Passive Income Tax Rules Canada

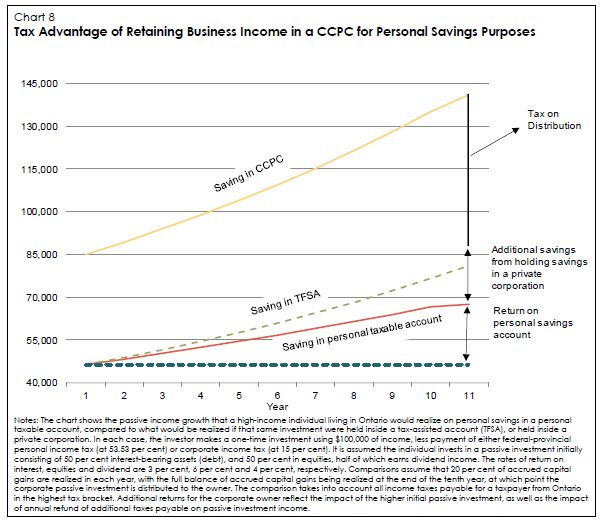

1 above the 50 000 threshold every 1 of passive investment income earned has the potential to expose 5 of active business income to additional taxation.

Passive income tax rules canada. Once a ccpc s passive investment income exceeds 50 000 the amount of active business income eligible for the small business tax rate is reduced. For every 1 over 50 000 in passive income earned in a given year the threshold for the small business tax rate will be lowered by 5 in the following year. Beginning in 2019 as your passive income increases there is a corresponding decrease in the amount of your active business income that can be taxed at the small business tax rate. If you work with small businesses that have a significant.

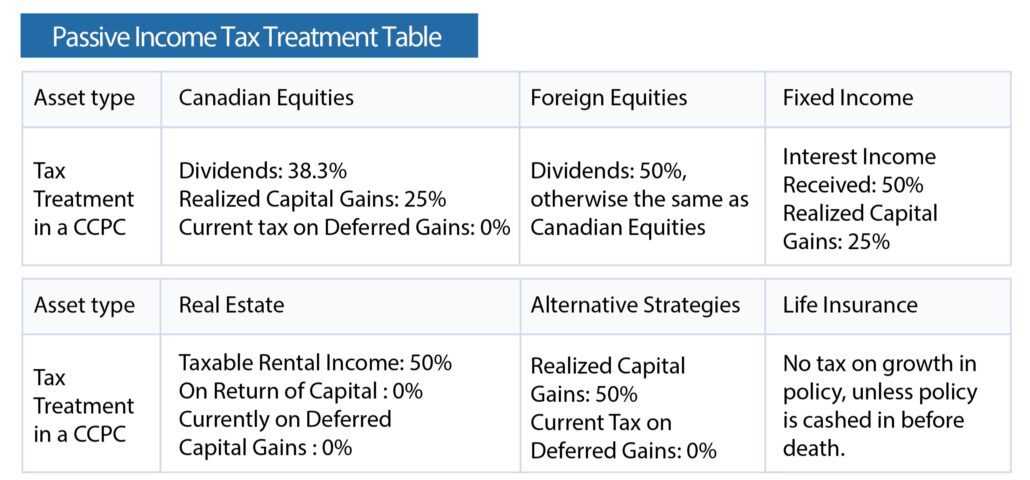

Income earned through the leasing of a rental property is another prevalent method of generating passive income. Passive income canada rental properties. These deductions include most repairs most energy costs if the landlord is the payor and even the interest portion of the taxpayer s mortgage. The new income rules relate to the amount of business income that can be taxed at the lower small business rate versus the higher corporate rate.