Passive Income Tax Rate Ontario

Abi in excess of 500 000 per year is subject to the general corporate tax rate.

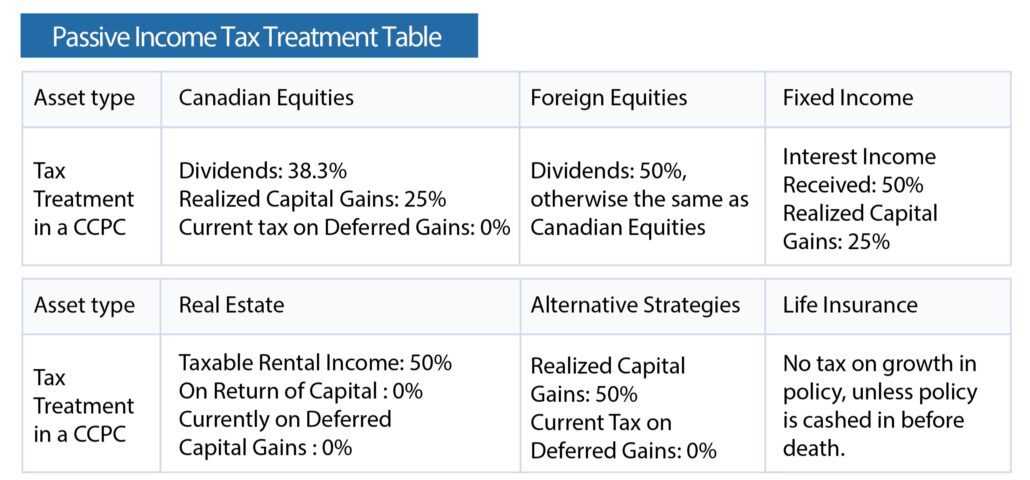

Passive income tax rate ontario. As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. The top individual marginal tax rate in ontario is approximately 53 5. In other words the small business deduction is a reduced rate of tax available on active business income abi up to 500 000 each year. This is frequently higher than the marginal tax rate payable by the individual which reduces the desirability.

The ford government is also nixing 2018 ontario budget proposals to adjust the rates brackets surtax and credits for ontario s income tax. Note that in its 2018 fall economic statement the ontario government proposed that it would not parallel the federal passive income measures. The rates for an ontario ccpc s active business income not eligible for the small business tax rate are 11 5 provincially and 15 federally. Upon death an individual is deemed to dispose of his her property at its fair market value.

The new administration estimates this will prevent a personal tax increase of about 200 on average for. In 2019 the company will earn 500 000 of active business income. The corporate tax rate applicable to active business income in ontario is approximately 15 and to investment income is 50. The new rule changes mean that a ccpc s passive investment income now exposes a business owner to more tax on active business income.

In 2018 the company earned 100 000 of passive investment income. In ontario corporations that receive the sbd pay a rate of 12 5 percent instead of the corporate tax rate of 26 5 percent.