Passive Rental Income Qbi

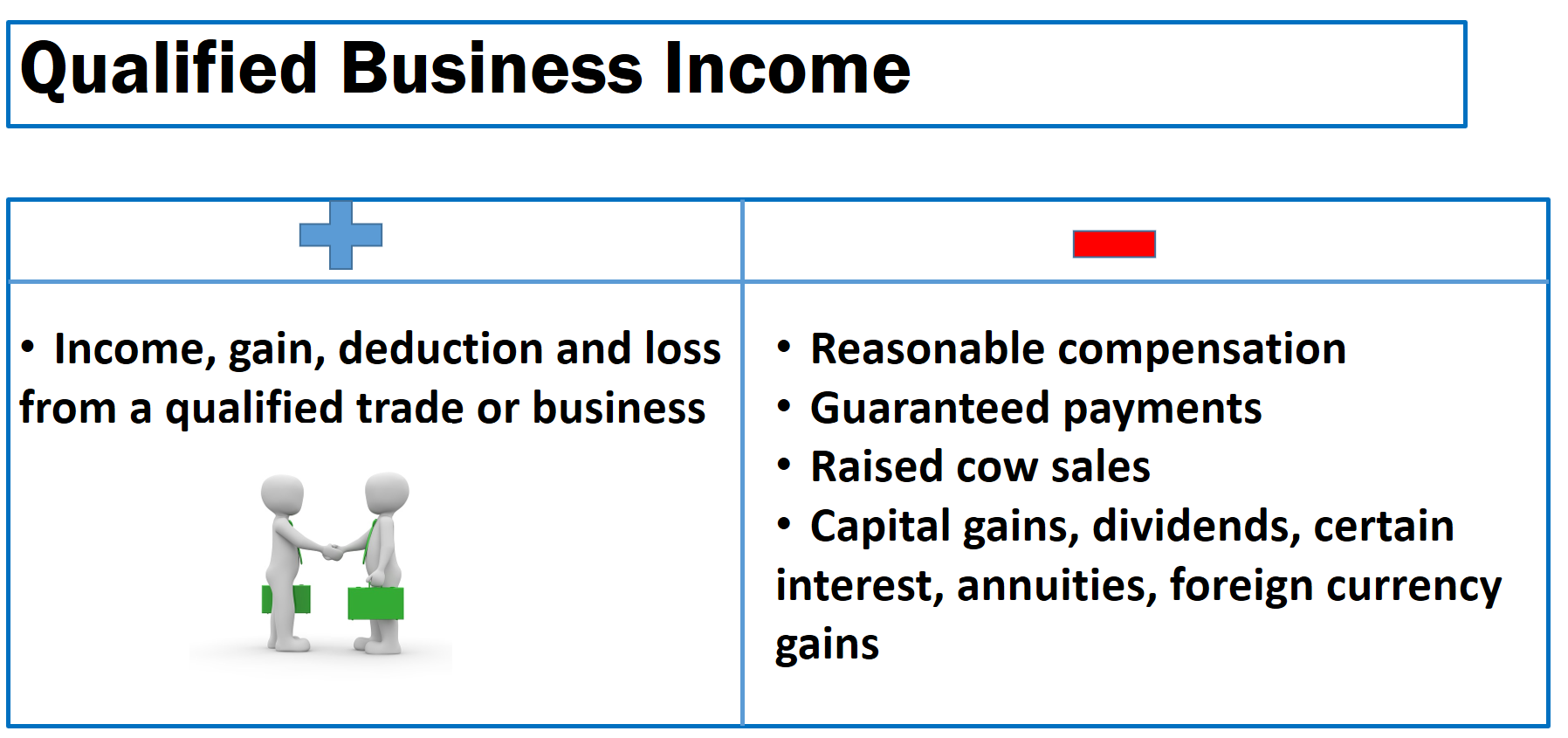

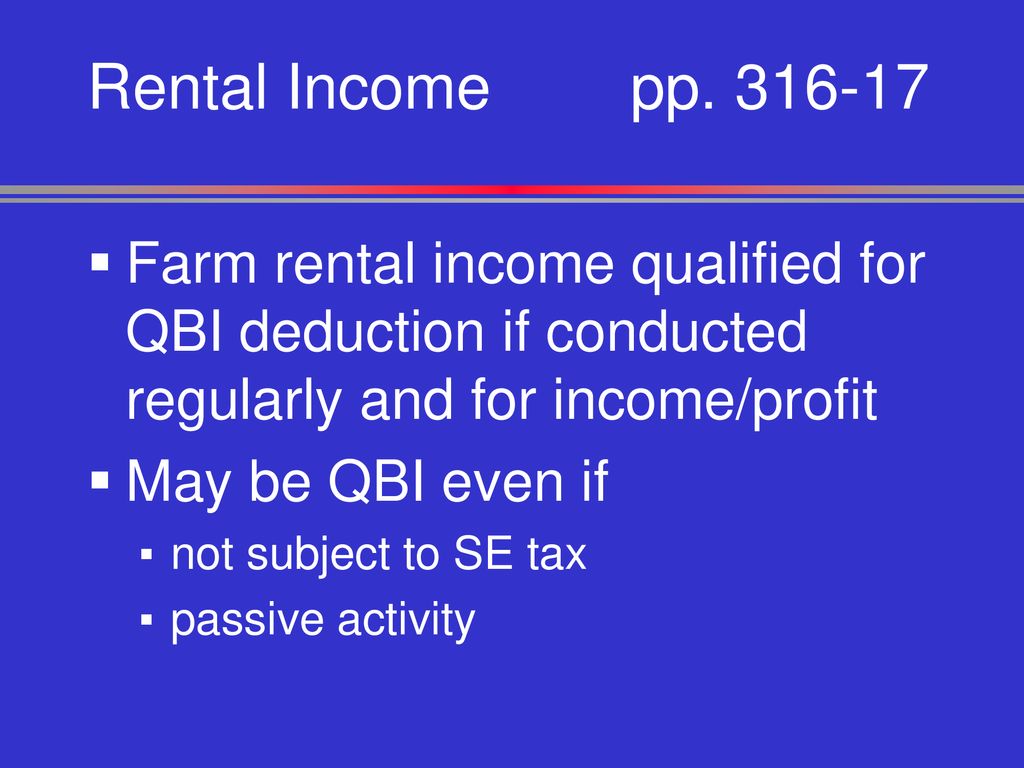

Section 199a was added to the internal revenue code under the tax cuts and jobs act of 2017 to provide taxpayers with a 20 deduction from income attributable to qualifying trades or businesses.

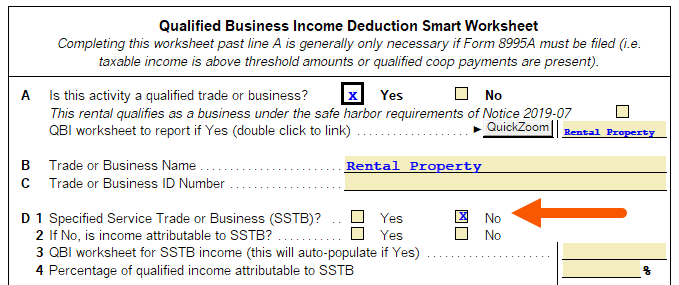

Passive rental income qbi. Combining allows rental income to be qbi 43. Logically since the qbi is allowed on such income it should be allowed on income from rental real estate activities. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. However the rental income is specified service income because partnership b is an sstb and the two partnerships are commonly owned.

Reits specifically hold passive assets that would not rise to the level of a trade or business in the hands of say an individual taxpayer. Beginning in 2018 rental income will be eligible to receive the same preferential tax treatment as the qualified business income qbi for small business. 2019 07 rental real estate safe harbor 44. Some rental activity may qualify as a trade or business.

Income from these types of rentals is specifically excluded for the purposes of the qbi deduction. Although real estate has some favorable provisions compared to w2 income. Irs rejected suggestions to use the 469 passive activity rules taxpayers should report items consistently if rental activity is treated as a trade or business also comply with form 1099. It provides proposed safe harbor requirements for a rental.

The net rental income from partnership a is deemed qbi. So in this case the qbi is applicable for such types of income. Rental real estate as passive income. For example owning only commercial rental real estate is typically considered a trade or business because of the level of.

Under current law rental income is classified as passive income and that income simply passes through to the owner s personal tax return and they pay ordinary income tax on it. Under current law rental income is classified as passive income and that income simply passes through to the owner s personal tax return and they pay ordinary income tax on it. There are some aspects that bother me. How qualified business income qbi affects rental income tax reform will change the way rental income is taxed to landlords beginning in 2018.

With the qbi deduction most self employed taxpayers and small business owners can exclude up to 20 of their qualified business income from federal income tax. While it isn t entirely clear at this point the new qbi deduction is apparently available to offset net income from a profitable rental real estate activity that you own through a pass through entity.