Passive Income Federal Tax Credit

Passive income broadly refers to money you don t earn from actively engaging in a trade or business.

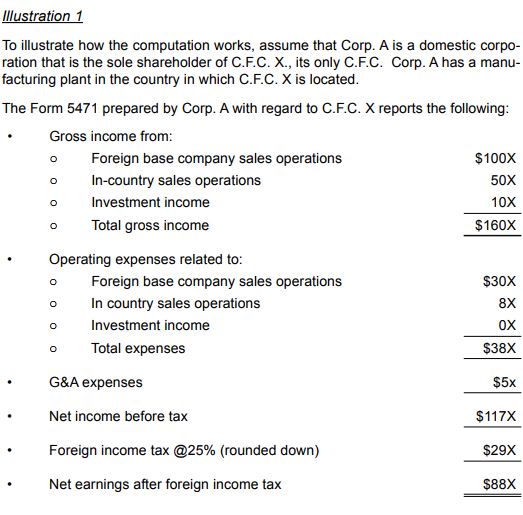

Passive income federal tax credit. Tax equivalency is the amount of income tax attributable to the net passive income. For investors in rehabilitation projects this income level is raised to 200 000. Passive income is earnings derived from a rental property limited partnership or other enterprise in which a person is not actively involved. By its broadest definition passive income would include nearly all investment income including.

The unused balance of the credit 5 000 carries forward as a passive activity credit to apply against tax on passive activity income in future years. A taxpayer s passive activity credit is the amount by which the sum of all of the taxpayer s credits that are subject to sec. 469 for a tax year exceeds the taxpayer s regular tax liability allocable to all passive activities for the year. As with active income passive income is usually.

If the tax were computed without considering passive activity income albert s tax would be 50 000 thus albert can take up to 10 000 in passive credits. Even passive income from investments requires that you research your options and make wise choices. There are few if any opportunities for 100 completely passive income. The tax equivalency computation fortunately is straightforward.

If a taxpayer s investment is passive and income is below 200 000 how is the tax credit affected. If net passive activities produce a loss the credits are suspended and carried forward to the next tax year. Generally rental real estate losses up to 25 000 may be deducted in full by anyone whose modified adjusted gross income is less than 100 000.