Passive Income Tax Rates Canada

2020 federal tax bracket rates.

Passive income tax rates canada. Long term passive income tax rates long term capital gains assets held for more than one year are taxed at three rates. The combined general corporate income tax rate will be 27 percent 15 percent federal tax plus 12 percent alberta tax. This would result in 55 000 of tax on that active business income at the combined small business tax rate of 11. If passive investment income is less than 50 000 all of that 500 000 will qualify for the sbd.

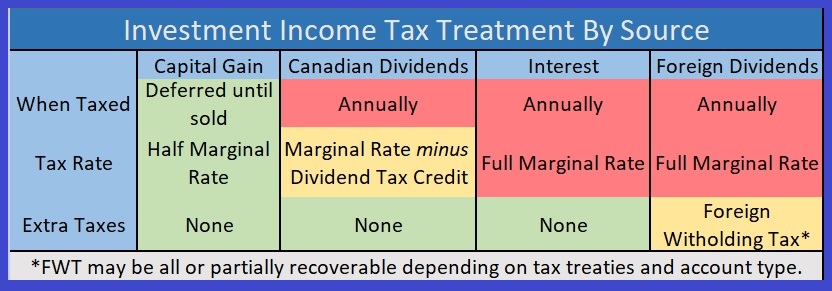

This is a federal calculation only as the provinces do not have a refundable component. As long as passive investment income is below 50 000 the full 500 000 qualifies for the sbd. 0 15 and 20 based on your income bracket. However a portion of the federal tax on passive and dividend income is refundable when a taxable dividend is paid to a corporation s shareholder.

Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different. So if you have a portfolio within your corporation that generates more than 50k year in passive income more of your corporate active income will face the higher general tax rate. The federal income tax rates and brackets for 2020 are. However the sbd is reduced by 5 for every 1 of passive income a corporation earns over 50 000 and is completely eliminated once the corporation exceeds 150 000 in passive investment income.

The end result is a large increase in tax. This is frequently higher than the marginal tax rate payable by the individual which reduces the desirability. Passive income tax rate for 2017 for 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. The small business deduction limit will get reduced by 5 for every 1 in excess passive income.

After 500k active earnings are taxed at the general tax rate of 15. The combined federal and provincial small business tax rate in 2019 will be 11 percent. The federal personal income tax rates and brackets refer to taxes payable on your taxable income which is your gross income minus deductions tax credits and other adjustments. These new cra passive income changes will first apply to fiscal years that start in 2019 and will reduce the maximum small business deduction available to a ccpc or associated group of ccpcs by 5 for every 1 of passive investment income earned in the previous fiscal year in excess of 50 000.