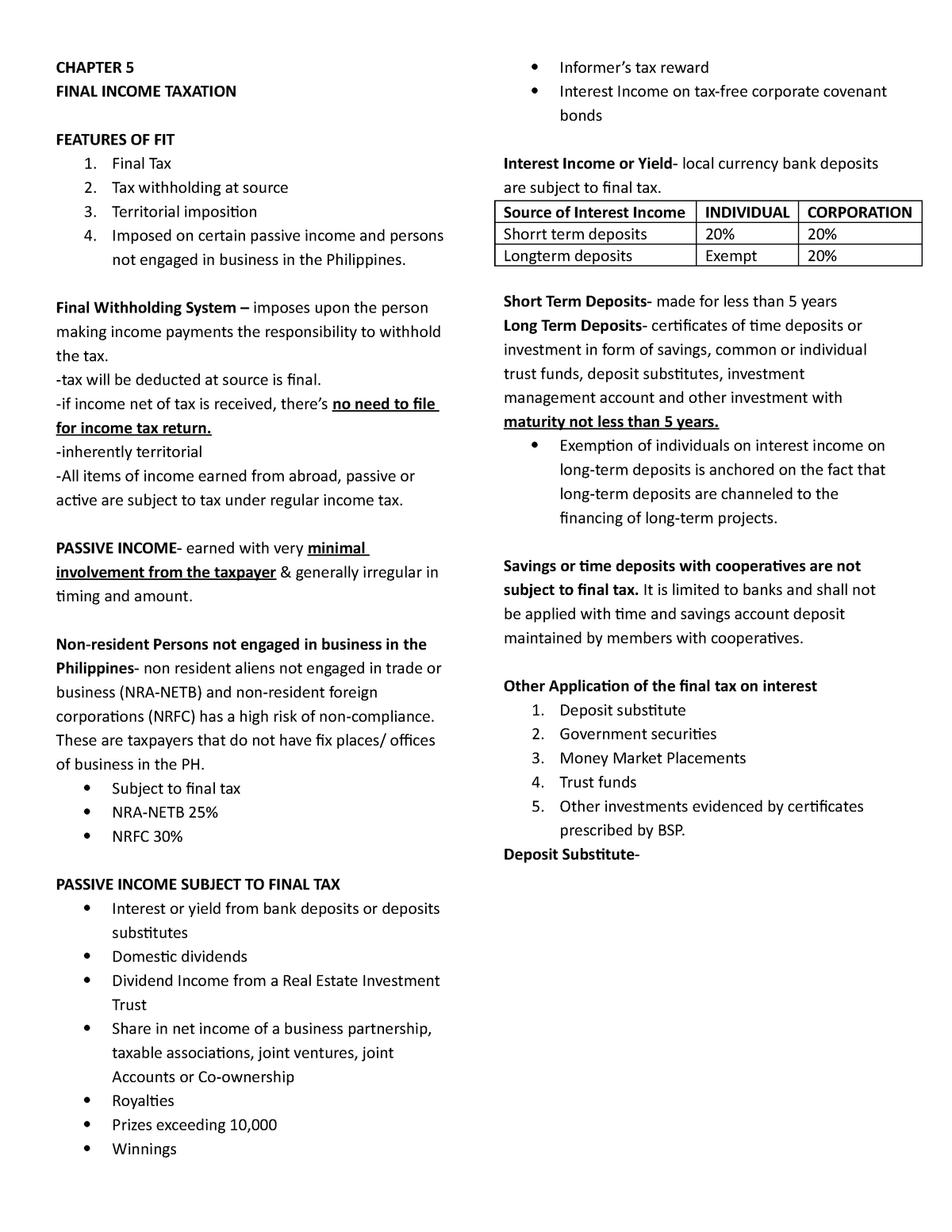

Passive Income Subject To Final Withholding Tax

C consummating the transaction.

