Passive Income And 199a

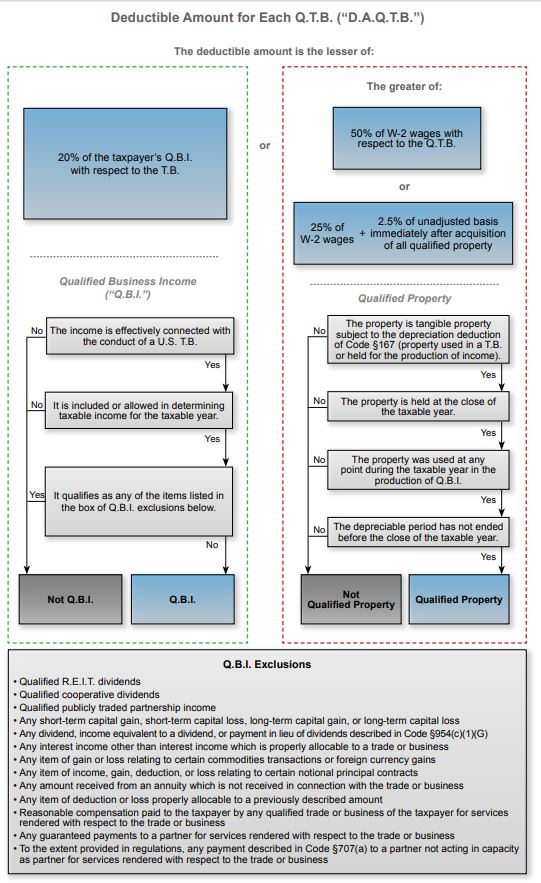

199a which permits owners of sole proprietorships s corporations or partnerships to deduct up to 20 of the income earned by the business.

Passive income and 199a. The proposed 199a rules introduce a new option to aggregate trades and businesses to maximize their 199a deduction. This aggregation would be separate from any grouping already in place for other tax provisions. In addition any losses disallowed before jan. The motivation for the new deduction is clear.

1 2018 are never taken into account for the qbi deduction. To allow these business owners to keep pace with. Consider the following scenario. With the enactment of legislation known as the tax cuts and jobs act the act 1 on dec.

Passive activity losses and sec. Niit was enacted to impose a medicare surcharge on passive income. However this 20 deduction found in new internal revenue code 199a is saddled with exclusions phase outs technical issues and uncertainties so that many well meaning non corporate. The section 199a only applied to qualified business income qbi which was generally defined as income from a qualified trade or business other than a specified service trade or business or the performance of.

In a nutshell roughly 97 of your clients have taxable income under the threshold so their deduction is equal to 20 of domestic qualified business income from a pass through entity subject to the overall limit based on taxable income roughly 3 of your clients are impacted by the threshold the deduction is phased out based on 1040 taxable income unless. After the issuance of proposed regulations in irc 199a commenters immediately looked for parallels between niit and qbi. In addition the section 199a deduction cannot exceed the ceiling limit of 20 of her total net income or the total marital net income if she and her spouse file a joint return so that losses. Passive income qualify for 199a.

Passive income qualify for 199a. When the 199a was first passed tax professionals didn t think it would apply to passive income from holding rental property. Passive activity losses pals are not taken into account for the qbi deduction if they are disallowed. Many taxpayers already group activities in response to the passive activity loss rules and the net investment income tax rules.

Section 199a was added to the internal revenue code under the tax cuts and jobs act of 2017 to provide taxpayers with a 20 deduction from income attributable to qualifying trades or businesses.