Passive Income Tax Rate Canada

And active earnings greater than 500k.

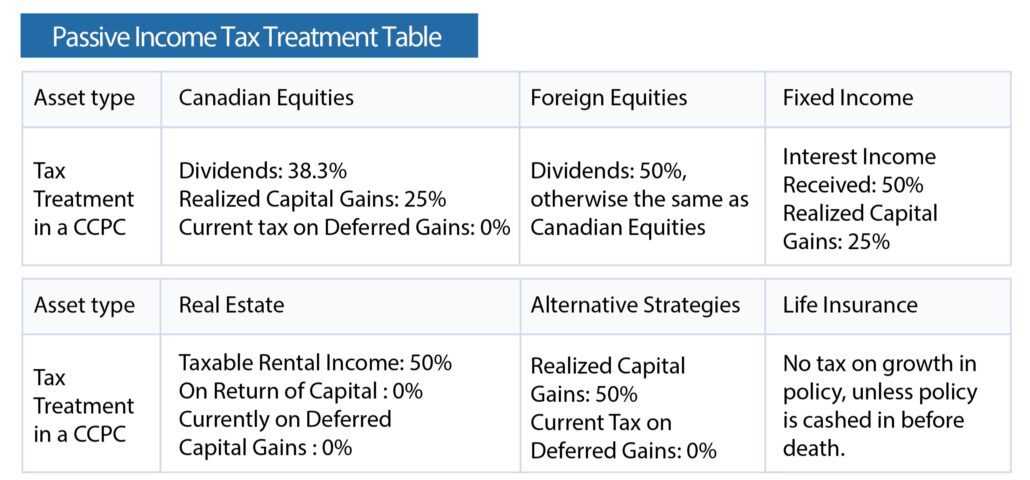

Passive income tax rate canada. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. Since 2009 a ccpc using the sbd could claim the small business tax rate on the first 500 000 of its active business income carried on in canada representing a fairly substantial reduction in tax. As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. The current tax rates for short term gains are as follows.

Additional refundable tax levied on canadian controlled private corporations. This assumes that 500 000 of income is taxed at corporate tax rates and then paid out to the shareholders as a taxable dividend. In 2018 the company earned 100 000 of passive investment income. The new rule changes mean that a ccpc s passive investment income now exposes a business owner to more tax on active business income.

Assumed average provincial tax rate on this type of income 3. 10 12 22 24 32 35 and 37. In 2019 the company will earn 500 000 of active business income. The small business deduction limit will get reduced by 5 for every 1 in excess passive income.

General corporate tax rate of 15. With the exception of inter corporate dividends passive income earned by ccpcs or any corporation in canada is ineligible for deductions and consequently fully taxable at the corporation s combined provincial and federal tax rate. For this ccpc 150 000 of passive investment income results in 135 500 of tax on active business income at the combined corporate tax rate of 27. In other words short term capital gains are taxed at the same rate as your income tax.

Effective tax rate on income eligible for the small business deduction. As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. At 150 000 of passive income none of the active business income will qualify for the small business tax rate.

Net tax rate on active business income up to 500 000. In february 2018 the government of canada introduced new rules for passive income that could affect how your small business clients are taxed. Small business tax rate of 10. This is frequently higher than the marginal tax rate payable by the individual which reduces the desirability.

Short term passive income tax rates. The table below is a summary of the tax penalty by the amount of passive income. This has a dramatic effect on the amount of tax on that 500 000.