Passive Income Tax Table

That s an average tax rate of just under 17.

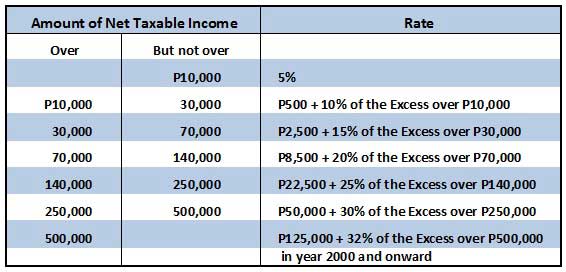

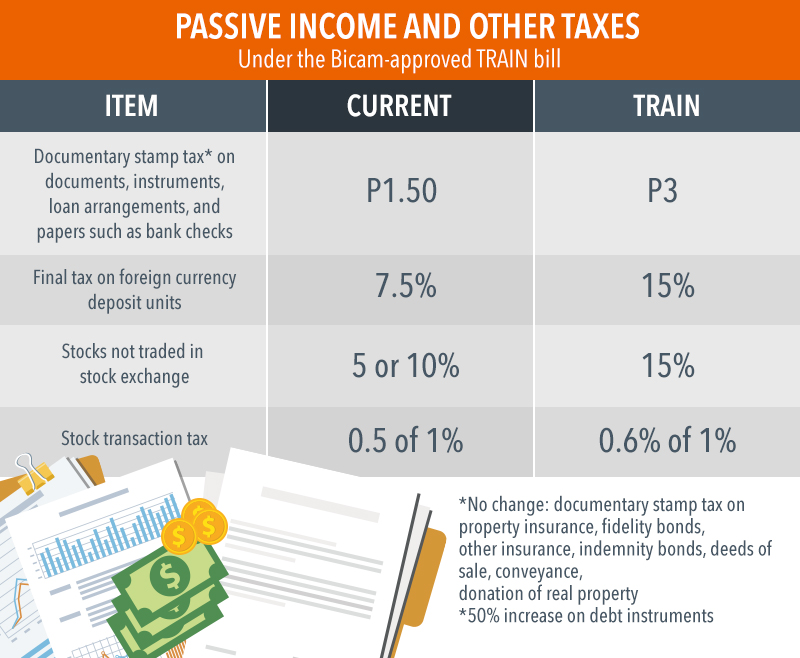

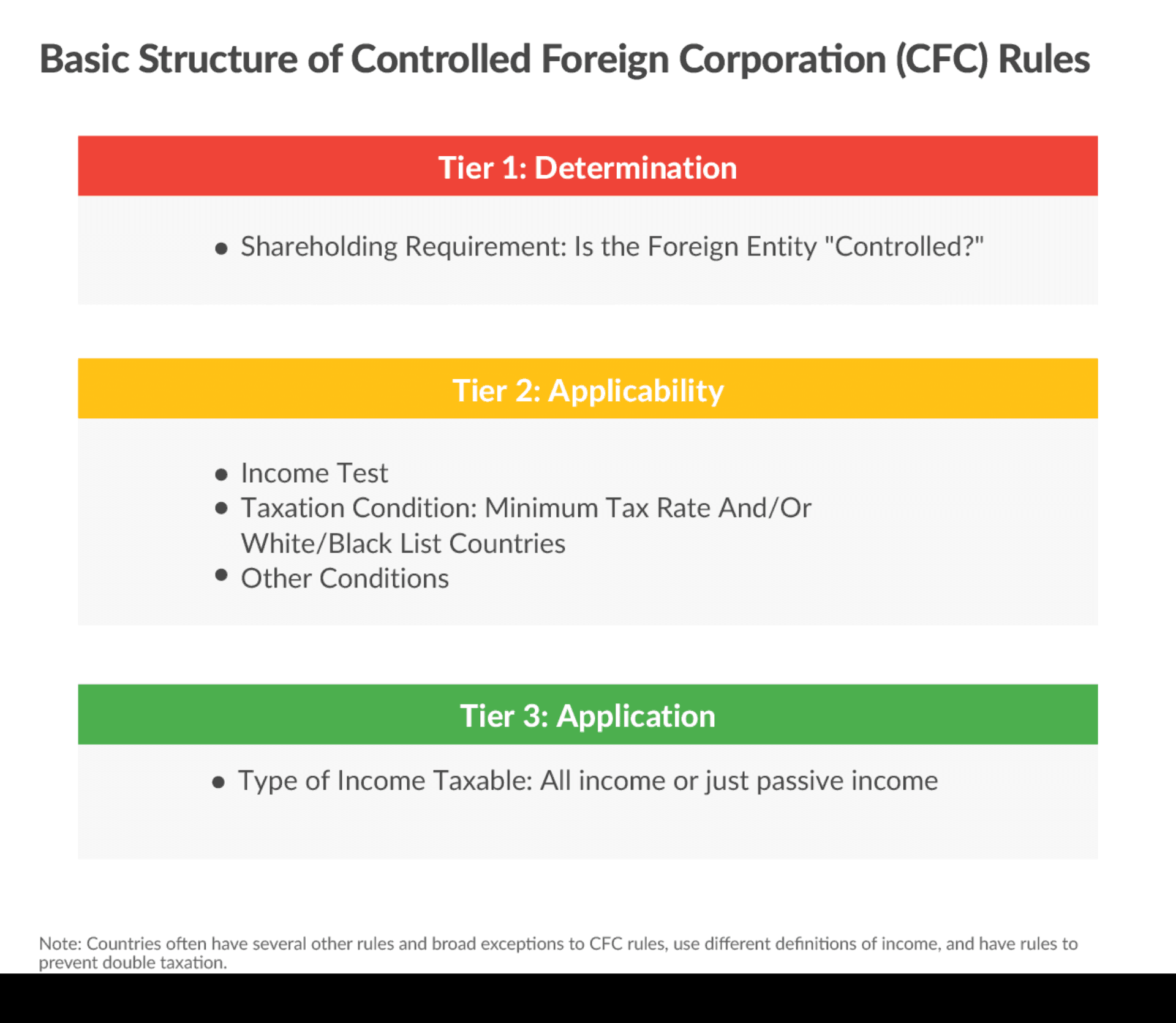

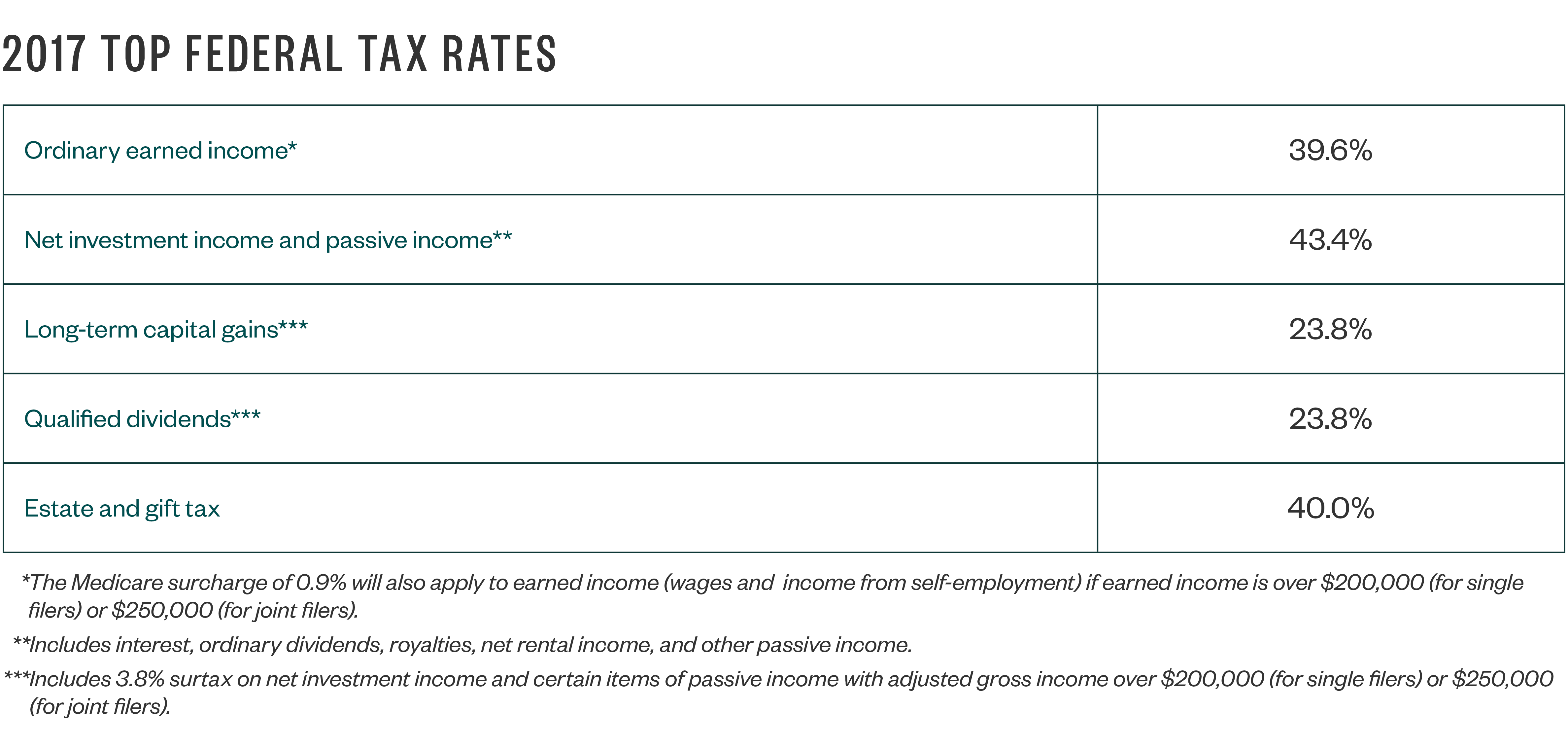

Passive income tax table. Is passive income taxable. As outlined the effective tax rate on passive income is 50 7 while dividend income is taxed at 38 3. Below is a summary table showing how much i earned from each passive income stream and the tax for each. Table 1 below walks us through the corporate tax rates for those four types of income.

