Passive Income Tax Changes 2019

The chart below shows the reduction of the small business limit at selected passive income levels.

Passive income tax changes 2019. How the 2019 passive investment income changes affect your small business. After a lot of public debate in the tax and small business community around the way in which passive investment income is taxed in canadian controlled private corporations the changes that were announced in the 2018 federal budget are now law. Passive income includes interest dividends mutual fund income capital gains and most rental real estate income. This reduction begins when a corporation or a group of associated.

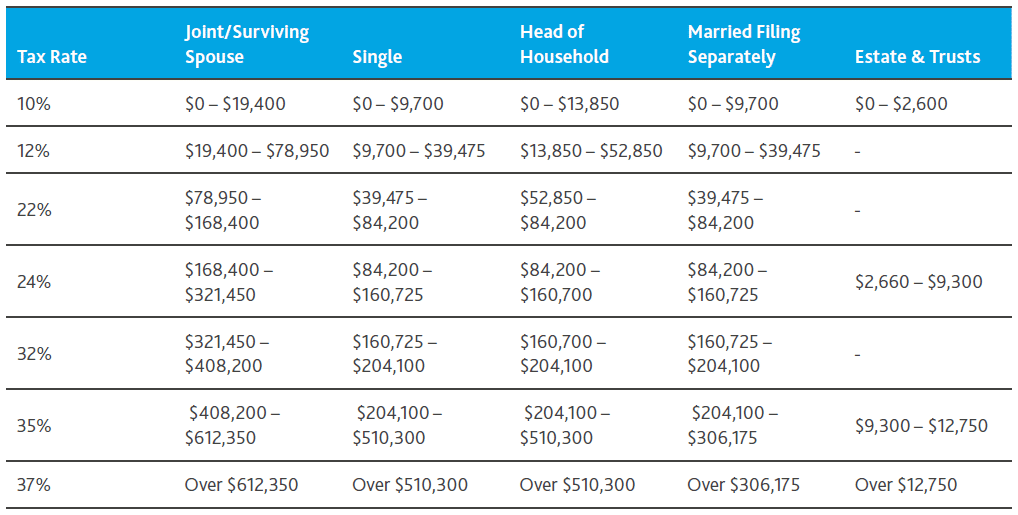

Rules change new strategies emerge and the process repeats. The small business tax changes are another round in the game of tax change and adaptation. There have been several income tax developments that have impacted professional corporations over the last few years. Along with relevant topics like passive activity 2020 passive income tax rates and how investors can qualify for the many tax advantages offered in the new tax cuts act of 2018.

To quantify this clawback let s consider a corporation taxable in alberta assuming no change in the projected tax rates for 2019 and assuming that alberta follows the federal changes in the proposals. Posted on january 22nd 2019 by jeremy doan in domestic tax healthcare other professionals. Tips the amount of tax you will pay on passive income will largely depend on the amount of income you generated and the ways in which it was obtained. Starting in 2019 passive income earned inside a corporation can lower a corporation s small business deduction sbd.

A summary of the new split income and passive income rules for professionals. 2019 also will be the first tax year when low income workers can qualify for a more generous canada workers benefit a program intended to help the working poor stay employed. Also learn about the financial impact of short term versus long term investments and how they are taxed differently. Note that the tax rate for passive income will differ for the 2018 tax year as the new tax bill signed in december 2017 changes some of these provisions.

As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. In 2018 the company earned 100 000 of passive investment income. In 2019 the company will earn 500 000 of active business income.