Passive Loss Rules Real Estate Professional

If you are a real estate professional rental real estate is not considered a passive activity for you.

Passive loss rules real estate professional. Passive loss rules do not apply to real estate professionals. However the rules for who is a real estate professional for tax purposes are rather specific and the irs enforces these rules rather strictly. What is passive activity loss exception for real estate professionals. However there may be some limitations to this under the excess business loss limits found in the tax cuts and jobs act but we won t go into that here.

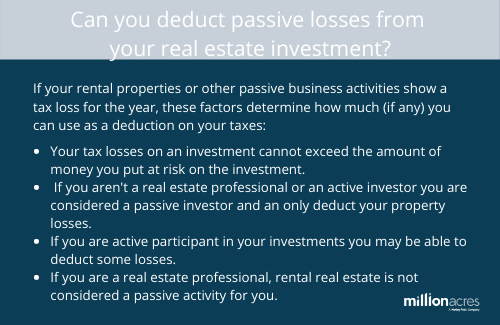

Don williamson jd cpa llm in taxation. So losses from those activities can be deducted against earned income interest dividends etc if you materially participate. Ordinarily rental activities are automatically considered passive activities and their losses may only be used to offset passive activity income thus most rental activities involving real estate are treated as passive activities. If you qualify as a real estate professional which requires performing substantial services in real property trades or businesses your rental real estate activities aren t automatically treated as passive.

National society of tax professionals the real estate professional. The real estate professional and activity grouping rules can allow taxpayers to avoid having their losses limited by the pal rules. The real estate professional status the real estate professional status historically allowed real estate investors to take unlimited rental losses against their ordinary income. Careful planning with your tax professional should ensure that the best decisions are made with respect to the appropriate elections as well as meeting specific rules and requirements.

The passive activity loss pal rules can limit the ability to deduct losses from passive activities such as rental losses. So losses from those activities can be deducted against earned income interest dividends etc if you materially participate. Exception to the passive activity loss rules. If you qualify as a real estate professional which requires performing substantial services in real property trades or businesses your rental real estate activities are not automatically treated as passive.

Thus at first glance it appears the taxpayers took every necessary step to help ensure they could treat the real estate activities as nonpassive activities. Paul la monaca mst cpa director of education national society of tax professionals. If one is classified as a real estate professional any losses are treated as ordinary losses and may be deducted against other income sources. Therefore the passive income deduction rules don t apply to you at all.