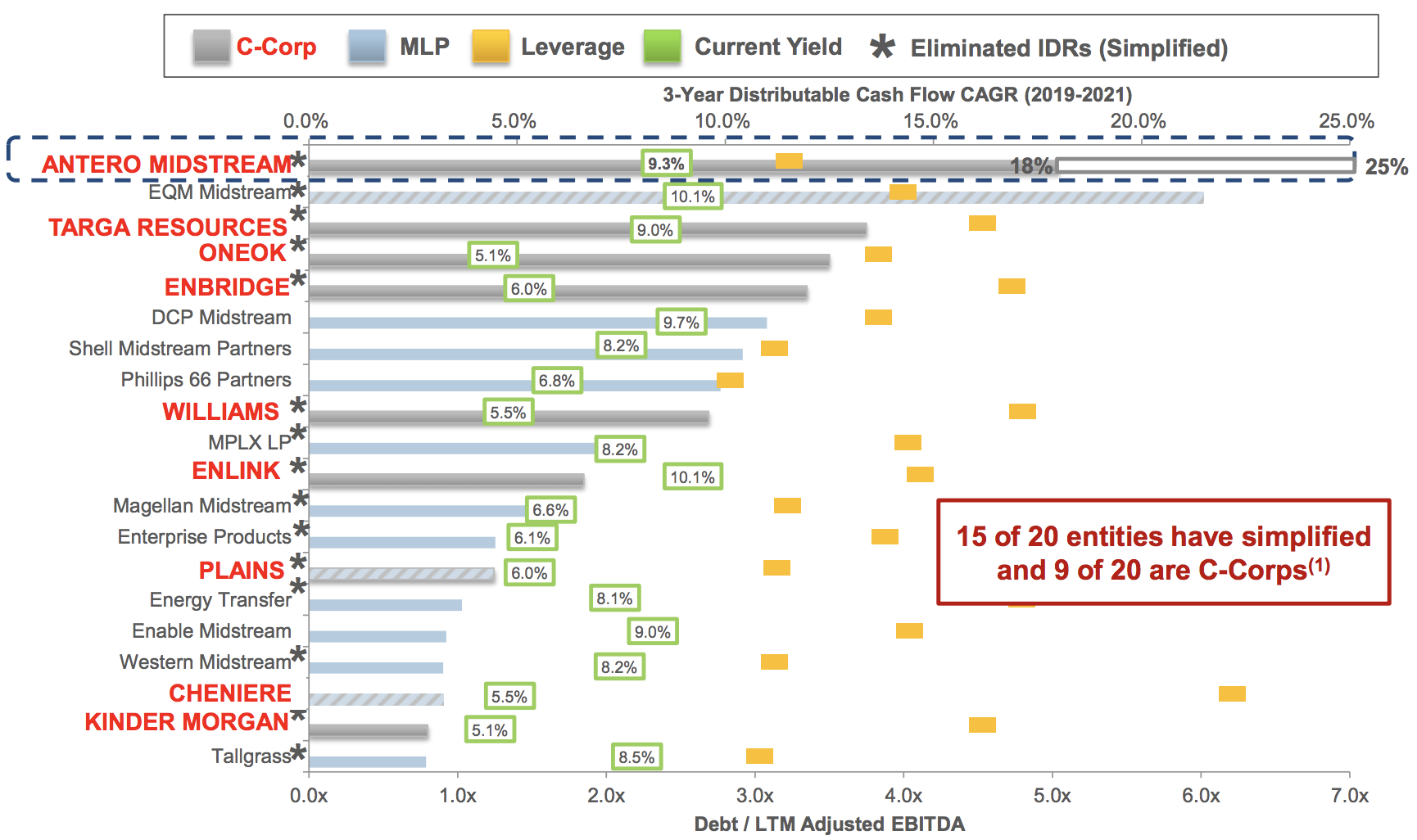

Passive Loss Rules For C Corporations

Personal service corporations and closely held corporations use this form to.

Passive loss rules for c corporations. 10 chcs are subject to the passive loss rules because of concern that individuals would incorporate their portfolio investments to avoid the limitations. Figure the amount of any passive activity loss pal or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation s tax return. They specifically apply to taxpayers who are individuals estates trusts closely held c corporations and personal service corporations. Closely held c corporation.

The court acknowledged that the passive loss rules do not refer to s corporations at all. An associated regulation defining certain passive activities including rental activities specifies. 3 a c corporation i can use its capital losses only to offset. I will discuss converting from c corporation to an s corporation in a later blog post.

The passive activity rules apply to individuals estates trusts closely held c corporations and personal service corporations. C ordering rule to reflect separate phase outs if subparagraph b applies for any taxable year paragraph 1 shall be applied i first to the passive activity loss ii second to the portion of the passive activity credit to which subparagraph b does not apply and. For the at risk rules a c corporation is a closely held corporation if at any time during the last half of the tax year more than 50 in value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals. In general a c corporation can carry a net operating loss or nol it has for any year forward indefinitely subject to various special rules including a rule that limits a c corporation s ability to use its nol carryforwards following an ownership change.

The passive loss rules apply to closely held c corporations chcs. 11 a c corporation is clo sely held if at any time during the. Work you do in your capacity as an investor does not constitute participation in the business unless you are directly involved in the day to day management or operations of the activity. Excess passive investment income s corporations that were formerly c corporations with passive investment income which includes rents in excess of 25 of their gross receipts are assessed a corporate tax at the highest corporate rate.