Passive Income Tax Rates Ontario

Note that in its 2018 fall economic statement the ontario government proposed that it would not parallel the federal passive income measures.

Passive income tax rates ontario. Business corporate income tax rates corporate income tax rates. The new administration estimates this will prevent a personal tax increase of about 200 on average for. Alberta and quebec administer their own corporation income tax systems. In ontario corporations that receive the sbd pay a rate of 12 5 percent instead of the corporate tax rate of 26 5 percent.

Short term passive income tax rates. In 2018 the company earned 100 000 of passive investment income. The federal personal income tax rates and brackets refer to taxes payable on your taxable income which is your gross income minus deductions tax credits and other adjustments. In other words short term capital gains are taxed at the same rate as your income tax.

Ontario corporate income tax is administered by ontario for taxation years ending before 2009 and by canada revenue agency cra for taxation years ending after 2008. The current tax rates for short term gains are as follows. Upon death an individual is deemed to dispose of his her property at its fair market value. The top individual marginal tax rate in ontario is approximately 53 5.

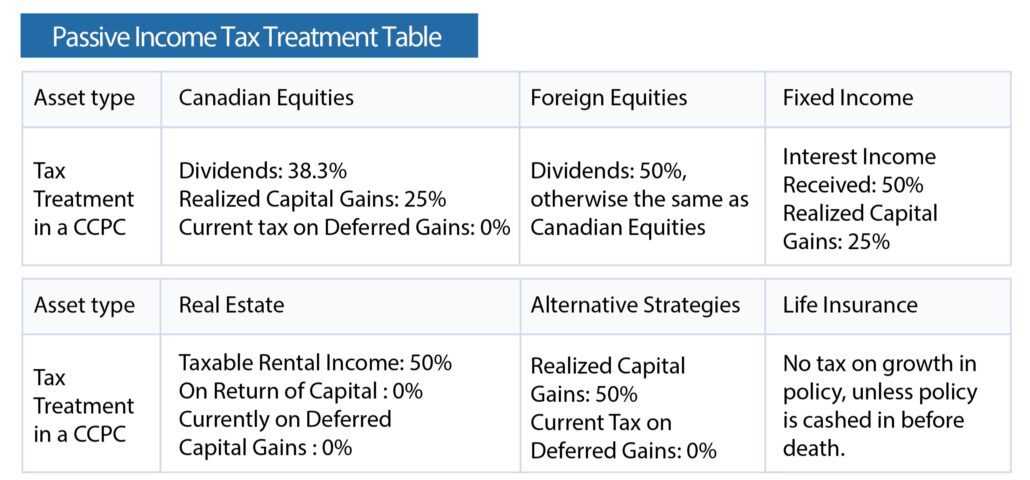

Abi in excess of 500 000 per year is subject to the general corporate tax rate. As illustrated in the table below the passive income rule change will result in the company paying 40 000 more tax than it would have before the cra passive income tax changes. While rental income is considered taxable income in canada passive income from a rental property allows taxpayers to deduct many expenses associated with the earning of the rental income. The federal income tax rates and brackets for 2020 are.

As mentioned previously short term gains apply to assets held for a year or less and are taxed as ordinary income. The tax cut is expected to cost the province 495 million in lost revenue the document says. 10 12 22 24 32 35 and 37. 2020 federal tax bracket rates.

The corporate tax rate applicable to active business income in ontario is approximately 15 and to investment income is 50. In other words the small business deduction is a reduced rate of tax available on active business income abi up to 500 000 each year. The rates for an ontario ccpc s active business income not eligible for the small business tax rate are 11 5 provincially and 15 federally.