Passive Income Rates Philippines

Interest income received by an individual taxpayer except a non resident individual from a depositary bank under the expanded foreign currency deposit system.

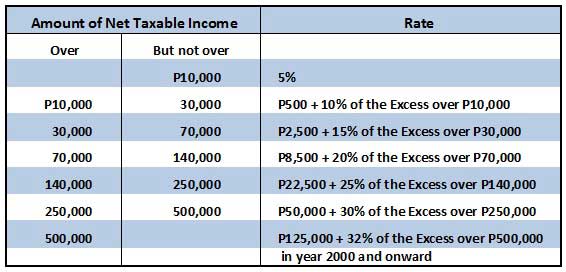

Passive income rates philippines. See capital gains and investment income in the income determination. Graduated income tax rates until december 31 2022. 11 passive income ideas in the philippines. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25.

A full time salaried and commissioned sales representative with office space a corporate automobile as well as a company bank card. Interests from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements. This will definitely provide you ideas on how you can start building your money machines now and enjoy the passive income after. There might be fees when you withdraw within a certain amount of time.

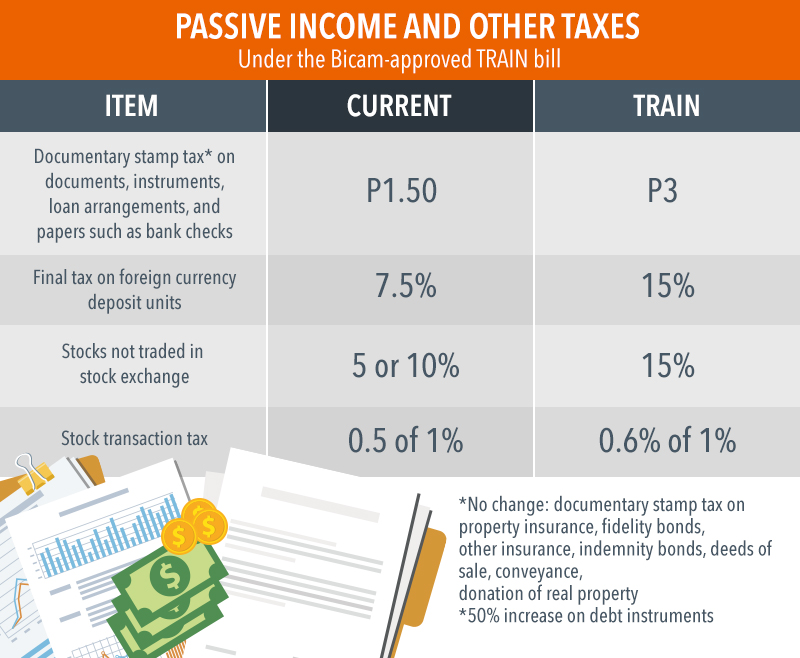

Section 27 d on the other hand provides that certain passive income which also includes royalties shall be subject to a final withholding tax rate of 20. The tax reform law introduced a new tax structure that has resulted in higher take home pay for employees in the philippines. Let s say you won php 1 million in the lotto. 20 high paying home based jobs in the philippines.

Earning passive income is a great way for you to make some extra money on the side to reach your financial goals. For local and foreign taxpayers living in the philippines here s the bir tax table showing the tax rates on passive income. If you re looking for passive income ideas this article will surely help. Income taxes are expected to go down further with the new graduated rates starting january 1 2023.

Each and every single company on the planet that manufactures or produces a product wishes to market it. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. A filipino investment vehicle favorite. Check out these 13 passive income ideas that work best in the philippines.

You can start with p5 000. My grandmother built and leased apartment units as her main. Here are 11 of the best sources for passive income in the philippines. Section 27 a of the tax code provides that gross income including royalties shall be subject to a regular corporate income tax rate of 30.

Like a mutual fund a uitf has a fund manager that oversees the day to day trading allowing investors to earn passive income. For uitf equities fund the average rate of return is 6 25. On this article we ll share with you the 9 great but simple and easy to establish sources of passive income in the philippines. The tax rate of 20 on prizes over php 10 000 is automatically deducted before you receive it.