Passive Income And Section 199a

While simple at face value the application of 199a is far from it.

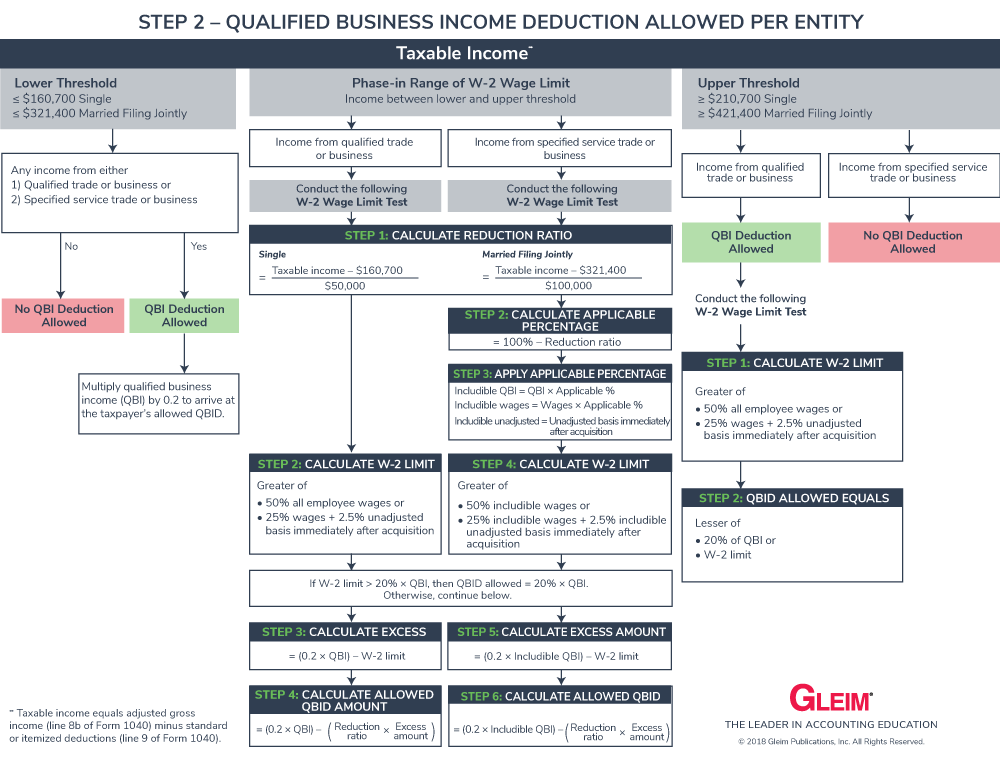

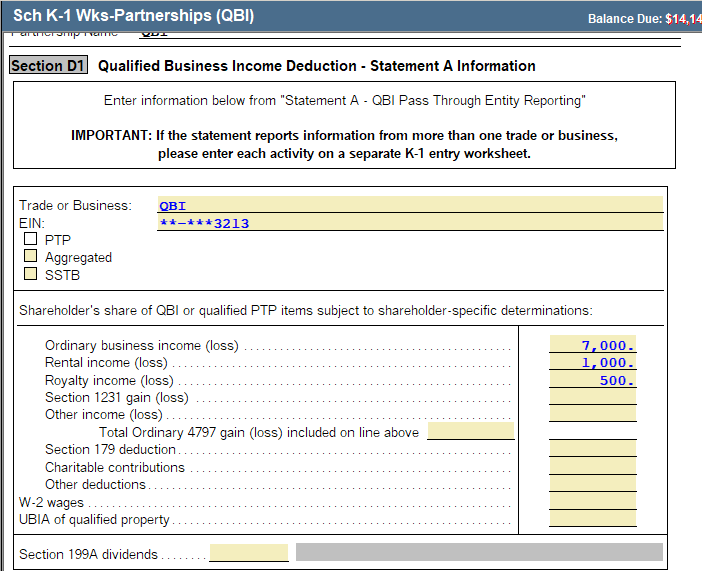

Passive income and section 199a. Written to help lessen the gap between the corporate tax rate and the individual tax rates for pass through income 199a allows a deduction of up to 20 of qualified business income reported by a pass through entity. Section 199a was added to the internal revenue code under the tax cuts and jobs act of 2017 to provide taxpayers with a 20 deduction from income attributable to qualifying trades or businesses. That s because this is the first year individuals estates and trusts owners that are owners of these pass through businesses will be able to claim the section 199a deduction the 2017 tax act p l 115 97 included this deduction to even the playing field with. To allow these business owners to keep pace with.

The irs will be issuing regulations and offering other administrative guidance in the coming months. After the issuance of proposed regulations in irc 199a commenters immediately looked for parallels between niit and qbi. When the 199a was first passed tax professionals didn t think it would apply to passive income from holding rental property. Tax season may begin early this year for pass through businesses.

O section 1231 recapture does qualify as qbi. 199a which permits owners of sole proprietorships s corporations or partnerships to deduct up to 20 of the income earned by the business. The 20 pass through deduction. Generally passive income such as dividends interest capital gains and losses and section 1231 gains do not qualify.

The section 199a tax deduction surely counts as the best small business and individual investor tax break of the 21st century. The motivation for the new deduction is clear. Much will be written now about new section 199a and the 20 deduction for pass thru businesses. 199a brought issues to the 2018 tax year that ranged from learning and understanding the new code section to simply making sure the tax software was calculating the deduction correctly.

Using section 199a business owners and real estate investors may get to simply not pay income taxes on the last 20 of the income they earn. The section 199a deduction. The section 199a only applied to qualified business income qbi which was generally defined as income from a qualified trade or business other than a specified service trade or business or the performance of. Additionally the regulations provide that qbi is net of reasonable compensation paid to an s corporation shareholder and guaranteed payments for services to a partner.

The qualified business income qbi deduction under sec. 22 2017 a new provision of the internal revenue code was born.