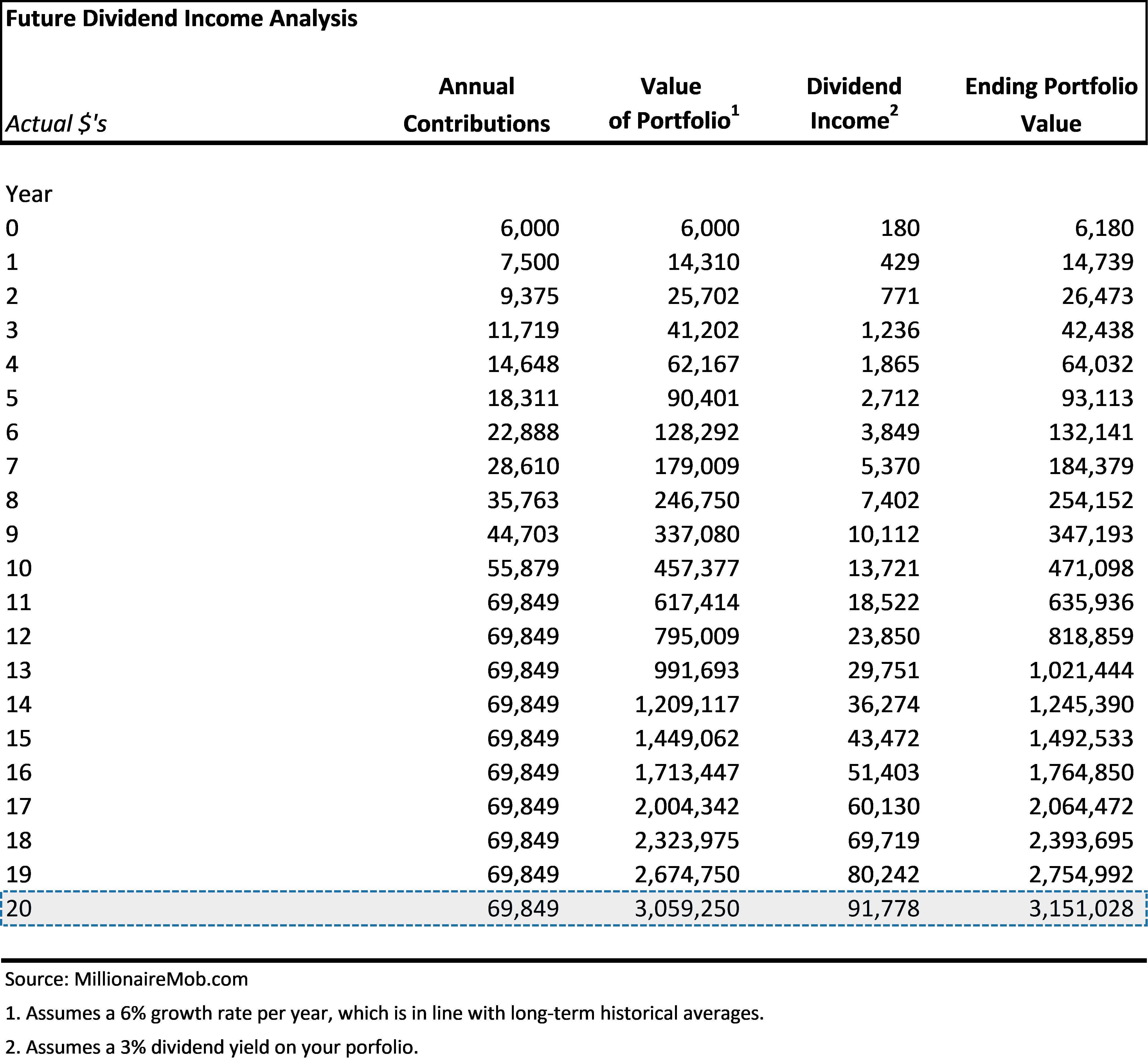

Paying tax on passive income from etf and lics in australia. The bottom line. This blows away the high income taxes we pay on our earned income. The passive income tax rate.

