Passive Income Qbi Deduction

Taxpayer a has disallowed pals of 30 000 and 50 000 for 2018 and 2017 respectively and has passive income of 35 000 in 2019.

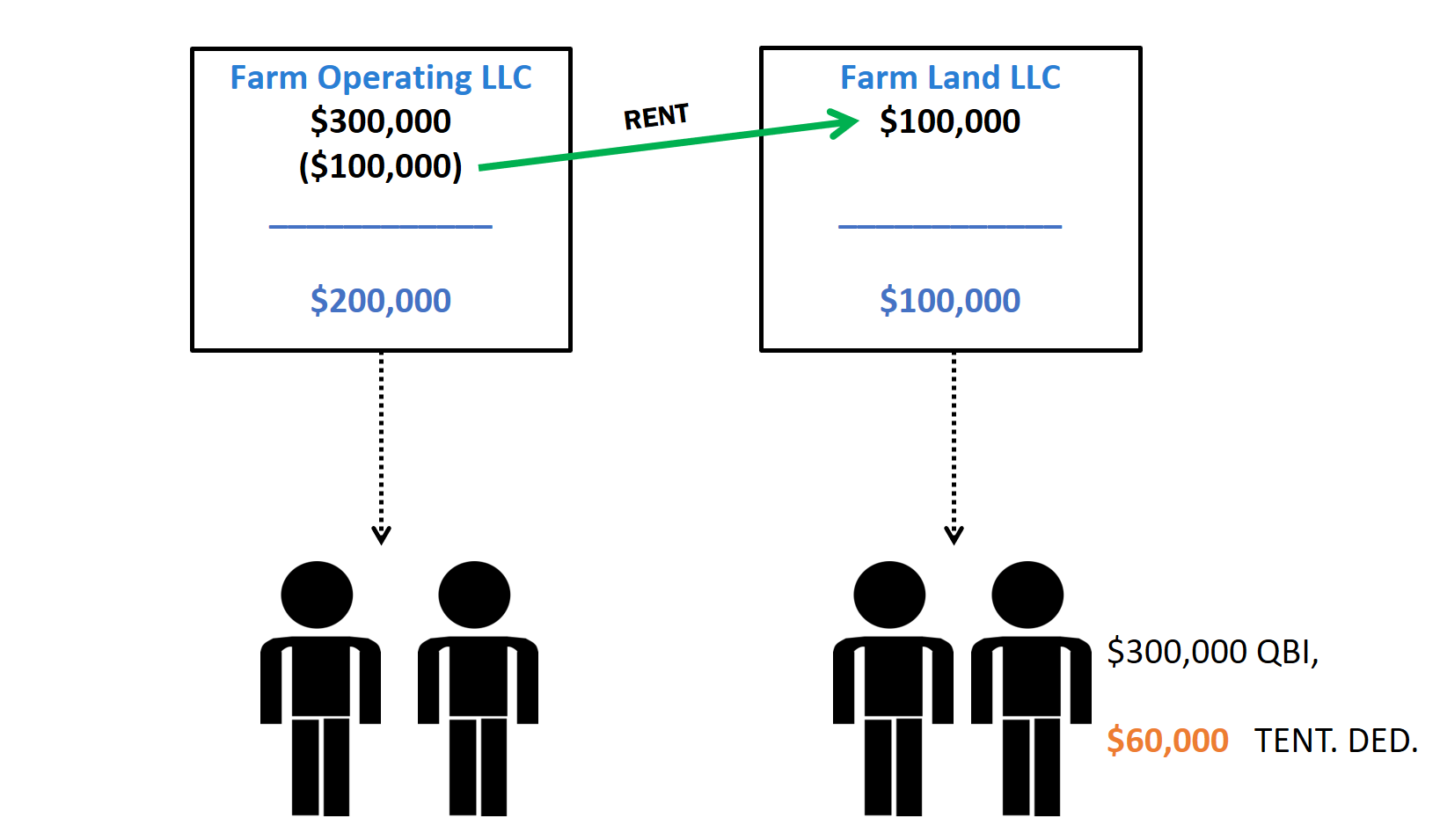

Passive income qbi deduction. The preamble to the final irc 199a regulations highlight that the u s. Income from these types of rentals is specifically excluded for the purposes of the qbi deduction. In addition any losses disallowed before jan. Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another.

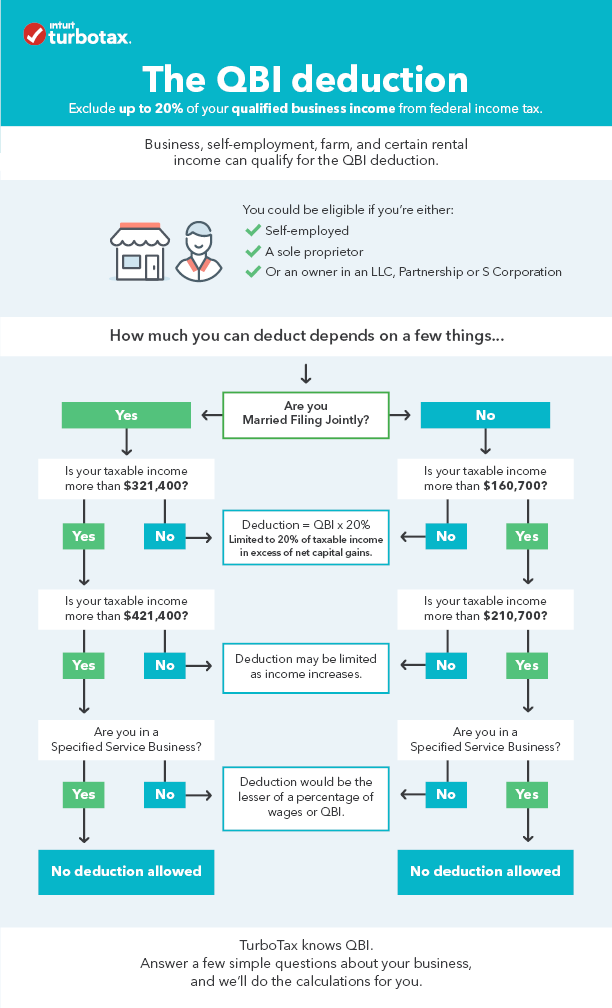

Before we dwell into qbi deduction for rental property let us understand what is qbi deduction. A qualified business income qbi deduction allows domestic small business owners and self employed individuals to deduct up to 20 of their qbi plus 20 of qualified real estate investment trust reit dividends and qualified publicly traded partnership ptp income on their taxes or 20 of a taxpayer s taxable income minus net capital gains. Rental real estate as passive income. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net qbi from a trade or business including income from a pass through entity but not from a c corporation plus 20 of qualified real estate investment trust reit dividends and qualified publicly traded partnership ptp income.

All income and losses are from qualified trades or businesses. Consider the following scenario. However your total qbi deduction is limited to 20 of your taxable income calculated before the qbi deduction minus net capital gain. With the qbi deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax.

Use form 8995 if your taxable income is less than the income threshold in the table above. 1 2018 are never taken into account for the qbi deduction. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. Department of the treasury treasury intentionally did not link irc 199a to a requirement for material.

Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. You simply multiply qbi 60 000 by 20 to figure your deduction 12 000. If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction in the following year irc sec. If taxable income exceeds the limit for your filing status then a special formula is used to figure the deduction.

The qualified business income qbi deduction also called pass through deduction or section 199a deduction was created by the 2017 tax cuts and jobs act tcja.