Passive Loss Rental Rules

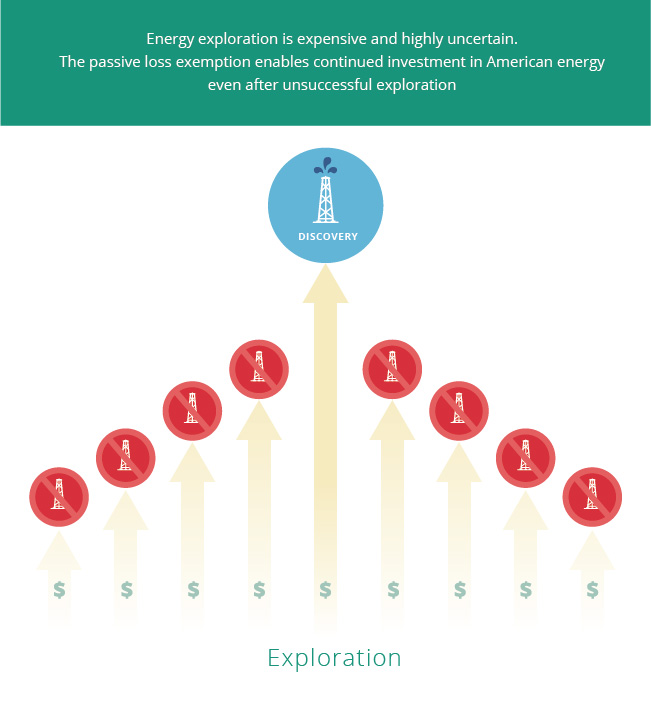

Passive activity loss rules are generally applied at the individual level but they also extend to virtually all businesses and rental activity in various reporting entities except c corporations.

Passive loss rental rules. The passive activity loss rules. However since rental real estate income is considered to be passive in nature there are special rules called the passive activity loss rules that can limit the amount of rental real estate or. In addition 500 of those hours must be spent materially participating in the business. For taxation purposes the irs looks at your annual income in terms of net gain or loss.

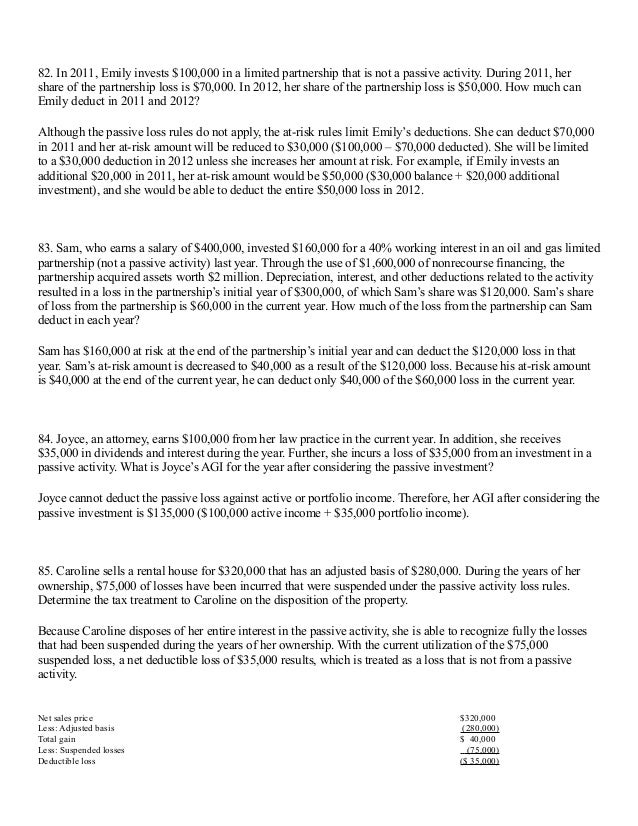

Using suspended passive losses. Starting with the obvious self charged rental may present an issue for taxpayers whose activities are subject to the passive loss rules. If your real estate rental income generates a net loss. To materially participate you must be involved in the operations on a regular continuous and substantial basis.

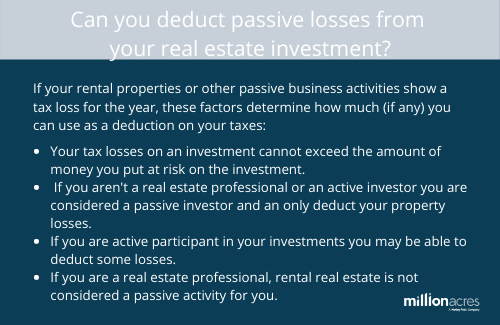

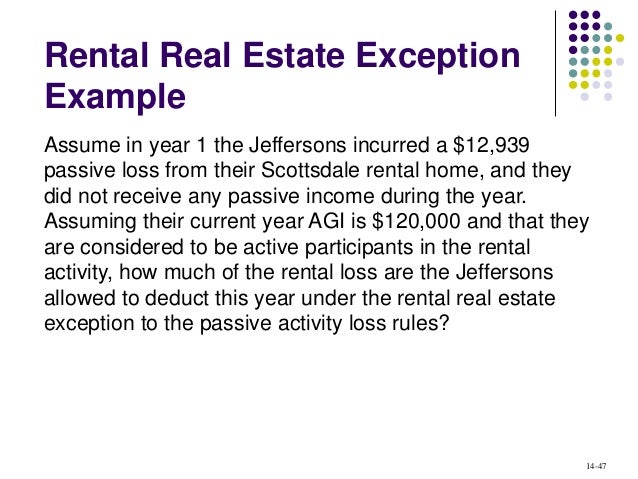

One of the most common ways to get around passive loss rules in order to deduct your rental losses is to meet the criteria of material participation. Beyond that is one of several recurring themes of this blog of which every tax adviser needs to be mindful when reviewing the tax and economic consequences and the associated risks of a transaction. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less. Passive activity loss rules.

To materially participate you must be involved in the operations on a regular continuous and substantial basis. A taxpayer must spend at least 50 percent of work time and 750 hours a year engaged in real estate activities. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. Exceptions to passive loss rules.

Your income is small enough that you can use the 25 000 annual rental loss allowance. On the other hand if you materially participate the activities aren t passive except for rental activities discussed below and the passive activity rules won t apply to the losses. Passive income is generated from property rentals and investments in which you do not participate in the ongoing activities of the business. Generally a passive activity loss can only be used.

As discussed in my blog post passive loss limitations in rental real estate the irs code generally prohibits taxpayers from deducting passive activity losses against other income including salaries interest dividends and income from nonpassive activities. You or your spouse qualify as a real estate professional or.