Passive Income And Fatca

More than 50 of the entity s gross income consisted of active income.

Passive income and fatca. 5 public these entities do not carry on a business of a financial institution. The entities listed below are active nfes. These entities do not carry on a business of a financial institution. These entities do not carry on a business of a financial institution.

Fatca attempts to deter tax evasion by us tax payers through offshore accounts. Very broadly passive entities are defined under fatca as entities organizations or companies that are in receipt of passive income or hold passive assets and do not fall under any of the other fatca classifications. Less than 50 of the assets held by the entity was used to produce passive income. Help menu mobile although the distinction between active and passive income is an important one for fatca compliance passive is not a defined term.

When you complete a fatca registration you are asked to include the name and contact information of 1 a responsible officer ro and 2 a point of contact poc. The foreign account tax compliance act is a tax law that compels us citizens at home and abroad to file annual reports on foreign account holdings. Very broadly passive entities are defined under fatca as entities organizations or companies that are in receipt of passive income or hold passive assets and do not fall under any of the other fatca classifications. What is meant by a passive entity passive nffe under fatca.

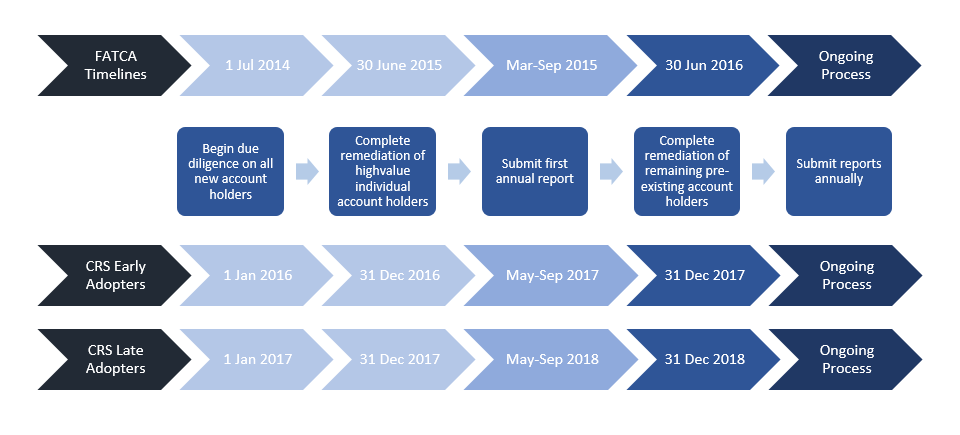

The fatca regime classifies all entities companies trusts associations and partnerships as either a financial institution an active non financial foreign entity active nffe or a passive non financial foreign entity passive nffe. Fatca foreign account tax compliance is a us law that requires financial institutions such as passive income usa commercial property fund outside us to identify collect and report information about us citizens and residents to the irs. The entity is an active entity if the entity during the last year. When less than 50 of the nffe s gross income for the preceding year or other appropriate reporting period is passive income and when less than 50 of the assets held by the nffe during the preceding year or other appropriate reporting period are assets that produce or are held of passive income.

Passive income is earnings derived from a rental property limited partnership or other enterprise in which a person is not actively involved. To enable this the.