Passive Income Small Business Deduction

The small business deduction and the new passive investment rules.

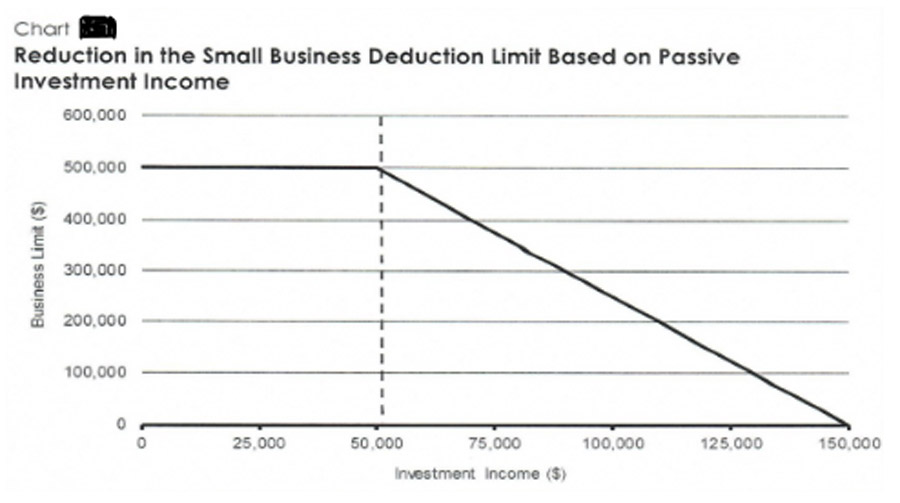

Passive income small business deduction. Passive investment income and the small business deduction grind. But for every dollar of passive income over that amount you lose 5 of the deduction. 500 000 500 000 x 5 75 000 50 000 1 x 5 25 000 125 000. Consequently abc company s business limit for its december 31 2020 taxation year will be reduced from 500 000 to 375 000 i e 500 000 125 000.

Small business deduction sbd is effectively a tax credit for small companies where they only pay a 10 in mb tax rate on the first 500 000 of income from active business operations. The recent federal budget proposed changes the proposals that will restrict access to the small business deduction sbd for many corporations. Businesses with less than 50 000 in annual passive income can claim the full 500 000 at the 9 small business rate. The amount eligible for the small business rate shrinks by 5 for every 1 over 50 000 that a business makes in passive income until it eventually reaches zero.

The budget introduces a new eligibility mechanism for the small business deduction based on a canadian controlled private corporation s ccpc passive investment income. These changes will apply where a corporation earns passive investment income and also earns income from active business that is taxed at the small business rate or small business income. If a corporation earns more than 50 000 of passive investment income in a year the amount of income eligible for the small business tax rate is reduced and more of its active income is taxed at the general corporate rate. At first the proposed changes released by the minister in july of 2017 would have taxed passive income essentially at a rate equal to the top marginal rate for individuals.

There is a new limitation on the 500 000 small business deduction based on a company s previous year s passive income. To be exact for every 1 in excess of 50 000 5 in the small business deduction will be reduced. The federal government put forward a consultation paper in july 2017 that it was looking to prevent companies deferring excess income in the corporation to use it to earn passive investment income after paying small business tax rates. A corporation can have up to 50 000 of investment income in the prior year with no impact to the small business deduction.

Abc company s passive income business limit reduction for its 2020 taxation year is determined as follows.