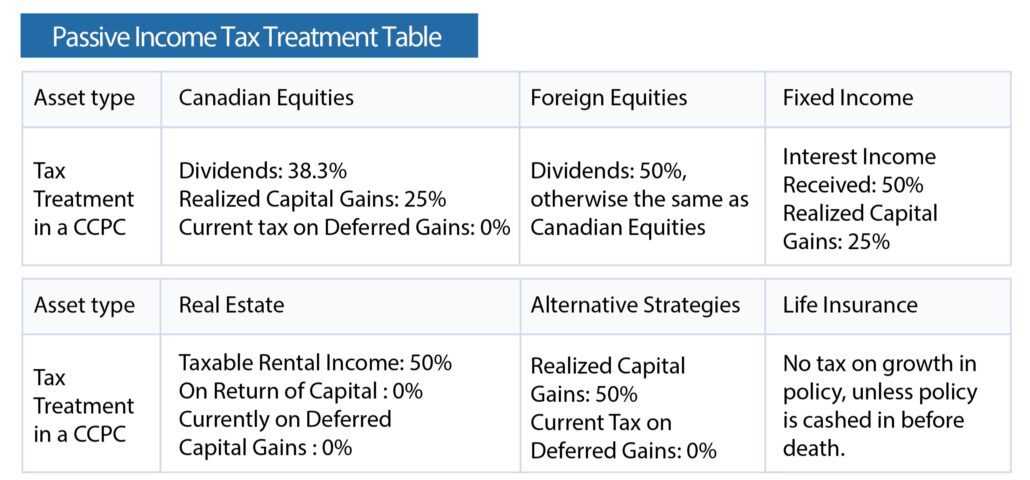

Short term passive income tax rates. The canadian government was concerned that business owners could structure their affairs to recover refundable tax paid by ccpcs on passive investment income through the payment of eligible dividends which are taxed in the hands of the individual shareholders at a lower rate than non eligible dividends. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. Passive income is very appealing especially the super low tax rate on dividend income.

However dividends do not fall under the passive income. As you will soon discover passive income is technically taxed a lot like active income. If your income is in between 25000 34000 as a single tax filer or between 32 000 44 000 as a joint taxpayer 50 of the social security benefits will fall under the taxable income bracket. So i am sure you have understood by now that passive income tax rate is a rather complicated financial arrangement.

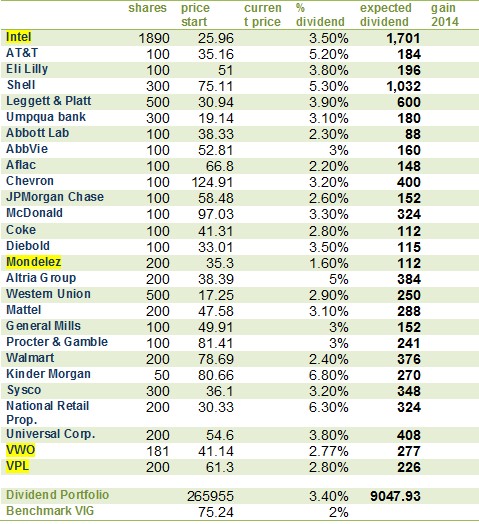

At its most structured the best passive income comes from investments in stock market etf and lics and these entities will already have paid tax on their earnings at the corporate tax rate before the dividends are paid to you. Is passive income tax rate complicated. In other words short term capital gains are taxed at the same rate as your income tax. By its broadest definition passive income would include nearly all investment income.

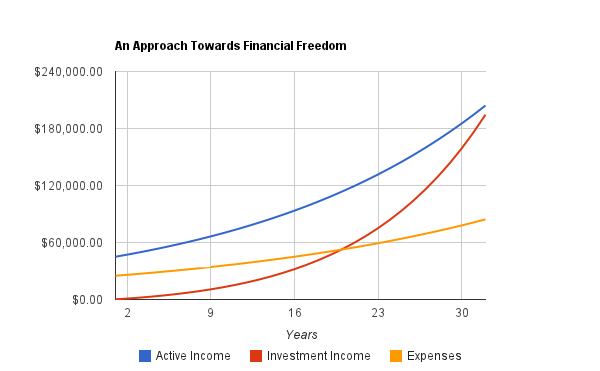

Passive investors on the other hand tend to gravitate towards buy and hold assets. Passive income broadly refers to money you don t earn from actively engaging in a trade or business. If you fall in the 35 37 bracket the qualified dividend tax rate is 20. Passive income qualifies for capital gains tax which is a lower rate than ordinary income tax making it more attractive.

Section 199a is part of the tax cuts and jobs act of 2017.