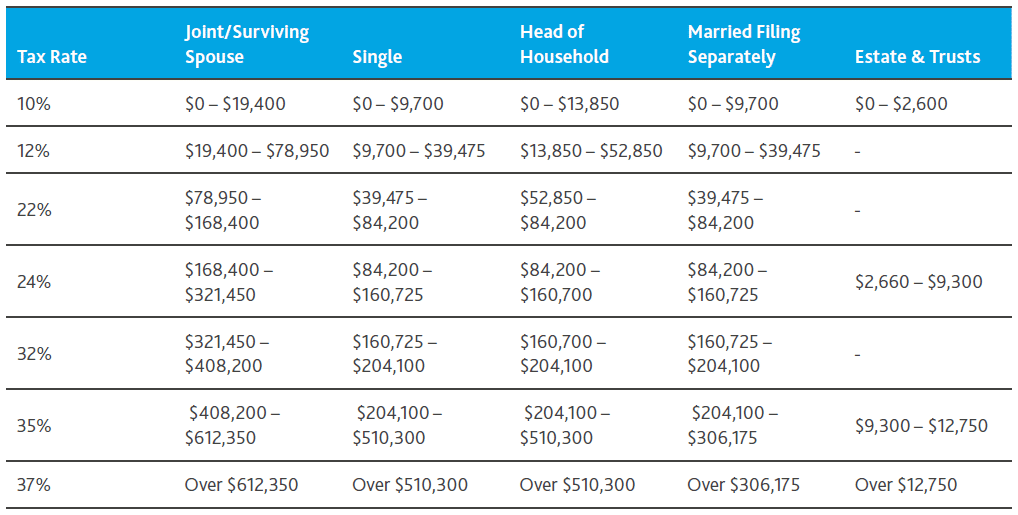

Tax rates on each type of passive income will vary based on how long your investments are held the amount of profit earned and or net income. 24 b 25 a 2 27 d 28 a 7. For 2017 passive income that is taxed as ordinary income will be taxed in the 2017 tax brackets and so the income tax rates range from 10 to 39 6 percent depending on your annual income. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1.

There are different types of passive income from capital gains and dividends to income earned on interest. View 4 1 final income tax table pdf from accounting 100 at king fahd university of petroleum minerals. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples filing jointly. How passive income is taxed.

In total i owed 127 44 as a result of the 752 59 in passive income i earned. Long term capital gains and qualified dividends are taxed at zero 15 and 20 percent for 2017 but the brackets are different.