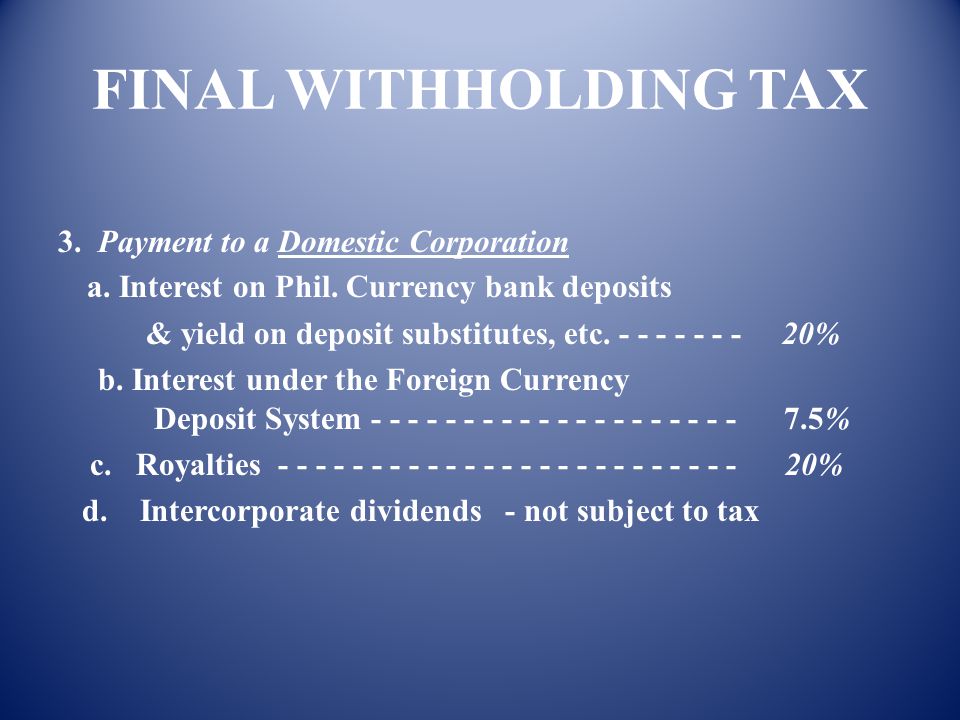

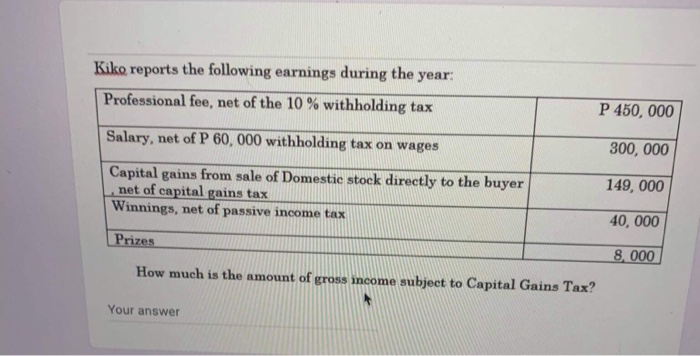

Passive income subject to final withholding tax. Nraetb non resident alien engaged in trade or. The withholding of the tax has the effect of a a final settlement of the tax liability on the income. Section 27 d on the other hand provides that certain passive income which also includes royalties shall be subject to a final withholding tax rate of 20. On certain passive income cash and or property dividend share in the distributable net income of a partnership interest on any bank deposits royalties prizes except prizes amounting to p10 000 or less which is subject to tax under sec.

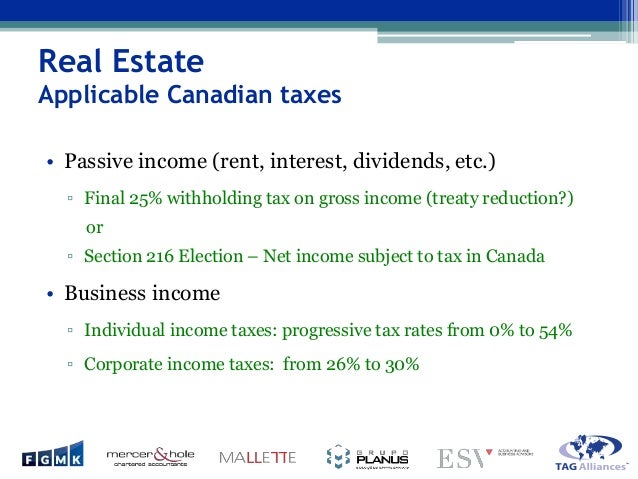

Passive income broadly refers to money you don t earn from actively engaging in a trade or business. Nature of income payments tax. The withholding of the tax has the effect of a a final settlement of the tax liability on the income. As from 2004 qualifying royalty payments within the eu member states are not subject to withholding tax under the eu interest royalty directive.

