Passive Income Tax Rates Philippines

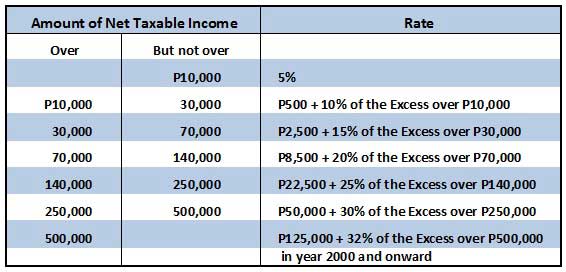

How to compute your income tax based on graduated rates.

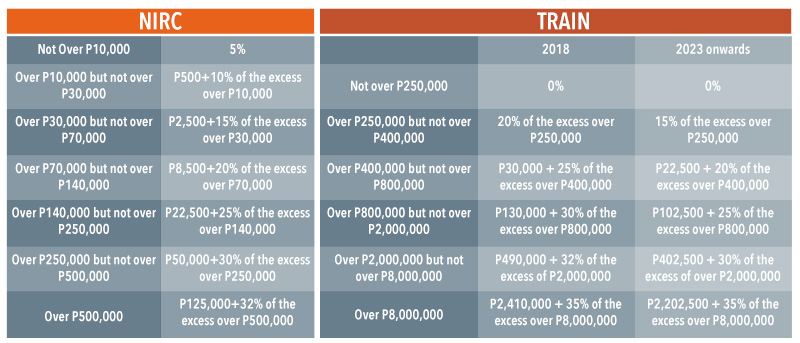

Passive income tax rates philippines. Graduated income tax rates until december 31 2022. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. It will also harmonize the tax rates on interest dividends and capital gains and the business taxes imposed on financial intermediaries. Income tax rates in the philippines.

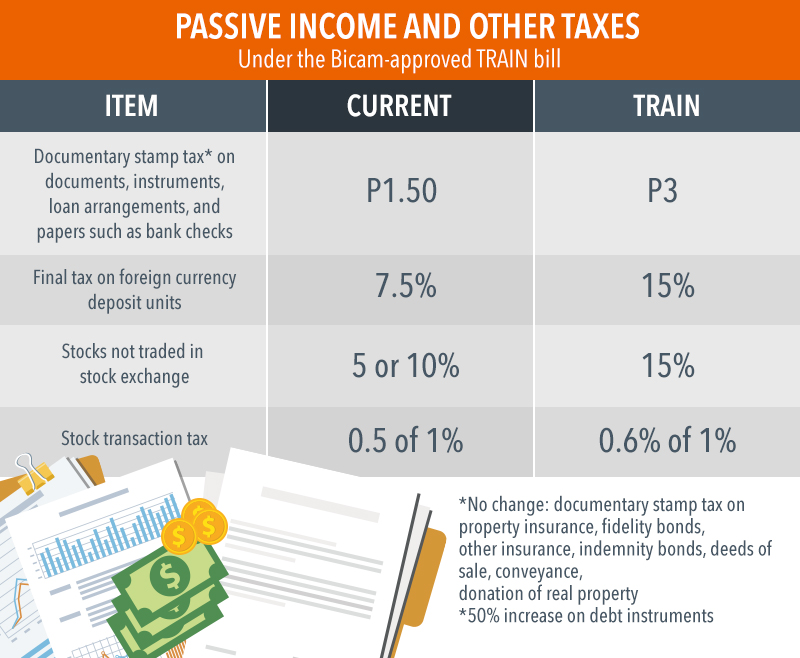

8 2018 which discusses the income tax provisions of the train law. It will reduce the number of tax rates from 80 to 36. The newly approved train tax reform law also adjusted the tax rates on certain passive income in addition to revised personal income tax rates and new taxes imposed on oil sugary beverages tobacco mining etc. Package 4 will greatly simplify the taxation of passive income financial services and transactions.

Lowering these rates will make the country more competitive against the other countries. For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. Thus reforming the current tax system related to the financial sector is necessary to eventually encourage savings develop our capital markets and increase. Tax rates for income subject to final tax.

Sample income tax computation for the taxable year 2020.