Passive Income Rules Canada

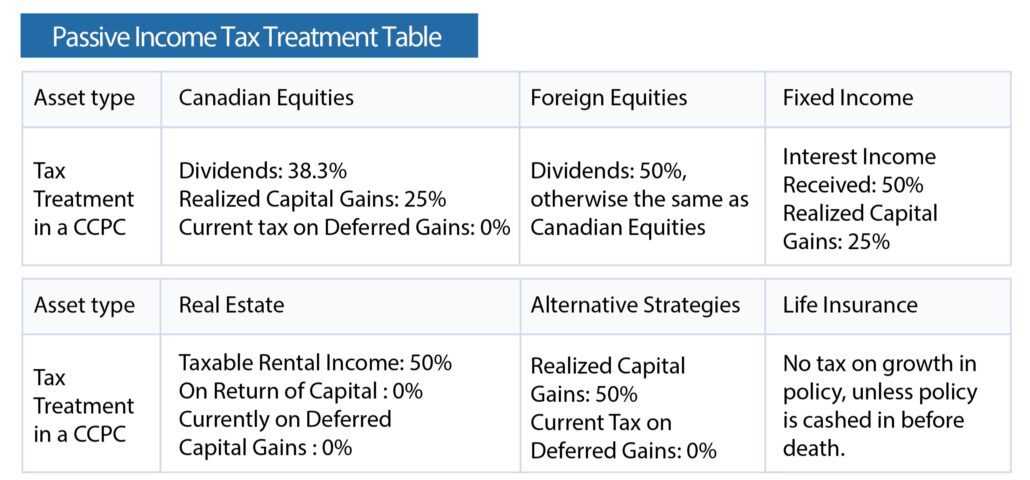

The federal government finally clarified new rules on passive income for canadian controlled private corporations ccpcs.

Passive income rules canada. In 2019 corporations with more than 50 000 of annual passive income. In february 2018 the government of canada introduced new rules for passive income that could affect how your small business clients are taxed. This has a dramatic effect on the amount of tax on that 500 000. These deductions include most repairs most energy costs if the landlord is the payor and even the interest portion of the taxpayer s mortgage payment.

All we had was speculation. At 150 000 of passive income none of the active business income will qualify for the small business tax rate. Those rules introduced in the 2018 federal budget for the 2019 tax year include the potential looming loss of the small business deduction sbd for corporations with more than 50 000 of passive investment income in 2018 says jamie golombek in a report co authored with debbie pearl weinberg. The new income rules relate to the amount of business income that can be taxed at the lower small business rate versus the higher corporate rate.

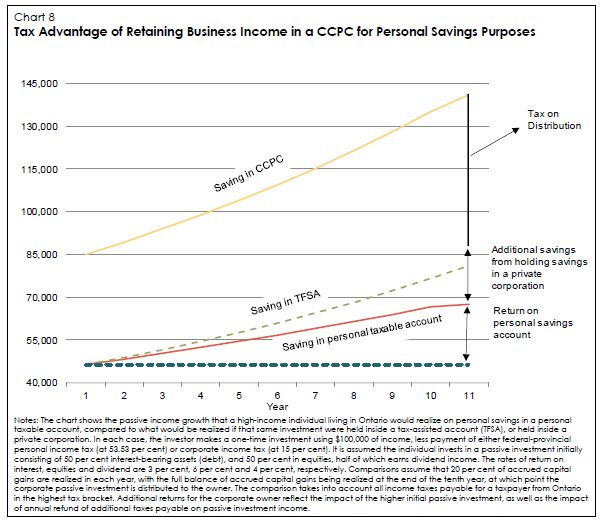

In the summer of 2017 the canadian government dropped a tax bomb on canadian small business owners with proposed changes to how they are able to split their income and their ability to invest excess cash flow into passive investments. Passive investment income on july 18 2017 the government released a consultation paper with proposals to address tax planning strategies using private corporations including an outline of possible approaches to limit the tax deferral opportunities that are associated with holding passive investments inside a private corporation. In this case the corporation has 3 000 000 of passive investments with a 5 rate of return equalling 150 000 of passive investment income. However as this ccpc s passive investment income moves beyond the 50 000 passive income threshold less and less of that 500 000 qualifies for the sbd.

Golombek is managing director and pearl weinberg is executive director of tax and estate. New passive income tax rules. Hardest hit are business owners entrepreneurs and incorporated professionals such as doctors lawyers and accountants. Salaries can help reduce net professional income thus reducing the impact of new passive income rules.

The 2018 federal budget saw the introduction of a set of new passive income rules in canada to restrict the small business deduction for ccpcs that alone or as part of an associated group earn more than 50 000 of passive investment income. While they had some vague guidelines they did not have concrete rules to wrap our heads around.