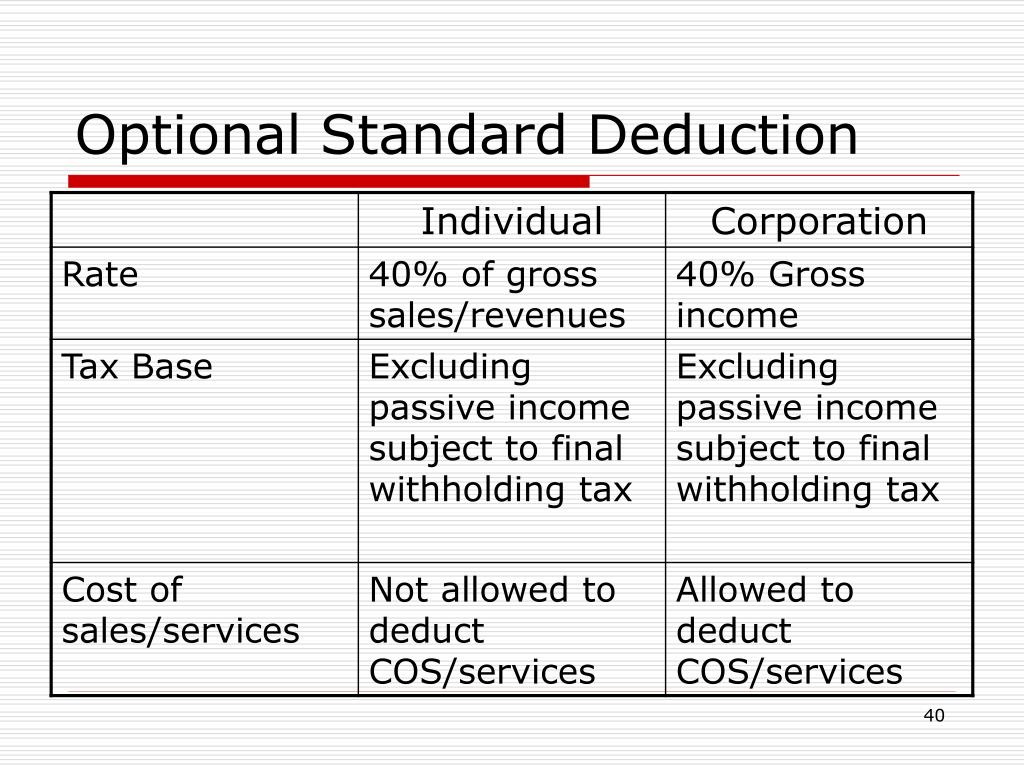

Who are required to file and pay final withholding tax. The taxpayer has no more responsibility to file an income tax return for the passive income covered subject to fwt. Royalties are generally taxed as income of the licensor in his residence state. By its broadest definition passive income would include nearly all investment income.

Withholding tax rates on final income taxes bir form 1601 f terminologies. Winnings except from philippine charity sweepstake office and lotto. Passive income final tax posted by jonathan ruiz cpa may 15 2017 may 7 2017 posted in taxation tags. Credit or exemption relief is given for any withholding tax paid in the source state.

B a credit from the recipient s income tax liability. Final tax interests passive income prizes royalties this is subject to final withholding income tax as follows. Once an income is subjected to final tax it will not be furthered taxed under the income tax and or capital gains tax. The final withholding tax final withholding tax is imposed to certain passive income under the final withholding tax system pm.

Paid credit subject to tax sparing rule 15 withholding tax rates on final income taxes bir form 1601 f. 25 a 1 of the tax code. C consummating the transaction resulting in an income. 10 the payor of passive income subject to final tax is required to withhold the tax from the payment due the recipient.

You will be a withholding agent only if your payment is included in the list of income payments subject to final withholding tax. The taxpayer actually shoulders the tax but it is the income payor who withholds and pays the tax the amount of tax withheld if final pm. Section 27 a of the tax code provides that gross income including royalties shall be subject to a regular corporate income tax rate of 30.