Passive Income For Base Rate Entity

Base rate entity passive income is.

Passive income for base rate entity. This act also makes changes to how a corporate tax entity calculates the amount of a franking credit it may attach to a frankable distribution. What is base rate entity passive income. The general scheme of the new law what amounts of assessable income are base rate entity passive income brepi. What is a base rate entity.

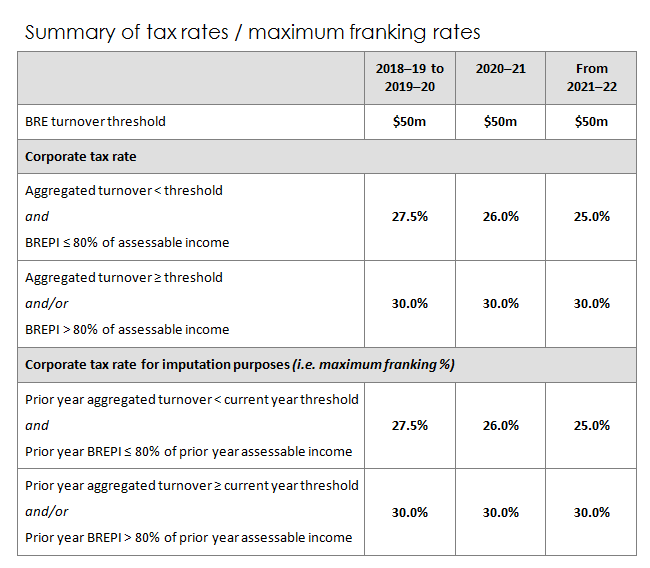

No more than 80 of its assessable income for the year of income is base rate entity passive income. There is just so much information around and also most of it simply doesn t function is obsoleted as well as wrong or is just simply scammy. Its aggregated turnover is less than the relevant threshold 25 million in the 2017 18 income year. A corporate tax entity s tax rate may change if there are fluctuations in either.

Starting any type of brand new business particularly an on the internet business can be actually difficult. A company dividend other than a non portfolio dividend which is a dividend paid to a company where that company has a voting interest of at least 10 per cent in the company paying the dividend. Interest income some exceptions apply gains on qualifying securities. Passive income for base rate entity.

From the 2017 18 income year a corporate tax entity must be a base rate entity to be taxed at the lower rate. 23ab of the itr act the following types of income are brepi. Meaning of base rate entity passive income 1 base rate entity passive income is assessable income that is any of the following. What is base rate entity passive income.

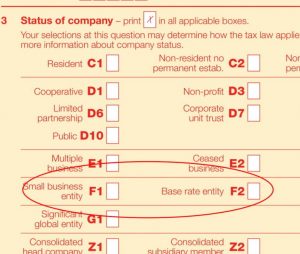

A a distribution within the meaning of the income tax assessment act 1997 by a corporate tax entity within the meaning of that act other than a non portfolio dividend within the meaning of section 317 of the assessment act. No more than 80 of its assessable income is base rate entity passive income brepi and. A net capital gain. The concept of base rate entity has now been enacted in treasury laws amendment enterprise tax plan base rate entities act 2018.

This new concept of base rate entity passive income passive income includes among other things portfolio dividends dividends on shares with less than 10 voting interest franking credits net capital gains rent interest royalties and certain amounts that flow through a partnership or a trust to the extent that it is attributable to an amount of passive income. 80 or less of their assessable income is base rate entity passive income this replaces the requirement to be carrying on a business. Its aggregated turnover for the year of income worked out as at the end of the year is less than 25 million. This draft ruling provides advice on.

A corporate entity will be a base rate entity if. Eligibility for the lower corporate tax rate depends on an entity s brepi and aggregated turnover in an income year.