Passive Loss Carryover Rules

Passive losses can be written off only against passive gains.

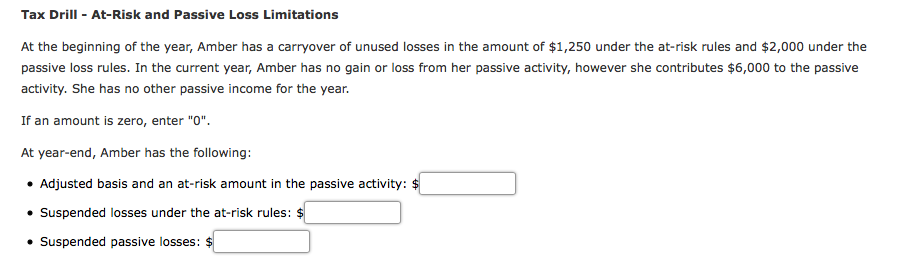

Passive loss carryover rules. Passive losses can include a loss from the sale of the passive business or property in addition to expenses exceeding income. A passive loss carryover is created when you have more expenses than income a loss from passive activities in a prior year that could not be used that year. What is a passive loss carry over. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out.

Aii noncorporate taxpayers including pass through entities such as estates and trusts are subject to the passive activity loss pal rules of irc sec. The internal revenue service places limits on passive losses the type that arise from activities you engage in on the side essentially as an investor. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Instead the passive loss is carried forward to future tax years to offset any passive income.

Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income.

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)