Passive Rental Income And Qbi

The irs issued notice 2019 07 concurrently with the final qbi regulations.

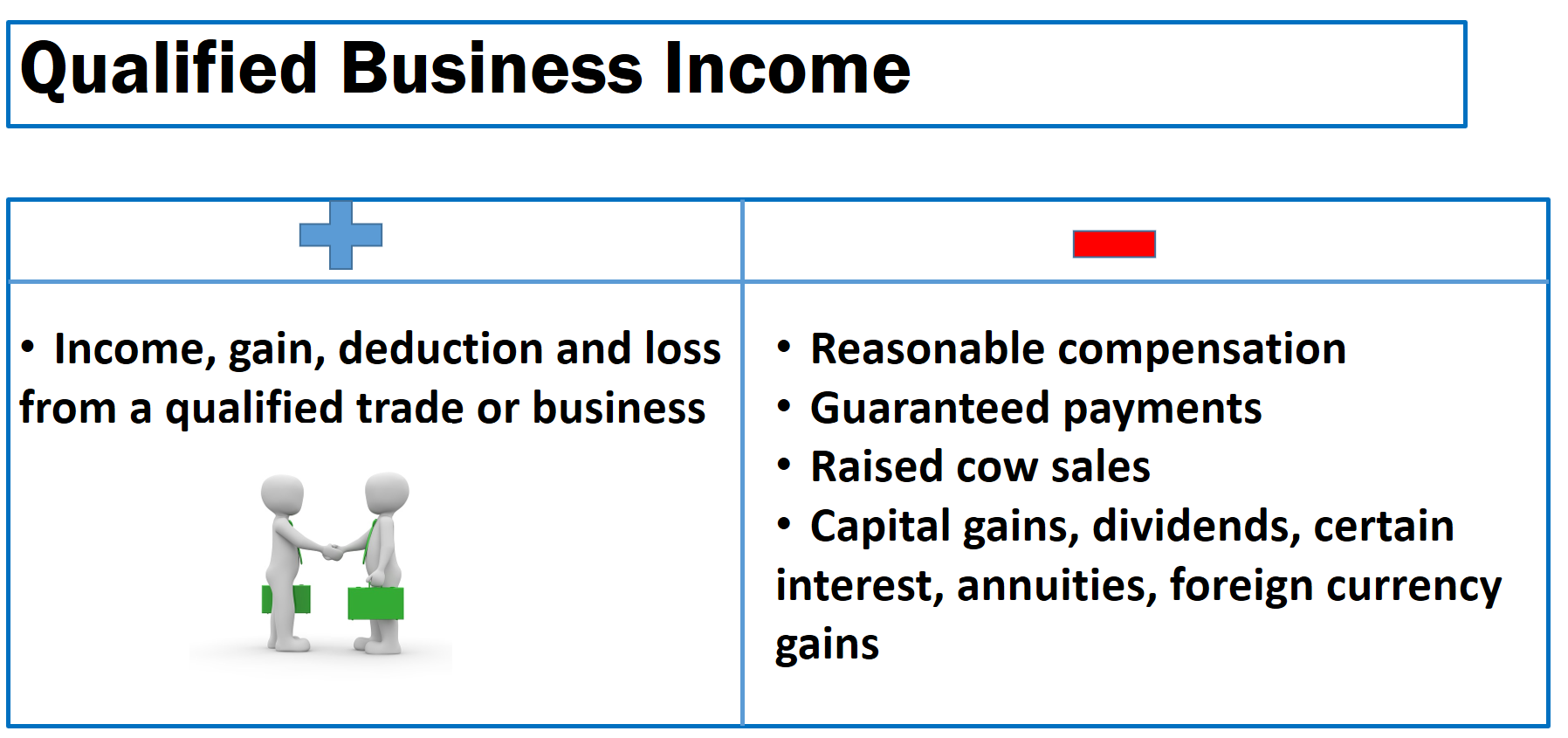

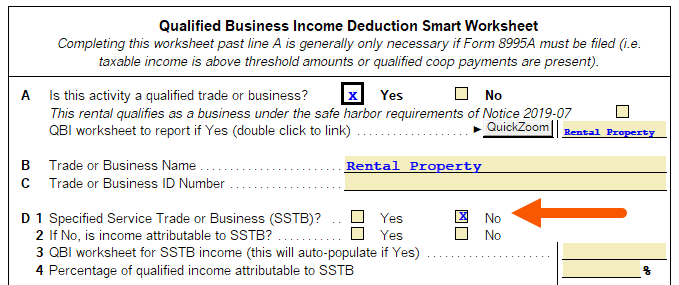

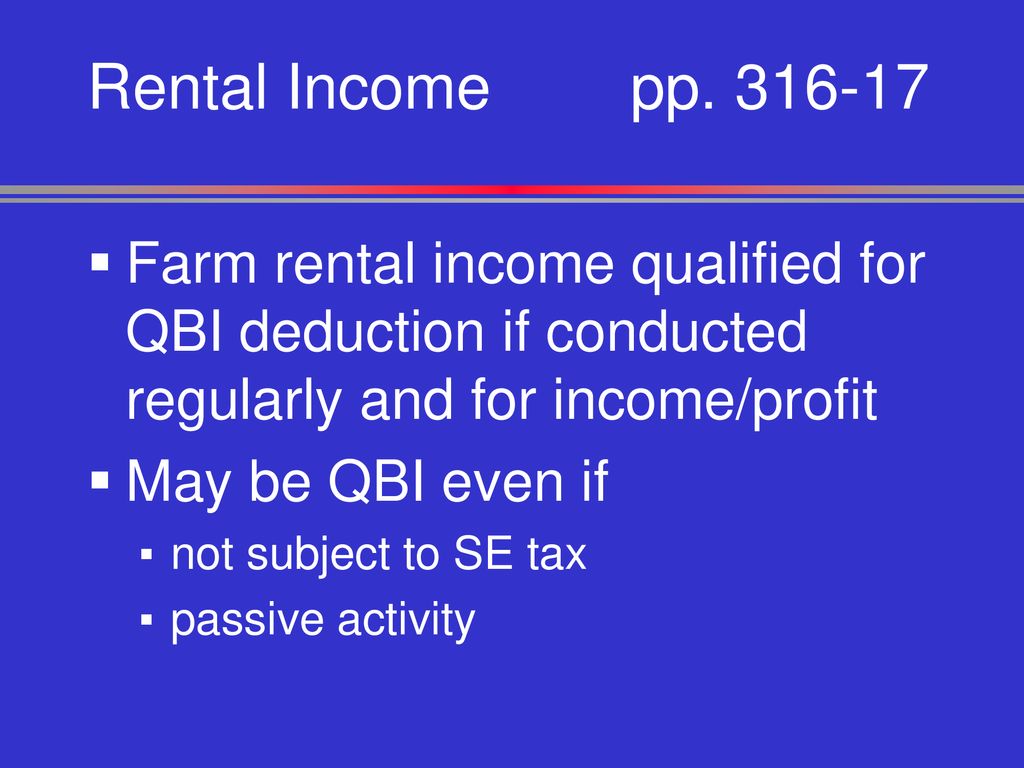

Passive rental income and qbi. 2019 38 can be treated as a trade or business for qbid purposes. The irs has expanded qualified business income qbi frequently asked questions to provide additional information on the relationship between rental real estate and the qbi deduction qbid. For example owning only commercial rental real estate is typically considered a trade or business because of the level of. With the qbi deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax.

The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year. The net rental income from partnership a is deemed qbi. How qualified business income qbi affects rental income tax reform will change the way rental income is taxed to landlords beginning in 2018. It provides proposed safe harbor requirements for a rental.

Although real estate has some favorable provisions compared to w2 income. Typically rental real estate activity is classified as passive with income and expenses reported on schedule e form 1040 instead of schedule c form 1040. A rental real estate enterprise that meets the safe harbor requirements discussed in notice 2019 07 and rev. However because it is carried over from a pre 2018 tax year it is disregarded for purposes of determining qbi.

Rental real estate as passive income. There are some aspects that bother me. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. Some rental activity may qualify as a trade or business.

However the rental income is specified service income because partnership b is an sstb and the two partnerships are commonly owned.